NEW YORK, NY / ACCESSWIRE / November 22, 2019 / Asset management is an ancient and modern industry, the asset owner wants to be able to receive any era of wealth growth effectively, from folk private lending to Banks bank finally evolved a special asset management institution, the purpose is to serve the asset value demand of customer assets among this experience the precious metals of gold silver copper to the notes to the iterated credit currency today, and professional requirements for asset managers more and more is also high.

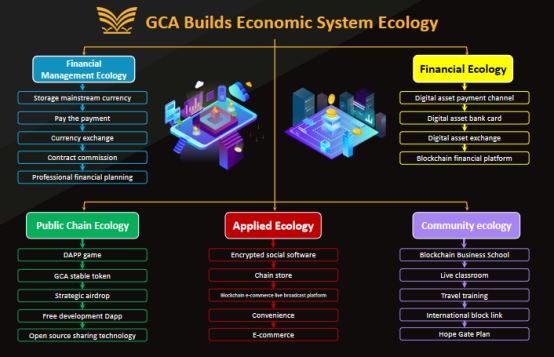

Today, the expression form of asset is facing innovation again, digital asset will become new asset carrier in global scope.Compared with the traditional asset model, digital asset is a brand-new field. The old asset management method and risk control system cannot adapt to the new challenges brought by digital asset.Therefore, digital assets need exclusive asset management institutions, and GCA is a new asset management group focusing on digital asset management, taking the lead in the field of digital assets and seizing the position of capital management in the next era.

1.Three financial licenses in hand, compliance first is the backing of digital asset security

GCA global asset management group, registered in the Cayman islands, one of the four largest offshore financial centers in the world, was founded by a group of financial professionals. Currently, it has Australia's DCE (Blockchain digital asset operation license), America's MSB (Money service business) financial license and Cayman fund license, and can carry out digital asset management services in compliance with global regulations.

The compliant operation represents that the asset management level of GCA team is recognized by the financial management departments of the mainstream countries in the world.

2.Targeting the digital currency market, a variety of arbitrage easy to cope with rising and falling prices

The GCA will only accept custody of mainstream digital assets and will focus its appreciation on the potentially huge digital currency market.According to statistics, there are more than 3,000 kinds of digital currency in the world, and more than 2,000 exchanges serving the circulation of digital currency, with a circulation market value of more than 100 billion yuan every day.Most importantly, digital currency has a much higher appreciation potential than any traditional asset, making it an excellent place to manage assets.

And GCA has set up special trading accounts in major exchanges around the world, including Binance and OKEX, which are operated by independent professional trading teams. As long as the market fluctuates, the GCA team is able to spot arbitrage opportunities and realize rapid growth of user assets.

Historically,GCA's professional team has been able to achieve a pure return of 5%-20% from the secondary market, based on a quantitative strategy, while ensuring the absolute safety of users' assets.

3.Strictly adhere to the risk control line, and GCA digital asset management is safe and reliable

As everyone in the industry knows, the greatest test of digital asset management is not the return on assets but the ability of institutions to manage risk.Risk control is an absolute professional technical work.In addition to strict regulations and supervision, the risk awareness of the team responsible for trading is the top priority.

The trading team of GCA is all experienced traders with many years of trading experience and is highly sensitive to potential risks in the market. Meanwhile, GCA also has its own strict risk control team which is responsible for real-time monitoring of the whole trading.

Choosing GCA is an asset allocation tool that opens the door to new wealth.

Company: GCA

Person: Eric Young

Email: info@gdfgd.com

Web: https://gca-hd.com/

SOURCE: GCA

View source version on accesswire.com:

https://www.accesswire.com/567690/Not-lagging-behind-in-the-era-of-global-economy-GCA-has-helped-multiply-global-digital-assets