VANCOUVER, BC / ACCESSWIRE / June 14, 2018 / Nexus Gold Corp. ("Nexus" or the "Company") (OTC PINK: NXXGF, TSX-V: NXS, FSE: N6E) is pleased to announce that it is initiating a 105-line kilometer geochemical survey on the Rakounga permit located in central Burkina Faso, West Africa.

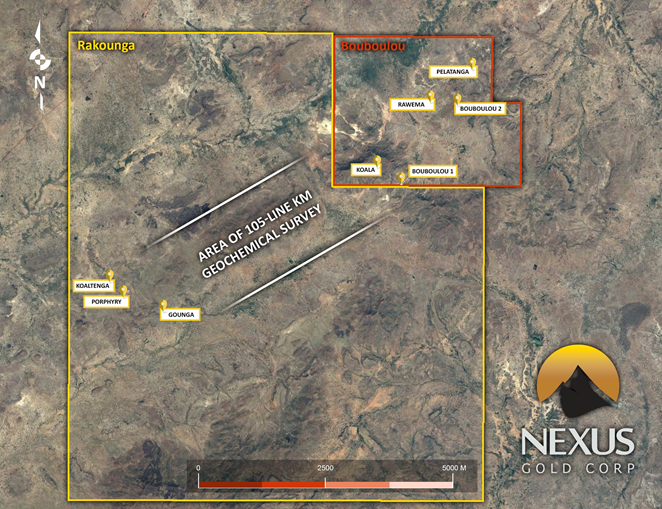

The survey is designed to aid in identifying gold mineralization which may occur in the nine-kilometer gap between the Koala showing on the Company's adjacent 38-sq km Bouboulou Gold Concession, and the Koaltenga showing, located on the western edge the 250-sq km Rakounga Gold Concession (see map following).

Prior drilling by the Company at Koala returned several intercepts of note, including 5.21 grams-per-tonne ("g/t") gold ("Au") over 3.05 meters, including 15.50 g/t Au over 1 meter (hole BBL-17-DD-07), and 4.41 g/t Au over 8.15 meters, including 23 g/t Au over 1 meter (hole BBL-17-DD-08) (see Company news release dated October 5, 2017).

Previous drilling conducted by the Company at Koaltenga also returned significant results, including 1.01 g/t over 32 meters, including 5.65 g/t Au over 2 meters and 2.81 g/t Au over 6 meters (hole RKG-17-RC-002) and 1.00 g/t gold over 34 meters, including 5.57 g/t Au over 4 meters (hole RKG-17-RC-008) (see Company news release dated December 13, 2017).

The survey will cover the area underlain by the Sabce fault zone, a prominent structural feature which extends some 200 kilometers across the Goren greenstone belt.

Figure 1: Geochemical program to target ground between Koaltenga lower left and Koala, upper right

"We're pleased to get the 2018 work program underway," said president & CEO, Alex Klenman. "This is an important step in the development of Bouboulou-Rakounga. The area we're covering has the potential to significantly expand the mineralized footprint. Ultimately, we are looking at this project to produce a resource estimate and the data generated by this survey will move us closer to that goal," continued Mr. Klenman.

"Given the gold mineralization we have already encountered on the Bouboulou and Rakounga permits, it makes this area highly prospective ground and it will be exciting to see what sort of numbers we get from this initial program," said Senior Vice-President of Exploration, Warren Robb.

The Rakounga permit has seen only minimal exploration since Boliden conducted RAB drilling on the property in 1997. The Company believes the area to be explored has the potential host gold mineralization similar to the Koala and Koaltenga showings mentioned above.

Company to Grant Options

The Company also announces that it will grant 1,000,000 incentive stock options to certain directors, officers and consultants of the Company. These options will vest immediately and will be exercisable at a price of $0.33 for a period of sixty months.

The grant is subject to the terms of the Company's incentive stock option plan and the approval of the TSX Venture Exchange.

About the Company

Nexus Gold is a Vancouver-based gold exploration and development company operating primarily in Burkina Faso, West Africa. The company is currently concentrating its efforts on establishing a compliant resource oat one or more of it's three current projects. The 38-square km Bouboulou project comprises no less than five established gold zones contained within three separate 5km gold trends. The adjacent 250-square km Rakounga gold concession extends the Bouboulou gold trends and currently contains three drill tested zones of mineralization. The Niangouela gold concession is a 178-square km project featuring high-grade gold occurring in and around a primary quartz vein and associated shear zone approximately one km in length.

Warren Robb P.Geo., Vice-President, Exploration, is the designated Qualified Person as defined by National Instrument 43-101 and is responsible for the technical information contained in this release.

On behalf of the Board of Directors of

NEXUS GOLD CORP.

Alex Klenman

President & CEO

604-558-1920

info@nexusgoldcorp.com

www.nexusgoldcorp.com

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release. This news release may contain forward-looking statements. These statements are based on current expectations and assumptions that are subject to risks and uncertainties. Actual results could differ materially because of factors discussed in the management discussion and analysis section of our interim and most recent annual financial statement or other reports and filings with the TSX Venture Exchange and applicable Canadian securities regulations. We do not assume any obligation to update any forward-looking statements, except as required by applicable laws.

SOURCE: Nexus Gold Corp.