LONDON, April 2, 2019 /PRNewswire/ -- Free online mortgage broker Glow has launched a new web app full of market leading tech aimed at making mortgage applications a breeze.

Without any appointments or interviews, users can get an initial mortgage quote quickly via their mobile device without a credit check. At all times customers are supported on the website by an online mortgage broker who is available via advanced live chat at the click of a button.

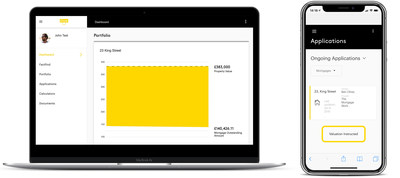

When it comes to submitting a mortgage application this is where Glow really streamlines the process. ID checks are carried out digitally from a quick snap of a Passport or Driving License and users can verify their income and expenses by one-time syncing their online banking transactions directly to the Glow web app. Users can also track the progress of their mortgage application online and get automatic alerts and updates at every key stage.

The Glow web app features a basic property valuation using an API valuation system that the top mortgage lenders are using. This technology could help prevent potential down valuation issues before a mortgage application is even submitted and help customers understand how a mortgage lender will view the value of their property.

Ben Olney the owner of Glow comments "The API valuation data is a potential game changer. Customers are not always aware of the current value of their homes, especially in areas that are being impacted by market conditions surrounding Brexit (such as parts of London). If we can determine that a mortgage lender will view a property value higher or lower than expected, we can prepare more accurate advice on the most suitable mortgage that will fit the loan to value. Even a small difference in the loan to value could affect the interest rate quoted and overall mortgage deal obtainable."

First established as an online mortgage broker in 2017 under a mortgage network, Glow have made the move to become Directly Authorised. They continue to be highly rated by their customers in TrustPilot and Google reviews for their dedication to customer service and tech aimed at simplifying the mortgage application process.

Glow was recently nominated for Best Mortgage Broker 2019 at the British Bank Awards and reached the final in London in March this year. A great achievement for a firm without major investment keeping up with the Series A & B funded competition. Their experienced mortgage advisors are online between 8am - 10pm on weekdays and 10am - 4pm over the weekend.

Glow is a registered trading style of MBOT LTD who are authorised and regulated by the Financial Conduct Authority in the UK, registration number 827692 in respect of mortgage and insurance mediation activities only. Further details may be found by visiting www.fca.org.uk. As a mortgage is secured against your home, it could be repossessed if you do not keep up the mortgage repayments.

Photo: https://mma.prnewswire.com/media/844337/Glow_app.jpg