The future of fracture fixation with novel side-specific nails featuring variable angle locking technology

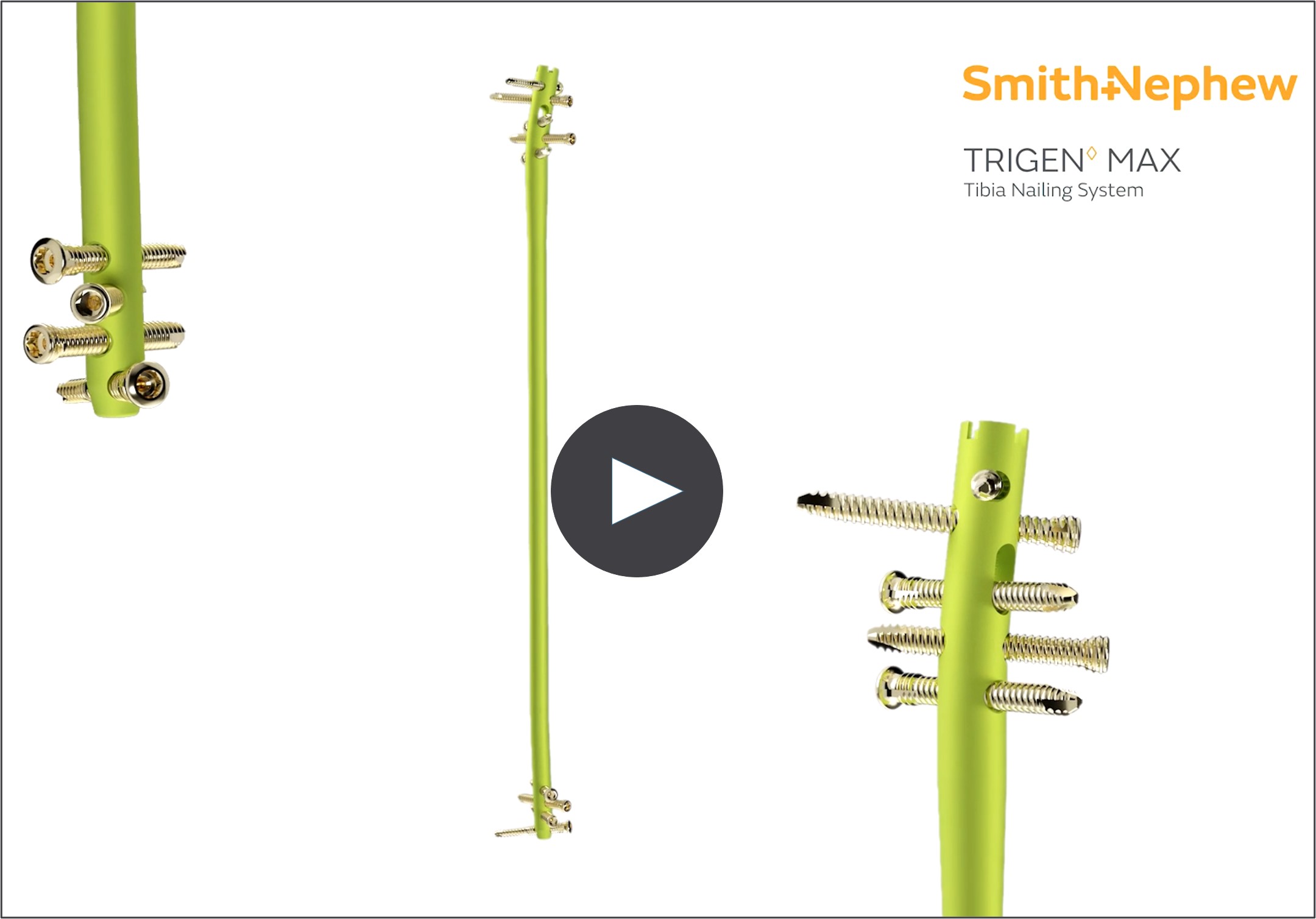

Smith+Nephew (LSE:SN, NYSE:SNN), the global medical technology company, today announces the launch of its new TRIGEN MAX Tibia Nailing System for stable and unstable fractures of the tibia, including the shaft. It is the only system to now offer trauma surgeons the choice of side-specific (right and left) nails for anatomic screw trajectories, which help to optimize fragment fixation and minimize soft tissue irritation with headless and low-profile screw options.1, 2

The TRIGEN MAX Tibia Nailing System aims to streamline operative procedures and provide efficiency through surgeon-centered design of components and instrumentation, including:

- Two-piecemodular drop system to help when using ancillary instruments and aid visualization.

- 12.5mm channel reamer for the tibia which is designed to preserve the integrity of the entry point and provide soft tissue protection.

- 5.0mm Lag Screws that compress the fracture in one screw insertion step, creating a streamlined workflow.3

Smith+Nephew's family of TRIGEN Nails have delivered proven performance and industry-leading design for more than two decades.*4-7 The new TRIGEN MAX Tibia Nailing System is poised to be the next flagship product setting the standard of care and performance for intramedullary nails.

"What takes the TRIGEN MAX Tibia Nailing System to the next level is its ability to reach fractures we never imagined treating with an intramedullary implant before - but we're there now," said Joseph R. Hsu, MD, Orthopaedic Trauma Surgeon at Atrium Health in Charlotte, NC. "It's not just a nail, it's a platform that allows us to rethink how we approach complex injuries. Most importantly, it makes those treatments reproducible. What's especially exciting is that the TRIGEN MAX system represents a truly patient-centered approach; from the design of the instruments to the implants themselves, it's all about optimizing recovery and addressing each patient's unique anatomy and potential complications."

