MIDDLETOWN, DE / ACCESSWIRE / March 19, 2019 / Global ad spend rose to $628.63 billion in 2018 and is expected to grow steadily at more than 5.0% per year through 2022. Although ad budgets are growing, return on digital ad investment (ROI) is going in the opposite direction. What's fueling the disconnect? According to the Association of National Advertisers, only 25% of all digital ad spend reaches real people due to ad fraud.

Ad fraud is any attempt to deceive advertisers with fake traffic, fraudulent leads, or phony ads that will never be seen by a real user. It's become an ever-growing billion-dollar industry with no signs of stopping. In 2018, $19 billion was lost to ad fraud and that number is expected to rise to $44 billion by 2022.

Brands who use affiliate marketing to find leads are finding themselves among the victims of ad fraud. Affiliates are rewarded through the classic cost-per-lead (CPL) pricing model, and this model can be manipulated. Deceitful affiliates will maximize leads by using bots, malware, or an even more sophisticated method - human fraud farms engaged in filling out forms with real people's information.

Exacerbating the issue is they're not the only ones making the connection between form fills and bots. Bad actors are also using this tactic to keep their click operations afloat, tricking the system through bots that scan landing pages for lead forms like email, subscription sign-ups, or ebook download offers, and then fill them out to trigger a conversion.

While fake clicks and bad traffic can wreak havoc on the bottom line of advertisers, form fills carry a heavier financial risk for those in the lead generation space. Some bots are sophisticated enough to enter valid information like a real email address, name, mailing address, and phone number. However, the bot doesn't have the real user's permission to submit that information. If the form's owner doesn't property vet the generated lead, it could create a TCPA compliance issue, says Anura.io

Contacting a person without their express permission is a violation of TCPA rules, which brings with it hefty fines, ranging from $500 to $1,500, should the individual decide to file a complaint. Added to the financial risk are the time and resources wasted on reaching out, as well as tarnished brand reputation by what may be perceived as suspect practices on the part of the company.

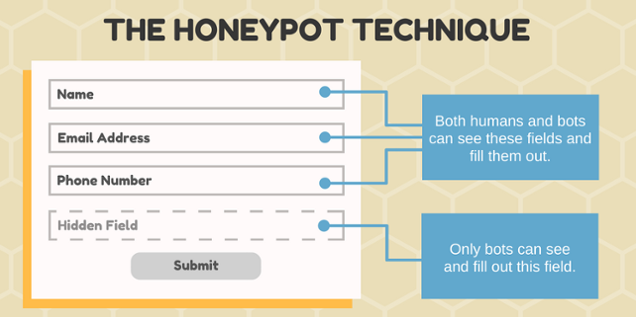

While it is impossible to avoid all attacks, businesses can take certain precautionary measures to reduce fraudulent form fills and TCPA violations, as Anura.io points out. One solution is the Honeypot Technique, which is used to identify bot submissions. The method involves the creation of an invisible form field using CSS within the website source code. Since human users will not be aware of its existence, submissions that have the hidden section filled out will indicate the work of a bot. Another method is CAPTCHA, which consists of a visually distorted word in a box. This technique is used to block bots, counting on the fact that only humans can decipher the text and type it into the designated space to proceed. These options are excellent for stopping bots and malware, but dealing with human fraud farms that fill out forms can become complicated, so it is best to seek a solution designed to address performance-marketing ad fraud.

Anura.io is the company behind sophisticated technology that can spot the difference between a real user and a human fraud farm, bot, or another malicious agent. Built and optimized on customer conversion data since 2005, the ad fraud detection and traffic analytics expert excels in performance-based campaigns, surpassing the competition both in terms of accuracy and volume of fraudulent visits identified. The integration of the solution offers complete transparency with a full analytics dashboard and an API to identify bad traffic through a variety of metrics.

Anura.io: https://www.anura.io

Rich Kahn - CEO and Co-Founder - Anura.io - LinkedIn: https://www.linkedin.com/in/richkahn

Prediction Series 2019: Interview with Rich Kahn, CEO, Anura.io: https://martechseries.com/mts-insights/tech-bytes/prediction-series-2019-interview-rich-kahn-ceo-founder-anura-io/

Contact Information:

Anura.io

Melissa Duko

mduko@anura.io

Rich Kahn

rich@anura.io

SOURCE: Anura.io

View source version on accesswire.com:

https://www.accesswire.com/539192/Anuraio-Explains-the-Impact-of-Bot-Form-Fills-and-Suggests-Counter-Measures