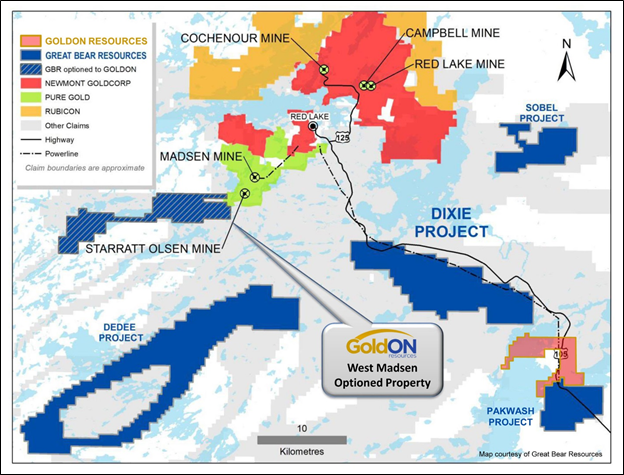

West Madsen Property Adjoins Pure Gold's Madsen Project, Where Mine Construction has Begun on the Highest-Grade Gold Development Project in Canada

VICTORIA, BC / ACCESSWIRE / October 22, 2019 / GoldON Resources Ltd. (TSX-V:GLD) ("GoldON" or the "Company") is pleased to announce that Phase II exploration has commenced on the West Madsen gold property (the "Property") optioned from Great Bear Resources (see news release of May 28, 2019).

The West Madsen Property is directly adjacent to Pure Gold's Madsen property, which is interpreted to host the extension of the Balmer Assemblage rocks of the Red Lake Greenstone Belt and where construction has begun on the new Madsen Gold Mine. Pure Gold's Madsen property includes historical production of 2.6 million ounces of gold, and a current indicated resource of 2,063,000 ounces gold (7.2 million tonnes at 8.9 g/t Au) and an inferred resource of 467,000 ounces gold (1.9 million tonnes at 7.7 g/t Au) (see NI 43-101 Technical Report filed July 5, 2019).

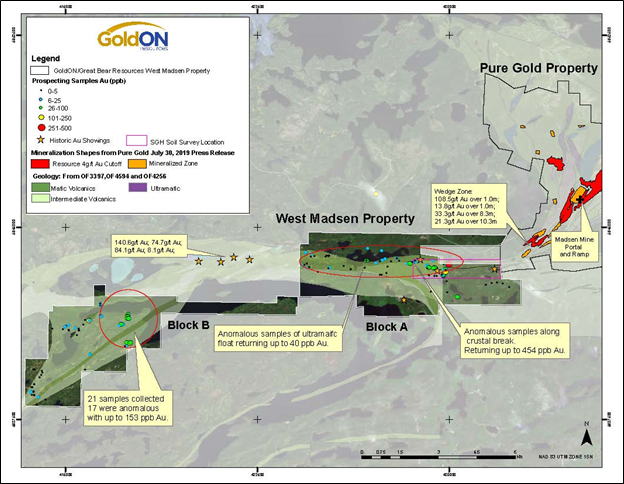

Phase I exploration on the West Madsen Property was completed this summer by GoldON's project manager and Red Lake specialist, Rimini Exploration & Consulting Ltd. Fieldwork included a property-scale grassroots prospecting survey and a 3-D Spatiotemporal Gas Hydrocarbon ("SGH") soil survey.

The prospecting survey was successful in:

identifying ultramafic rocks of potential Balmer Assemblage,

returning anomalous gold mineralization along the projected contact between the Balmer, and Confederation Assemblages, and

recognizing a relatively new area of anomalous gold for Block B.

The discovery of ultramafic rocks on the Property has significant implications given that most of the historical gold production and current reserves hosted on Pure Gold's Madsen property are hosted within the Balmer Assemblage in close proximity to ultramafic rocks. The rare-earth and litho-geochemical profiles of these boulders confirm that they are ultramafic in affinity and consistent with similar profiles from rocks sourced from within the Balmer Assemblage.

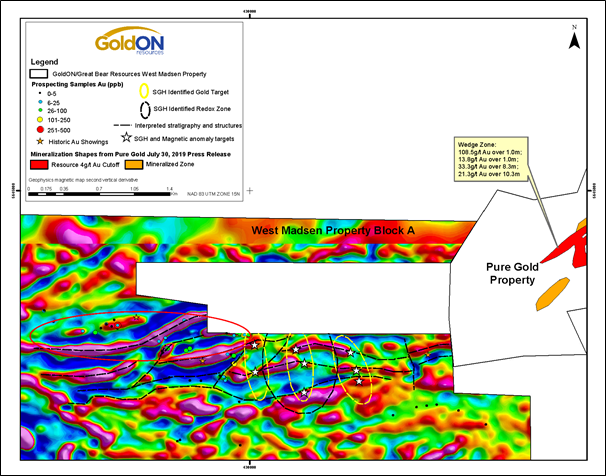

Results from the SGH soil survey identified a potential redox cell with three associated areas prospective for gold mineralization. These SGH survey targets are shown overlain on a geophysical magnetic survey of the area (below). The interpreted magnetic breaks and disruptions of the stratigraphic and structural trends correlate well with the identified SGH gold targets and redox zone. The target areas appear to be on trend from the mineralized areas on the adjacent Pure Gold Madsen property.

GoldON has mobilized Rimini Exploration & Consulting crews to initiate the Phase II exploration program that will include the following:

A prospecting and geological mapping program near Block A anomalous samples and the "Gold Zones" identified by the SGH survey with emphasis on collecting structural data that could identify mineralization controls and define drill targets.

Extension of the SGH survey west of Tack Lake along the projected contact of the Confederation and Balmer stratigraphy. This geological/structural environment is similar to the adjacent Madsen Mine increasing the priority of exploration in this area.

These programs could be followed up with a diamond drilling program focusing on the mafic to ultramafic rocks at Tack Lake and the gold zones identified from the current and extended SGH surveys.

"While we have already exceeded our first-year exploration expenditure commitments in keeping with our West Madsen option agreement with Great Bear Resources, we are implementing this Phase II exploration program prior to winter with the goal of generating initial drill targets for 2020," said Michael Romanik president of GoldON.

R. Bob Singh, P. Geo, an independent qualified person as defined in National Instrument 43-101, has reviewed and approved the technical contents of this news release on behalf of the Company.

About GoldON Resources Ltd.

GoldON is an exploration company focused on discovery-stage properties located in the prolific gold mining belts of northwestern Ontario, Canada. Active projects include the West Madsen property in the Red Lake Gold Camp and our flagship Slate Falls project in the Patricia Mining Division where 18 Au-Ag mineralized zones have been identified over the 7-kilometre breadth of the property. GoldON has 15,152,282 shares issued and is fully funded to complete its fall exploration programs.

For additional information please visit our website and you can view our latest presentation by clicking here.

ON BEHALF OF THE BOARD

Signed "Michael Romanik"

Michael Romanik, President

Direct line: (204) 724-0613

Email: romanikm@mymts.net

###

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

SOURCE: GoldON Resources Ltd.

View source version on accesswire.com:

https://www.accesswire.com/563681/GoldON-Commences-Phase-II-Exploration-on-West-Madsen-Property-in-Ontarios-Red-Lake-Gold-Camp