VANCOUVER, BC / ACCESSWIRE / June 21, 2019 / Ximen Mining Corp. (TSX.v: XIM) (FRA: 1XMA) (OTCQB:XXMMF) (the "Company" or "Ximen") announces its option partner, GGX Gold Corp (TSX.v: GGX), has completed 32 diamond drill holes on the C.O.D. vein and has moved the drill rig to start drilling the C.O.D. North Vein at the Gold Drop property in the Greenwood Mining Camp.

Photo of piece of NQ drill core from Hole 2019-31 containing coarse pyrite mineralization.

The drill rig has now completed the first stage of in-fill drilling on the C.O.D. vein. The rig has now been moved to explore the C.O.D. North vein, which is a parallel vein located 700 meters northeast of the main vein. Trench samples collected in 2018 from the C.O.D. North vein assayed up to 21.7 grams per tonne gold over 0.4 meters. An initial stage of 10 holes is planned to test the structure in the area of the surface trenches.

Since the start of the season in mid-April, 32 holes for a total of 1923 meters have been completed on the main C.O.D. structure. Fourteen holes intersected the C.O.D. quartz vein at the target depths containing variable amounts of pyrite mineralization (see photo). Five vein intercepts were visibly mineralized with possible gold-telluride mineralization (sylvanite, (Ag,Au)Te2) and one other intercept contained visible gold.

Following on from the C.O.D. North structure, the drill program will continue this season with planned holes to test the Everest vein, a visible gold bearing vein that was discovered in 2018, and the Gold Drop mine, where visible gold in quartz has been identified in surface exposures.

The drill core is currently being logged and cut in half with a diamond saw at a facility in Greenwood, B.C. Half core samples will be shipped for assay later this month.

Dr. Mathew Ball, P.Geo., VP Exploration for Ximen Mining Corp. and a Qualified Person as defined by NI 43-101, approved the technical information contained in this News Release.

On behalf of the Board of Directors,

"Christopher R. Anderson"

Christopher R. Anderson,

President, CEO and Director

Investor Relations:

Mr. William Sattlegger,

604-488-3900

ir@XimenMiningCorp.com

About Ximen Mining Corp.

