SURREY, BC / ACCESSWIRE / July 23, 2020 / Larry W. Reaugh, President and Chief Executive Officer of American Manganese Inc. (TSXV:AMY)(OTC PINK:AMYZ)(FSE:2AM) (the "Company"), is pleased to announce the Company is proposing to maximize shareholder value by spinning out their B.C. mineral claims into a new company. Current shareholders of the Company would receive shares of the new company, provided that the proposed plan of arrangement through which the spin-out occurs is approved by the shareholders, the TSX Venture Exchange and other regulatory authorities.

Recent investor focus on precious and base metals supports the Company's decision to maintain these valuable assets, which AMY believes are not currently reflected in its stock price. By contributing these mineral claims to a separate, newly formed company, AMY believes shareholders will benefit from the market's view on these assets.

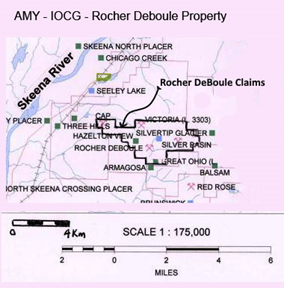

"A spin-out of our mining assets now would allow our shareholders to take advantage of the bull market in precious and base metals, especially in gold, copper and cobalt," says Mr. Reaugh. "Our Rocher DeBoule property is in a good position to capitalize on this upsurge, being an IOCG target with past production." Highlights of the Rocher Deboule property are as follows:

IRON OXIDE COPPER GOLD (IOCG) BRITISH COLUMBIA (100% Ownership) *

AMY's IOCG 980 (Hectares)/2,421 (Acres) target is located 10 km from Hazelton, BC. The property contains several mineral occurrences over a 12 kilometer east, west direction. The original Rocher Deboule mine and three other properties were mined and shipped to smelter by railroad as follows:

PROPERTY | TONS | GOLD | SILVER | COPPER | MO (lbs) | LEAD/ZINC | COBALT |

Rocher DeBoule | 52,719 | 4,492 | 84,477 | 6,203,584 | 7,970 | ||

Victoria ** | 90 | 326 | 0 | 2,100 | 4918 | ||

Highland Boy | 75 | 4 | 35 | 10,493 | |||

Cap | 29 | 3 | 252 | 3,375 | |||

Production s are reported in Sutherland Brown, A., 1960: Geology of the Rocher Deboule Range, Bulletin | |||||||

** One high-grade shipment of 23 tons averaged 6.25 opt Gold, Silver (8.70 opt) Copper (7.0%), Cobalt (2.5%) and Molybdenum (1.15%). Soil, mapping, rock sampling and magnetometer program in 2011-2016 have identified three (3) bulk tonnage targets, within the claim group. A similar program in 2017 returned rock sample assays up to 2.75% Cobalt and 164.0 gram/metric tonne Au (4.78 troy ounce/short ton Au).

Along with the Rocher Deboule property, the Company's Rare Earth Project would also be spun out. Highlights of those claims are as follows:

RARE EARTH PROJECT, BRITISH COLUMBIA (100% OWNERSHIP) *

The Virgil and Lonnie Carbonatite Claims totaling 735 (Hectares)/1,817 (Acres) is located on Granite Creek, south east of Manson Creek in North Central British Columbia contain two showings defined by trenching (1970's) with a combined strike length of 620 meters (2,040 ft.) with widths ranging from 1-40 meters width grading 0.20% Niobium. a 56-meter chip sample on the Brent carbonatite assayed .05% Lanthanum, .03% Neodymium and .15% titanium. Airborne geophysics and geochemical field work identified four significant anomalies with soil sampling results approaching 1% total rare earths plus additional Niobium credits.

* These tables provide values which could be considered historical estimates. A Qualified Person (as that term is defined under National Instrument 43-101) has not done sufficient work to classify the historical estimates as current mineral resources or mineral reserves, and the Company is not treating the historical estimate as current mineral resources or mineral reserves.

About American Manganese Inc.

American Manganese Inc. is a critical metals company focused on the recycling of lithium-ion batteries with the RecycLiCo Patented Process. The process provides high extraction of cathode metals, such as lithium, cobalt, nickel, manganese, and aluminum at battery-grade purity, with minimal processing steps. American Manganese Inc. aims to commercialize its breakthrough RecycLiCo Patented Process and become an industry leader in recycling cathode materials from spent lithium-ion batteries.

This release has been reviewed by Andris Kikauka, P.Geo. a qualified person pursuant to National Instrument 43-101.

On behalf of Management

AMERICAN MANGANESE INC.

Larry W. Reaugh

President and Chief Executive Officer

Telephone: 778 574 4444

Email: lreaugh@amymn.com

www.americanmanganeseinc.com

www.recyclico.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release. This news release may contain "forward-looking statements", which are statements about the future based on current expectations or beliefs. For this purpose, statements of historical fact may be deemed to be forward-looking statements. Forward-looking statements by their nature involve risks and uncertainties, and there can be no assurance that such statements will prove to be accurate or true. In particular, there is no assurance that the Company will be able to proceed with its plan to spin out its mineral properties to NewCo in a timely fashion, or that it will be able to obtain the necessary approvals to do it at all. Investors should not place undue reliance on forward-looking statements. The Company does not undertake any obligation to update forward-looking statements except as required by law.

SOURCE: American Manganese Inc.

View source version on accesswire.com:

https://www.accesswire.com/598711/American-Manganese-Inc-Proposes-Spinout-of-Mineral-Properties-to-Maximize-Asset-Values