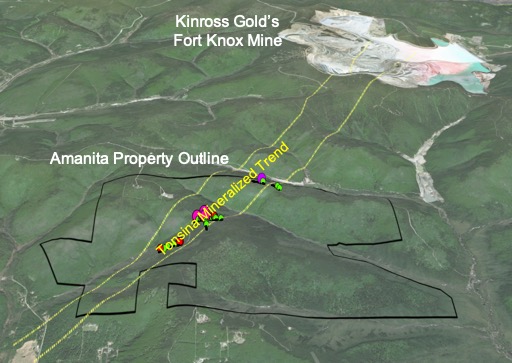

TORONTO, ON / ACCESSWIRE / June 24, 2020 / Avidian Gold Corp. ("Avidian" or the "Company") (TSX-V:AVG) wishes to announce that it has converted 1,320 acres (5.3 sq km) of its 3,607 acre (14.6 sq km) Amanita gold property to an Uplands Mining Lease ("Mining Lease"). The Amanita property is located 15 km northeast of Fairbanks, Alaska, and approximately 5 km southwest and contiguous to the Fort Knox open-pit gold mine (Figure 1).

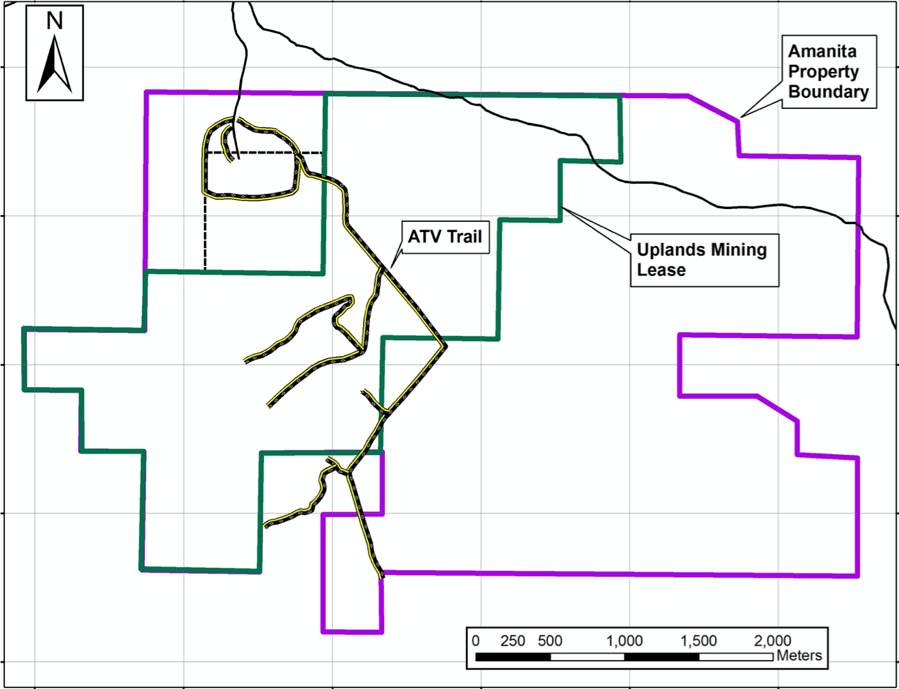

The Amanita Mining Lease is valid for 20 years and grants the exclusive right to explore for minerals within the leased area and the exclusive right to mine, extract and remove all minerals subject to obtaining all the required permits and approvals necessary to be able to mine and produce from the lease area.

This Mining Lease was established over the mineralized Tonsina Trend (Figures 2 and 3) which is a fault bounded, 800 metre wide, northeast trending structural corridor that can be traced along a strike length of approximately 4 km on the property. A trenching program completed in 2019 encountered the following highlight oxide gold results within the Tonsina Trend (see Jan. 7, 2020 Press Release):

- 94.5 m of 3.04 g/t Au, including 22.5 m of 11.51 g/t Au;

- 27 m of 4.22 g/t Au, including 6 m of 4.70 g/t Au and 6 m of 13.85 g/t Au

The Tonsina Trend has been sparsely drilled with 39 historical reverse circulation holes, of which 30 intersected oxide mineralization with grades > 1.0 g/t Au such as: 13.72 m of 3.02 g/t Au, 10.67 m of 1.08 g/t Au, 12.19 m of 2.28 g/t Au, 4.57 m of 11.49 g/t Au, and 3.05 m of 14.04 g/t Au. Gold mineralization intersected in the drill holes was hosted in steeply dipping oxidized bodies hosted within metamorphosed sediments proximal to intrusive Cretaceous age rocks (see press release Jan. 7, 2020). The historical drilling was designed to test a prominent gold geochemical anomaly that extends throughout the majority of the property. The drilling tested only a small portion of the geochemical anomaly with average vertical drill hole depth being less than 100 m.