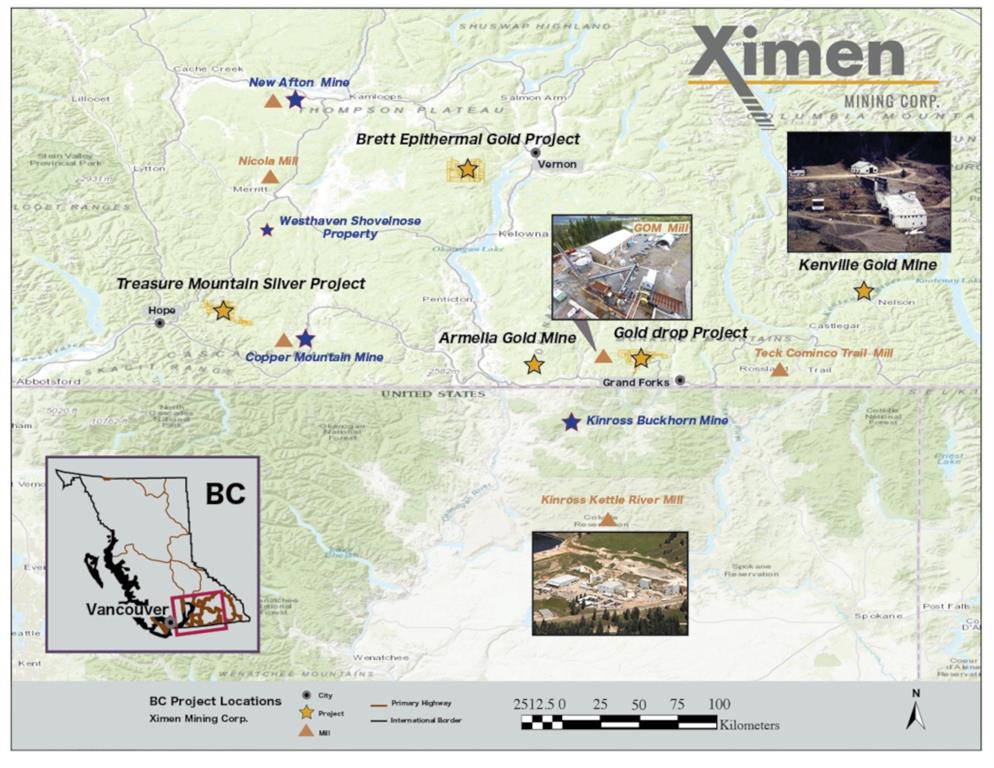

Ximen Mining Corp. owns 100 percent interest in all three of its precious metal projects located in southern BC. Ximen's two Gold projects are The Gold Drop Project and The Brett Epithermal Gold Project. Ximen also owns the Treasure Mountain Silver Project adjacent to the past-producing Huldra Silver Mine. Currently both the Gold Drop Project and the Treasure Mountain Silver Project are under option agreements. The option partners are making annual staged cash and stocks payments as well as funding the development of these projects. The company has recently acquired the Kenville Gold mine near Nelson, British Columbia and The Amelia Gold Mine.

Ximen is a publicly listed company trading on the TSX Venture Exchange under the symbol XIM, in the USA under the symbol XXMMF, and in Frankfurt, Munich, and Berlin Stock Exchanges in Germany under the symbol 1XMA and WKN with the number as A2JBKL.

Forward-looking statements

This press release contains certain "forward-looking statements" within the meaning of Canadian securities legislation, including statements regarding the financing available to the Company under its Investment Agreement with Alumina, and the Company's related plans for exploration and on-going acquisition of gold assets in British Columbia. Although the Company believes that such statements are reasonable, it can give no assurance that such expectations will prove to be correct. Forward-looking statements are statements that are not historical facts; they are generally, but not always, identified by the words "expects," "plans," "anticipates," "believes," "intends," "estimates," "projects," "aims," "potential," "goal," "objective," "prospective," and similar expressions, or that events or conditions "will," "would," "may," "can," "could" or "should" occur, or are those statements, which, by their nature, refer to future events. The Company cautions that Forward-looking statements are based on the beliefs, estimates and opinions of the Company's management on the date the statements are made and they involve a number of risks and uncertainties. Consequently, there can be no assurances that such statements will prove to be accurate and actual results and future events could differ materially from those anticipated in such statements. Except to the extent required by applicable securities laws and the policies of the TSX Venture Exchange, the Company undertakes no obligation to update these forward-looking statements if management's beliefs, estimates or opinions, or other factors, should change. Factors that could cause future results to differ materially from those anticipated in these forward-looking statements include the risk that the Company will not be in compliance with the draw-down conditions under the Investment Agreement at a time when it wishes to rely upon financing under that agreement, the risk that the Company will not be able to secure the acceptance of the TSX Venture Exchange for any draw-down under the Investment Agreement, the risks associated with mineral exploration, development and extraction operations, the risk that its business partners will encounter unanticipated geological factors, or the possibility that they may not be able to secure permitting and other governmental clearances, necessary to carry out their stated plans, and the risk of political uncertainties and regulatory or legal disputes or changes in the jurisdictions where the Company carries on its business that might interfere with the Company's business and prospects. The reader is urged to refer to the Company's reports, publicly available through the Canadian Securities Administrators' System for Electronic Document Analysis and Retrieval (SEDAR) at www.sedar.com for a more complete discussion of such risk factors and their potential effect.

This press release shall not constitute an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any state in the United States in which such offer, solicitation or sale would be unlawful. The securities referred to herein have not been and will not be registered under the United States Securities Act of 1933, as amended, and may not be offered or sold in the United States absent registration or an applicable exemption from registration requirements.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

SOURCE: Ximen Mining Corp.

View source version on accesswire.com:

https://www.accesswire.com/549415/Ximen-Mining-Corps-Option-Partner-Starts-Drilling-COD-North-Vein-Gold-Drop-Property