SINGAPORE / ACCESSWIRE / September 19, 2019 / On the afternoon of September 13, 2019, "Chain to the Future: Exploring Trends of Global Digital (Crypto) Assets Securities Companies in 2019," organized by BitDATA, marked BitDATA's launch of its global strategy and product line.

This first conference, held in Singapore, saw BitDATA CEO Ken and BitDATA CSO Dr. Dave Yan, OKEx AVP Anna, Jubilee Capital CTO Alvin, HomiEx CEO Hong Ming, Jenga Advisors LLC & Delta Strategy Group Derivatives & Digital Asset Regulatory Attorney CEO Kevin and other well-known investment delegates in attendance at the formal launch ceremony. Key personalities and principal correspondents from the mainstream media attended as special guests.

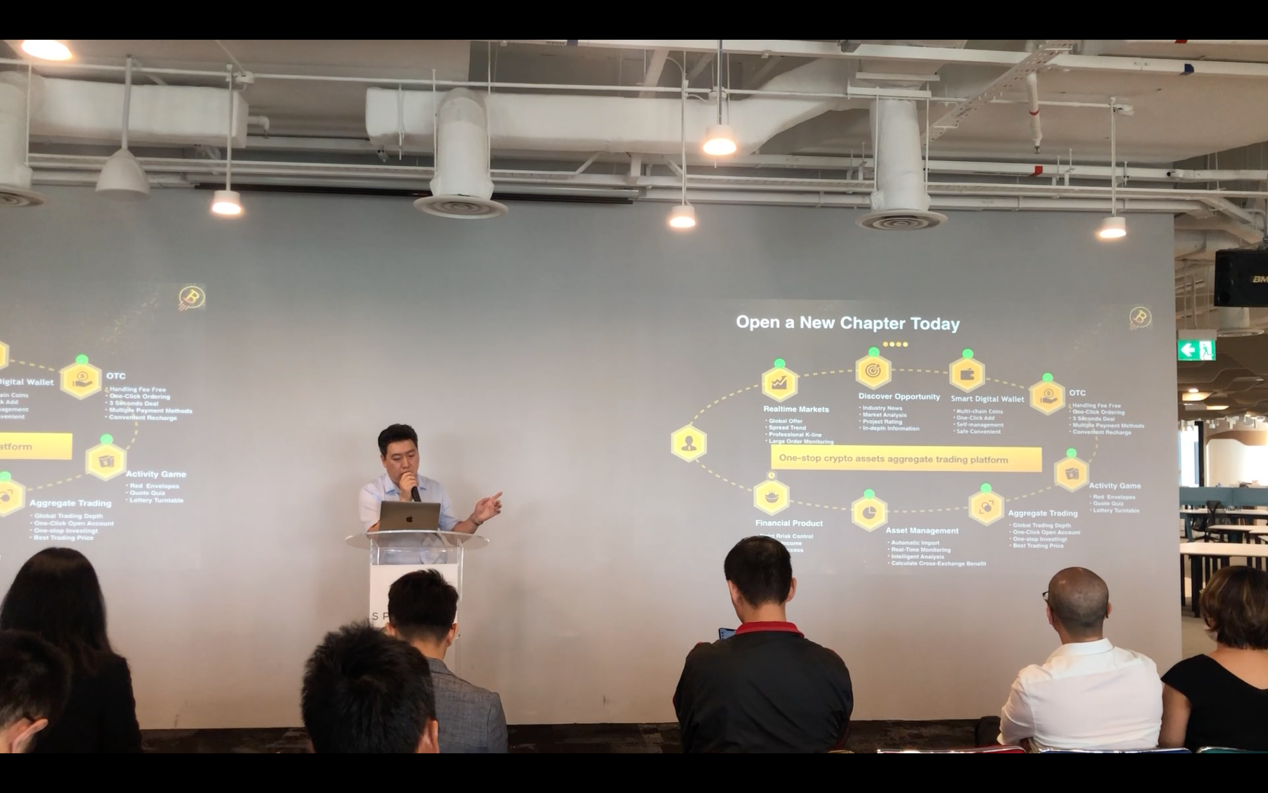

At the conference, BitDATA CEO Ken delivered a speech on behalf of the organizer, describing BitDATA's main business and its product advantages, as well as its plans for future development. BitDATA's main business segment consists of four components: (1) Brokerage business (opening accounts, wallet, coin/fiat recharge, train, market and Information, transaction, information management, etc.); (2) Investment banking (financing, merchandiser, incubation, issuance, listing, underwriting, market-making, etc.); (3) Research business (ratings, research papers, strategy, weekly research, exchange/project rankings, etc.); (4) One-stop crypto assets aggregate trading platform, combining data and tools to help investors find investment opportunities and seize them. Comparable to the East-Money in Digital Assets (choice.eastmoney.com + fund.eastmoney.com + Securities Dealers).

BitDATA, he said, has built a one-stop service platform for providing market data and information, smart wallets, one-click purchases, trading strategies, aggregated transactions and position management. As the next step in pursuing its strategy, BitDATA will undergo development centered on the three key words Professional, International and Compliance before formally launching its platform strategy, business strategy and BDT strategy.

For its platform strategy, BitDATA will focus on creating Aggregate Transaction 2.0, which will allow users to quickly purchase mainstream assets at the optimal market price and lowest commission by simply registering a BitDATA account. Its business strategy, in turn, will involve creation of a complete STO closed loop through a four-step process that will culminate in the creation of a trading platform able to provide mainstream coins as well as valuable STO coins. Finally, the company's BDT strategy will involve creation of valuable functional tokens around several dimensions: company development, global market development and compliance.

During the conference's round-table discussion session, guests discussed the "necessity of the global digital crypto asset brokers to the market," touching on the current regulatory status of digital assets, market ecology and division of labor, the importance of digital asset brokers and future market application trends while unanimously recognizing the essential role of digital brokers.

MaxiMine

This stimulating round-table discussion was followed by a road show hosted by MaxiMine, the conference's sponsor. MaxiMine is an open, fair and transparent distributed cloud pool that is committed to providing investors with substantial and transparent returns while lowering industry thresholds. MaxiMine holders distribute revenue through exchange of computing power, combined with user-oriented distributed applications, revenue distribution smart contracts, and predictive machines to ensure transparency and fairness throughout the process.

Next the organizers joined hands with Knownsec, BugX, Shulian Ratings, BITORANGES, SNC, Daling Research and other security and data research companies to announce the establishment of the "Crypto Asset Market Trusted Evaluation Alliance." The conference ended on a positive note, with organizers exchanging Mid-Autumn Festival greetings and sharing moon cakes while looking forward to the next conference, which will be held in New York.

Contact:

BitDATA

Media Relations

?+1 (321) 800-3487?

mail@presreleaseemail.com

SOURCE: BitDATA

View source version on accesswire.com:

https://www.accesswire.com/560284/BitDATA-Global-Strategy-and-Product-Line-Launched-to-Explore-Trends-in-Global-Digital-Crypto-Asset-Securities-Companies-in-2019