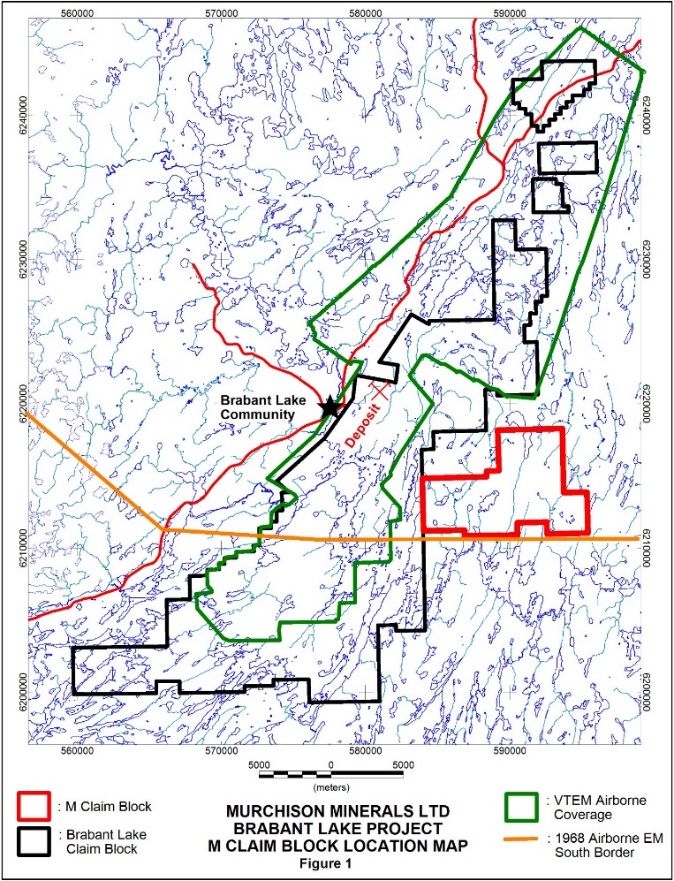

TORONTO, ON / ACCESSWIRE / December 9, 2019 / Murchison Minerals Ltd. ("Murchison" or the "Company") (TSXV: MUR) is pleased to announce it has acquired an additional 5,601 hectares (56.01 km2) of mineral claims (M Claim Block) located east of the existing Brabant Lake project in northern Saskatchewan (see Figure 1).

