ZUG, SWITZERLAND / ACCESSWIRE / July 22, 2019 / Accointing (www.accointing.com) launched its crypto tax tool with a portfolio tracking solution.

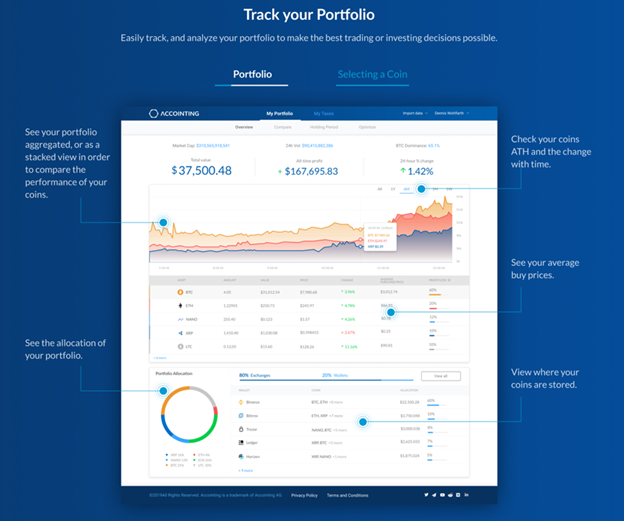

Whether the crypto market is in a bear or bull market, it is essential to track and have a proper summary of one's portfolio. If the market turns volatile, making irrational decisions due to not knowing where one's portfolio stands can be detrimental. Without an overview, crypto traders can't make optimal trading decisions.

Portfolio tracking applications already exist, however a few key issues with these arise:

1. The ease of use: they are not easy to connect with wallets and exchanges to live-track your portfolio

2. These portfolio management tools don't offer accounting or tax reporting tools. So, every time you need to do your taxes you need to reimport everything into a different tool.

"We tried all the crypto tax and portfolio management products out there, but they were producing wrong outputs and had a terrible user experience. Thus, we decided to build our own. Accuracy in portfolio tracking and taxes is key, and the tools weren't ticking like a Swiss watch." Dennis Wohlfarth, COO, and Co-Founder.

The Idea

The founders of Accointing are firm believers of the crypto industry going mainstream. Hence, end users need to have a user friendly, convenient and hassle free, one-time onboarding process to track their portfolio and file their taxes. Rather than being a tax reporting only tool, Accointing hits two birds with one stone, portfolio tracking and crypto tax reporting. It's a tool that helps you manage your trades, and when tax season is about, it lets you print out the correct report for you with just one click.

The Purpose

Accointing aims to be the world's leading crypto tax solution and portfolio management platform. The mission is to help the industry grow by helping investors and traders to easily track their crypto holdings, analyze trading performance, and file tax reports. On the other hand, it's also to legitimize the space by allowing accountants and users to have an easy to use tool to report their cryptocurrency holdings.

"We founded the company in Switzerland, due to the openness and the readily available access to speak with regulators. We aim to play a part in making crypto usage mainstream, and thus want to make the lives of crypto users, accountants, and regulators simpler," said Yann Allemann, CEO.

Conclusion

The majority of crypto taxation is still uncertain, and guidelines from the tax authorities are either ambiguous or just non-existent. Accointing provides reliable results where those are possible and points out any loose ends that the user can then appropriately amend.

"I have seen other tools that ignore the uncertainties of crypto taxation. However, in the end, it is the customer who will be responsible for filing a correct tax return. Accointing puts all the tools in your hands to do just that", said Dr. Detlef Laub, German Tax Law Attorney, and Crypto Tax Law Expert.

Contact Information: info@accointing.com

SOURCE: Accointing

View source version on accesswire.com:

https://www.accesswire.com/552836/A-Crypto-Tax-and-Portfolio-Management-Solution-that-saves-Time-and-Money