VANCOUVER, BC / ACCESSWIRE / July 31, 2019 / Renaissance Gold Inc. (TSX.V:REN / OTCQB:RNSGF) ("RenGold" or the "Company") is pleased to announce the commencement of drilling on its Ferguson Mountain Project, under an earn-in agreement with Hochschild Mining plc and its Fat Lizard Project, under an earn-in agreement with OceanaGold Corp. (see NRs dated January 17 and February 20, 2019).

Robert Felder, President and CEO states "We are excited to continue our 2019 drilling campaign in Nevada with new partners and new targets that have never been drilled. Following the drill program recently completed by AngloGold Ashanti on our Silicon Project, these are the second and third of an anticipated eight projects to be drilled this year, continuing RenGold's significant exposure to upside success through our portfolio approach to exploration."

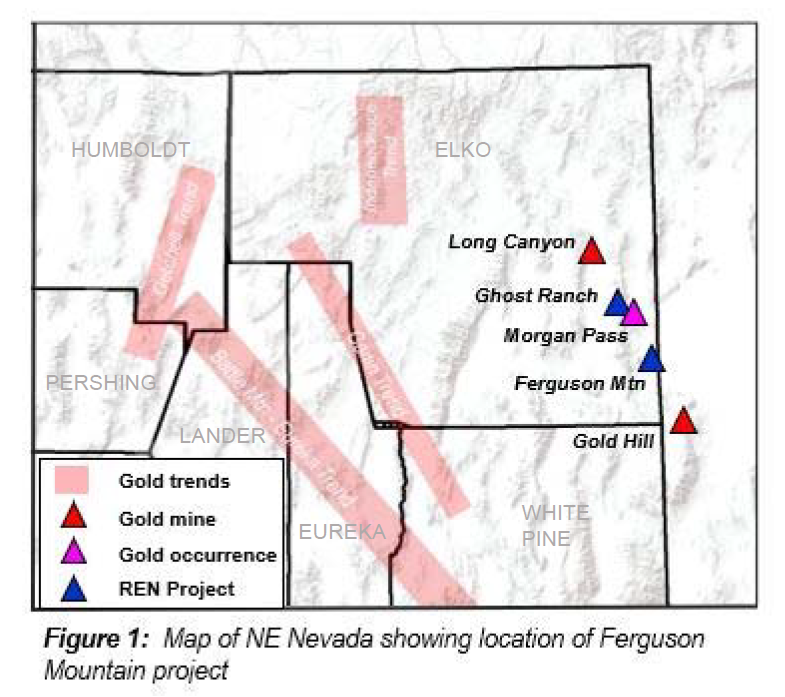

The Ferguson Mountain project, Elko County, Nevada is a Carlin-type gold target on a northwest trend of gold occurrences encompassing Nevada Gold Mining's (Barrick-Newmont JV) Long Canyon mine, the Morgan Pass gold occurrence and the Gold Hill mine in Utah (Figure 1).

Geologic mapping, soil and rock chip geochemical sampling and a recent CSAMT survey have refined our understanding of the structural architecture on the Ferguson Mountain project and a 5-hole, 1525 meter reverse circulation program is underway. The initial drill program will test several targets associated with mapped mineralized structures and newly recognized structures interpreted from the CSAMT and their potential intersection with favorable stratigraphic horizons at depth.

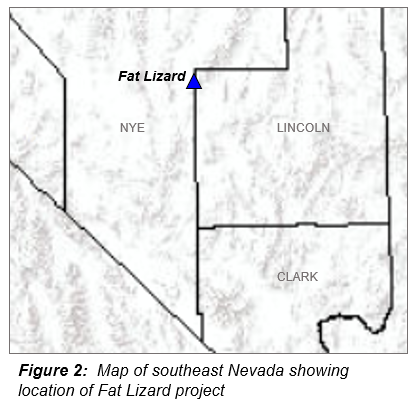

The Fat Lizard project, Nye County, Nevada is a low-sulfidation epithermal target with no historic drilling.

(Figure 2).

Target generation work conducted by RenGold and OceanaGold consisted of geologic mapping, geochemical sampling and a gravity survey. Mapping and sampling has documented the presence of silicified ridges and hydrothermal breccias containing anomalous gold (up to 0.5 g/t) and trace elements (Sb, Te, As, Hg). In addition, observations of alteration and vein textures further support the interpretation of a high-level exposure of a low-sulfidation epithermal system with the potential to host high-grade veins associated with boiling horizons at depth. The current drilling program will test the deeper portions of the system with 1240 meters in 3 core holes.

About Renaissance Gold Inc.

Renaissance Gold Inc. is a western US focused prospect generator utilizing a joint venture business model. RenGold applies the extensive exploration experience and high-end technical skills of its founders and team members to search for and acquire high quality precious metal exploration projects that are then offered for joint venture to industry partners who provide exploration funding. RenGold maintains a large portfolio of gold and silver exploration properties and has entered into over 70 exploration agreements over the past 16 years including those of its predecessor, AuEx Ventures Inc., and those from Kinetic Gold. RenGold's objective is to place its projects into exploration agreements, testing as many drill targets as possible and providing maximum exposure to success through discovery.

Qualified Person

All technical data disclosed in this press release has been verified by RenGold's Qualified Person, Robert Felder, M.Sc. and Certified Professional Geologist as recognized by the American Institute of Professional Geologists (AIPG).

By: Robert Felder, President & CEO

For further information, contact:

Robert Felder 775-337-1545 or bfelder@rengold.com

Ronald Parratt 775-337-1545 or rparratt@rengold.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This news release contains certain statements that may be deemed "forward-looking" statements. Forward looking statements are statements that are not historical facts and are generally, but not always, identified by the words "expects", "plans", "anticipates", "believes", "intends", "estimates", "projects", "potential" and similar expressions, or that events or conditions "will", "would", "may", "could" or "should" occur. Although Renaissance Gold Inc. believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results may differ materially from those in forward looking statements. Forward looking statements are based on the beliefs, estimates and opinions of Renaissance Gold Inc's management on the date the statements are made. Except as required by law, Renaissance Gold Inc. undertakes no obligation to update these forward-looking statements in the event that management's beliefs, estimates or opinions, or other factors, should change.

SOURCE: Renaissance Gold Inc.

View source version on accesswire.com:

https://www.accesswire.com/554032/Renaissance-Gold-Announces-Commencement-of-Drilling