LOS ANGELES, July 1, 2019 /PRNewswire/ -- The Qatar Investment Authority (QIA) and Douglas Emmett, Inc. (NYSE: DEI) today announced a further $365 million acquisition by their multibillion dollar real estate partnership. This latest investment made an acquisition of The Glendon, a residential community in Westwood with 350 apartments and approximately 50,000 square feet of retail.

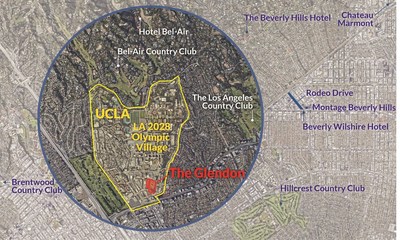

The Glendon is located within walking distance of UCLA Campus, and the Ronald Reagan UCLA Medical Center in Westwood. Westwood has more than 300 local shops and restaurants, and 1.7 million square feet of Class A high rise office properties previously purchased in a partnership between QIA and Douglas Emmett. Westwood will also be the home of the 2028 Olympic Village.

The location provides excellent connectivity to the area's growing population from primary transportation corridors including the I-405 and I-10 Freeways, as well as the LA Metro Purple Line extension planned for 2026.

QIA and Douglas Emmett to date have acquired nine office buildings in West Los Angeles along Wilshire Boulevard and in Downtown Santa Monica. This is their first residential real estate joint investment.

Douglas Emmett's total office portfolio consists of 72 office properties totalling approximately 18.4 million square feet, and premier apartment communities in Los Angeles and Honolulu, comprising over 4,000 units.

With the goal to deploy $45 billion throughout the US in the coming years, the acquisition is in line with QIA's announced intention to increase the diversification of its portfolio across the United States. Commenting on the acquisition, CEO of QIA, Mr. Mansoor Al-Mahmoud said:

"We are pleased to have invested with Douglas Emmett, a trusted partner, and to add a high-end residential property to our existing Los Angeles real estate portfolio."

Mr Al-Mahmoud added:

"This underlines QIA's ambition to substantially increase our US investments, and our confidence in the long-term possibilities offered by Los Angeles, and the State of California."

Jordan Kaplan, the CEO of Douglas Emmett, said:

"The Glendon acquisition confirms our commitment to expand our residential platform and our presence in Westwood, home of the 2028 Olympic Village. It also provided the perfect opportunity to broaden our relationship with QIA, an exemplary partner who shares our strategic long-term vision."

About Qatar Investment Authority (QIA)

Qatar Investment Authority is a leading Sovereign Wealth Fund in the world that offers economic strength for the future generations of Qatar. We are a major contributor to realizing the Qatar National Vision of 2030, by seeking to diversify and maximize long-term investments and sustainable growth. With our global and stakeholders commitment, our employees, nationals and internationals, we operate at the highest financial standards and investment principles. Our investments are socially, economically, and environmentally responsible, that looks beyond short-term returns, as we pursue a broader, innovative, and balanced development. www.qia.qa

About Douglas Emmett, Inc.

Douglas Emmett, Inc. (DEI) is a fully integrated, self-administered and self-managed real estate investment trust (REIT), and one of the largest owners and operators of high-quality office and multifamily properties located in the premier coastal submarkets of Los Angeles and Honolulu.Douglas Emmett focuses on owning and acquiring a substantial share of top-tier office properties and premier multifamily communities in neighborhoods that possess significant supply constraints, high-end executive housing and key lifestyle amenities. For more information about Douglas Emmett, please visit our website at www.douglasemmett.com

Disclaimer

Some of the statements in this press release may be forward-looking statements or statements of future expectations based on currently available information. Such statements are naturally subject to risks and uncertainties. Factors such as the development of general economic conditions, future market conditions, unusual catastrophic loss events, changes in the capital markets and other circumstances may cause the actual events or results to be materially different from those anticipated by such statements. QIA does not make any representation or warranty, express or implied, as to the accuracy, completeness or updated status of such statements. Therefore, in no case whatsoever will QIA and its affiliate companies be liable to anyone for any decision made or action taken in conjunction with the information and/or statements in this press release or for any related damages.

Logo - https://mma.prnewswire.com/media/941759/Qatar_Investment_Authority_Logo.jpg

Photo - https://mma.prnewswire.com/media/941761/Aerials.jpg

Photo - https://mma.prnewswire.com/media/941762/Exterior.jpg

Photo - https://mma.prnewswire.com/media/941764/Fire_Pit.jpg

Photo - https://mma.prnewswire.com/media/941765/Mansoor_Al_Mahmoud.jpg

Photo - https://mma.prnewswire.com/media/941766/Pool.jpg

Photo - https://mma.prnewswire.com/media/941767/The_Glendon_Map.jpg