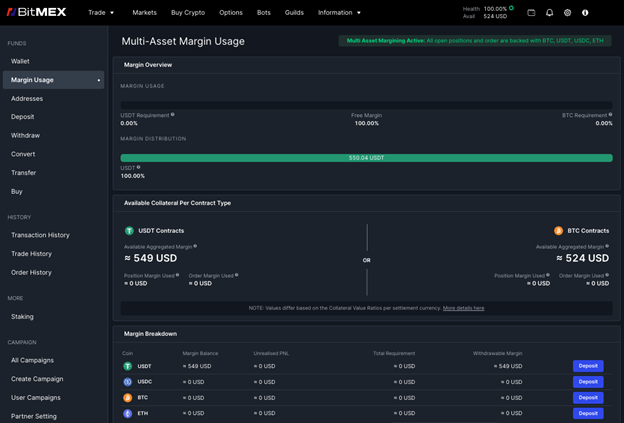

MAHE, Seychelles, Jan. 08, 2025, the OG crypto derivatives exchange, is announcing the launch of Multi Asset Margining. This game-changing feature allows traders to use multiple margin currencies - including USDT, USDC, ETH, and XBT (Bitcoin) - to trade derivatives contracts without the hassle of asset conversions or wallet transfers. The tool was designed to streamline the trading process, enhance flexibility, and increase capital efficiency, empowering users to trade with more currencies of their choice, with the list of currencies to expand in the future.

With the addition of Multi Asset Margining, users can open and maintain positions using currencies other than a contract's settlement currency. This eliminates the step of time-consuming asset conversions, allowing users to hold multiple currencies to gain exposure to diverse markets simultaneously.

Unlike the requirements set on most exchanges, BitMEX ensures a frictionless trading experience-users can deposit their preferred currency and start trading immediately without needing to shuffle funds between wallets.

Stephan Lutz, CEO of BitMEX said, "The launch of Multi Asset Margining on BitMEX marks a transformative milestone in simplifying trading for our users and to enhance their capital efficiency. By removing the need for tedious asset conversions and wallet transfers, this feature not only simplifies the trading process but also unlocks new opportunities for our users to maximise their capital and engage seamlessly with the crypto derivatives market. As we look to 2025 and the next decade, we want to affirm our commitment to creating a more accessible and efficient crypto trading ecosystem."

How Does Multi Asset Margining Work?

BitMEX's new Multi Asset Margining system automatically allocates a user's funds to meet the margin requirements of their positions in the most efficient way possible. Traders can easily enable the feature through their account settings and monitor their available margin on the Wallet page.

To get started:

- Navigate to the order form on the left side of the trading UI.

- Click on the 'Single Asset' button on the top left corner of the order form. In the pop-up window, select 'Multi Asset Margining'.

- The 'Single Asset' button should be changed to 'Multi Asset'.

- Start trading with a preferred margin currency.

For the full details on how Multi Asset Margining works on BitMEX, visit the FAQ page hereor the BitMEX blog.

About BitMEX

BitMEX is the OG crypto derivatives exchange, providing professional crypto traders with a platform that caters to their needs through low latency, deep crypto native liquidity and unmatched reliability.

Since its founding, no cryptocurrency has been lost through intrusion or hacking, allowing BitMEX users to trade safely in the knowledge that their funds are secure. So too that they have access to the products and tools they require to be profitable.

BitMEX was also one of the first exchanges to publish their on-chain Proof of Reserves and Proof of Liabilities data. The exchange continues to publish this data twice a week - proving assurance that they safely store and segregate the funds they are entrusted with.

For more information on BitMEX, please visit the BitMEX Blogor www.bitmex.com, and follow Telegram, Twitter and its online communities. For further inquiries, please contact press@bitmex.com.

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/3ccd5092-6b64-4546-a4a6-d84595141170