This is the second Mining Lease held by Avidian in Alaska. A 2,940 acre (11.9 sq km) mining lease on the Golden Zone Property overlies a NI 43-101 Indicated gold resource of 267,400 ounces (4,187,000 tonnes at 1.99 g/t Au) plus an Inferred gold resource of 35,900 ounces (1,353,000 tonnes at 0.83 g/t Au). Additionally, the Golden Zone property also has a 40 acre Mill Site Claim. Avidian is working to expand this resource.

Avidian plans to continue exploration of the Amanita property in 2020. The exploration program will focus on the gold mineralized Tonsina Trend and consist of a LIDAR survey as well as a core diamond drilling program. The drill program is designed to evaluate the size of the mineralization tested in the historical drilling and drill test the 2019 trench results. The trench results are adjacent to and in some cases overly the historical mineralization. Avidian will provide further details on these programs in the coming weeks.

The technical information contained in this news release has been approved by Steve Roebuck, P.Geo and President of Avidian Gold, who is a Qualified Person as defined in National Instrument 43-101 - Standards of Disclosure for Mineral Projects.

About Avidian Gold Corp.

Avidian brings a disciplined and veteran team of project managers together with a focus on advanced stage gold exploration projects in Alaska. Avidian's Golden Zone project hosts a NI 43-101 Indicated gold resource of 267,400 ounces (4,187,000 tonnes at 1.99 g/t Au) plus an Inferred gold resource of 35,900 ounces (1,353,000 tonnes at 0.83 g/t Au). Additional projects include the Amanita and the Fish Creek gold properties which are both adjacent to Kinross Gold's Fort Knox gold mine in Alaska, and the Jungo gold/copper property in Nevada.

Avidian is the majority owner of High Tide Resources, a private company with an option on the Labrador West iron ore property and owner of the base metal Strickland Property and the Black Raven gold property, all located in Newfoundland and Labrador, Canada.

Avidian is focused on and committed to the development of advanced stage mineral projects throughout first world mining friendly jurisdictions using industry best practices combined with a strong social license from local communities. Further details on the Company and the individual projects, including the NI 43-101 Technical report on the Golden Zone property (August 17, 2017, by L. McGarry P.Geo & I. Trinder P.Geo, A.C.A Howe International Ltd), can be found on the Company's website at www.avidiangold.com.

For further information, please contact:

Steve Roebuck, President

E: sroebuck@avidiangold.com or +1(905) 741-5458

Email: info@avidiangold.com

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release.

Forward-looking information

This News Release includes certain "forward-looking statements". These statements are based on information currently available to the Company and the Company provides no assurance that actual results will meet management's expectations. Forward-looking statements include estimates and statements that describe the Company's future plans, objectives or goals, including words to the effect that the Company or management expects a stated condition or result to occur. Forward-looking statements may be identified by such terms as "believes", "anticipates", "expects", "estimates", "may", "could", "would", "will", or "plan". Since forward-looking statements are based on assumptions and address future events and conditions, by their very nature they involve inherent risks and uncertainties. Actual results relating to, among other things, results of exploration, project development, reclamation and capital costs of the Company's mineral properties, and the Company's financial condition and prospects, could differ materially from those currently anticipated in such statements for many reasons such as: changes in general economic conditions and conditions in the financial markets; changes in demand and prices for minerals; litigation, legislative, environmental and other judicial, regulatory, political and competitive developments; technological and operational difficulties encountered in connection with the activities of the Company; and other matters discussed in this news release. This list is not exhaustive of the factors that may affect any of the Company's forward-looking statements. These and other factors should be considered carefully and readers should not place undue reliance on the Company's forward-looking statements. The Company does not undertake to update any forward-looking statement that may be made from time to time by the Company or on its behalf, except in accordance with applicable securities law.

Figure 1. Amanita Property

(Contiguous to Fort Knox)

Figure 2: Amanita Property - Uplands Mining Lease

Figure 3: Amanita Property - Trench Locations and Selected Historical Drill Hole Results

SOURCE: Avidian Gold Corp.

View source version on accesswire.com:

https://www.accesswire.com/595086/Avidian-Gold-Converts-the-Mineralized-Corridor-on-the-Amanita-Property-to-an-Uplands-Mining-Lease