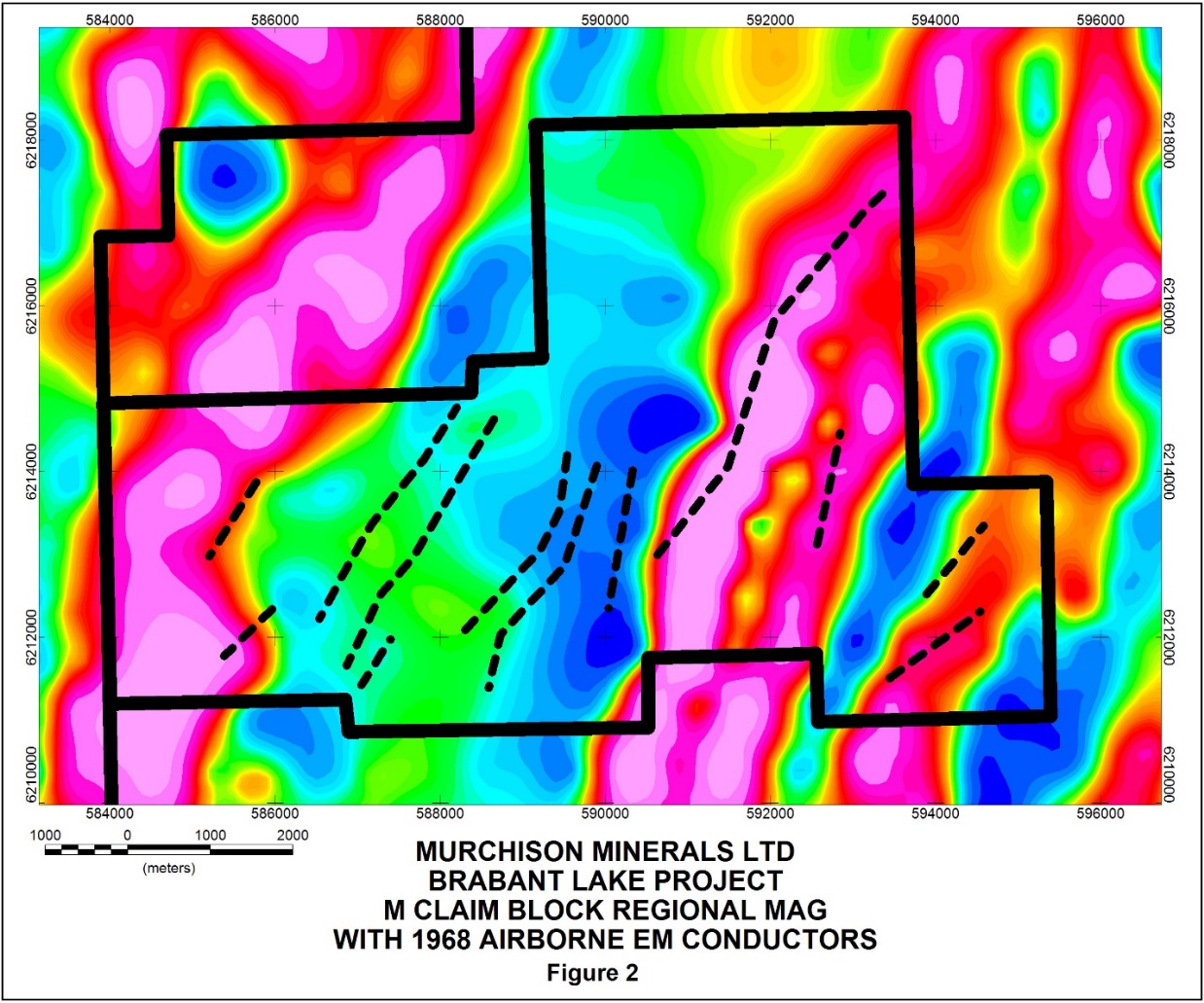

The M Claim Block covers twelve electromagnetic ("EM") conductors previously identified in an historic airborne geophysical survey completed in 1968. Figure 2 identifies these conductor traces which are presented over a regional airborne magnetic image, highlighting that some occurrences are coincident with magnetic high features, a criterion derived from the geophysical signature of the Brabant-McKenzie VMS deposit. The 1968 survey detected the Brabant-McKenzie deposit conductor as well as numerous other conductors detected by the modern VTEM airborne EM and magnetic surveys completed over the Brabant Lake project. This historical survey has also detected other EM conductors on lands already controlled by Murchison that do not have modern airborne EM coverage.

The area, including the M Claim Block, is dominantly underlain by garnetiferous biotite gneisses and highly-metamorphosed mafic volcanic rocks similar to those at the Brabant-McKenzie VMS deposit.

Murchison owns the Brabant-McKenzie VMS deposit, which remains open to expansion, and twelve high-priority targets scheduled to be drilled in Q1 / 2020. The recent addition of six new highly prospective claim blocks, covering about 107 km2 (Henry 1-5 and M Claim blocks), significantly enhances the Company's land holdings.

Qualifying Statement

The foregoing scientific and technical disclosures have been reviewed by Ehsan Salmabadi, P. Geo., and Martin St-Pierre, P. Geoph., qualified persons as defined by National Instrument 43-101. Mr. Salmabadi and Mr. St-Pierre are independent consultants to Murchison and the Brabant Lake project.

About the Brabant Lake Project

The Brabant Lake project is located 175 kilometres northeast of La Ronge, Saskatchewan and approximately three kilometres from the community of Brabant Lake. The area is accessed year-round via provincial Highway 102 and is serviced by grid power. The project consists of one mining lease which hosts the Brabant-McKenzie VMS deposit, and additional mineral claims totalling 430 km2 and extending over 57 kilometres of strike length over favourable geological horizons, multiple known mineralized showings, and identified geophysical conductors.

NI 43-101 Resources of the Brabant-McKenzie VMS Deposit

• Indicated - 2.1 million tonnes at 7.08% zinc, 0.69% copper, 0.49% lead, 39.60 g/t silver or 9.98% zinc equivalent

• Inferred - 7.6 million tonnes at 4.45% zinc, 0.57% copper, 0.19% lead, 18.40 g/t silver or 6.29% zinc equivalent

About Murchison Minerals Ltd. (TSXV: MUR)

Murchison is a Canadian-based exploration company focused on the exploration and development of the 100% owned Brabant Lake zinc-copper-silver project in north-central Saskatchewan. The Company also has a 100% interest in the HPM nickel-copper-cobalt project in Quebec. Murchison currently has 48.4 million shares issued and outstanding.

Additional information about Murchison and its exploration projects can be found on the Company's website at www.murchisonminerals.com. For further information, please contact:

Jean-Charles (JC) Potvin, President and CEO

jcpotvin@murchisonminerals.com

Erik H Martin, CFO

Tel: (416) 350-3776

info@murchisonminerals.com

Forward-Looking Information

Certain information set forth in this news release may contain forward-looking information that involves substantial known and unknown risks and uncertainties. This forward-looking information is subject to numerous risks and uncertainties, certain of which are beyond the control of the Company, including, but not limited to, the impact of general economic conditions, industry conditions, and dependence upon regulatory approvals. Readers are cautioned that the assumptions used in the preparation of such information, although considered reasonable at the time of preparation, may prove to be imprecise and, as such, undue reliance should not be placed on forward-looking information. The parties undertake no obligation to update forward-looking information except as otherwise may be required by applicable securities law.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

SOURCE: Murchison Minerals Ltd.

View source version on accesswire.com:

https://www.accesswire.com/569530/Murchison-Acquires-56-Km2-of-New-Claims-Hosting-12-EM-Conductors-at-Brabant-Lake-Saskatchewan