"The first case using the TRIGEN MAX Tibia Nailing System was completed last week, representing a significant advancement in lower extremity trauma care," said Mark McMahan, Vice President, Trauma & Extremities Marketing for Smith+Nephew. "By focusing on both implant innovation and instrumentation, we're delivering a smarter, more adaptable solution for today's orthopaedic challenges."

The TRIGEN MAX Tibia Nailing System is currently available in the United States only. To learn more about Smith+Nephew's new TRIGEN MAX Tibia Nailing System, please visit here.

- ends -

Media Enquiries

Dave Snyder +1 (978) 749-1440

Smith+Nephew david.snyder@smith-nephew.com

* The TRIGEN Tibial Nail System has demonstrated excellent union rates; Claims on the TRIGEN Tibial Nail System are based on evidence using TRIGEN META Tibia Nail

References

- Smith+Nephew 2023. Internal Report 10092864 Ver A.7. I20-4GEN-A Verification Activity - TRIGEN MAX Tibial Nail

- Smith+Nephew 2023. Internal Report 10092852 Ver A. I20-4GEN-A Verification Activity - Screw Prominence]

- Smith+Nephew 2023. Internal Report 10140753. I20-4GEN-A TRIGEN MAX Tibia Validation Lab

- Chan DS, Serrano-Ribera R, Griffing R, et al. Suprapatellar Versus Infrapatellar Tibial Nail Insertion: A Prospective Randomized Control Pilot Study. Journal of orthopaedic trauma. 2016;30(3):130-134.

- Sun Q, Nie XY, Gong JP, et al. The outcome comparison of the suprapatellar approach and infrapatellar approach for tibia intramedullary nailing. International Orthopaedics. 2016;40(12):2611-2617.

- Say F, Bülbül M. Findings related to rotational malalignment in tibial fractures treated with reamed intramedullary nailing. Archives of Orthopaedic and Trauma Surgery. 2014;134(10):1381-1386.

- Beytemür O, Baris A, Albay C, Yüksel S, Çaglar S, Alagöz E. Comparison of intramedullary nailing and minimal invasive plate osteosynthesis in the treatment of simple intra-articular fractures of the distal tibia (AO-OTA type 43 C1-C2). Acta Orthopaedica et Traumatologica Turcica.

About Smith+Nephew

Smith+Nephew is a portfolio medical technology business focused on the repair, regeneration and replacement of soft and hard tissue. We exist to restore people's bodies and their self-belief by using technology to take the limits off living. We call this purpose 'Life Unlimited'. Our 17,000 employees deliver this mission every day, making a difference to patients' lives through the excellence of our product portfolio, and the invention and application of new technologies across our three global business units of Orthopaedics, Sports Medicine & ENT and Advanced Wound Management.

Founded in Hull, UK, in 1856, we now operate in around 100 countries, and generated annual sales of $5.8 billion in 2024. Smith+Nephew is a constituent of the FTSE100 (LSE:SN, NYSE:SNN). The terms 'Group' and 'Smith+Nephew' are used to refer to Smith & Nephew plc and its consolidated subsidiaries, unless the context requires otherwise.

For more information about Smith+Nephew, please visit www.smith-nephew.comand follow us on X, LinkedIn, Instagramor Facebook.

Forward-looking Statements

This document may contain forward-looking statements that may or may not prove accurate. For example, statements regarding expected revenue growth and trading profit margins, market trends and our product pipeline are forward-looking statements. Phrases such as "aim", "plan", "intend", "anticipate", "well-placed", "believe", "estimate", "expect", "target", "consider" and similar expressions are generally intended to identify forward-looking statements. Forward-looking statements involve known and unknown risks, uncertainties and other important factors that could cause actual results to differ materially from what is expressed or implied by the statements. For Smith+Nephew, these factors include: conflicts in Europe and the Middle East, economic and financial conditions in the markets we serve, especially those affecting healthcare providers, payers and customers; price levels for established and innovative medical devices; developments in medical technology; regulatory approvals, reimbursement decisions or other government actions; product defects or recalls or other problems with quality management systems or failure to comply with related regulations; litigation relating to patent or other claims; legal and financial compliance risks and related investigative, remedial or enforcement actions; disruption to our supply chain or operations or those of our suppliers; competition for qualified personnel; strategic actions, including acquisitions and disposals, our success in performing due diligence, valuing and integrating acquired businesses; disruption that may result from transactions or other changes we make in our business plans or organisation to adapt to market developments; relationships with healthcare professionals; reliance on information technology and cybersecurity; disruptions due to natural disasters, weather and climate change related events; changes in customer and other stakeholder sustainability expectations; changes in taxation regulations; effects of foreign exchange volatility; and numerous other matters that affect us or our markets, including those of a political, economic, business, competitive or reputational nature. Please refer to the documents that Smith+Nephew has filed with the U.S. Securities and Exchange Commission under the U.S. Securities Exchange Act of 1934, as amended, including Smith+Nephew's most recent annual report on Form 20-F, which is available on the SEC's website at www. sec.gov, for a discussion of certain of these factors. Any forward-looking statement is based on information available to Smith+Nephew as of the date of the statement. All written or oral forward-looking statements attributable to Smith+Nephew are qualified by this caution. Smith+Nephew does not undertake any obligation to update or revise any forward-looking statement to reflect any change in circumstances or in Smith+Nephew's expectations.

? Trademark of Smith+Nephew. Certain marks registered in US Patent and Trademark Office.