VANCOUVER, BC / ACCESSWIRE / July 27, 2020 / Gaia Metals Corp. (the "Company") (TSXV:GMC)(OTCQB:RGDCF)(FSE:R9G) is pleased to announce that, further to its news release dated June 4, 2020, the Company has executed a definitive agreement (the "Agreement") with arm's length vendors whereby the Company may acquire a 100% undivided interest in the Freeman Creek Property (the "Property"). The Property consists of 76 claims covering approximately 599 hectares (1,481 acres) and is located on BLM lands, outside of US Forest Service Lands and other protective areas, within the state of Idaho, USA.

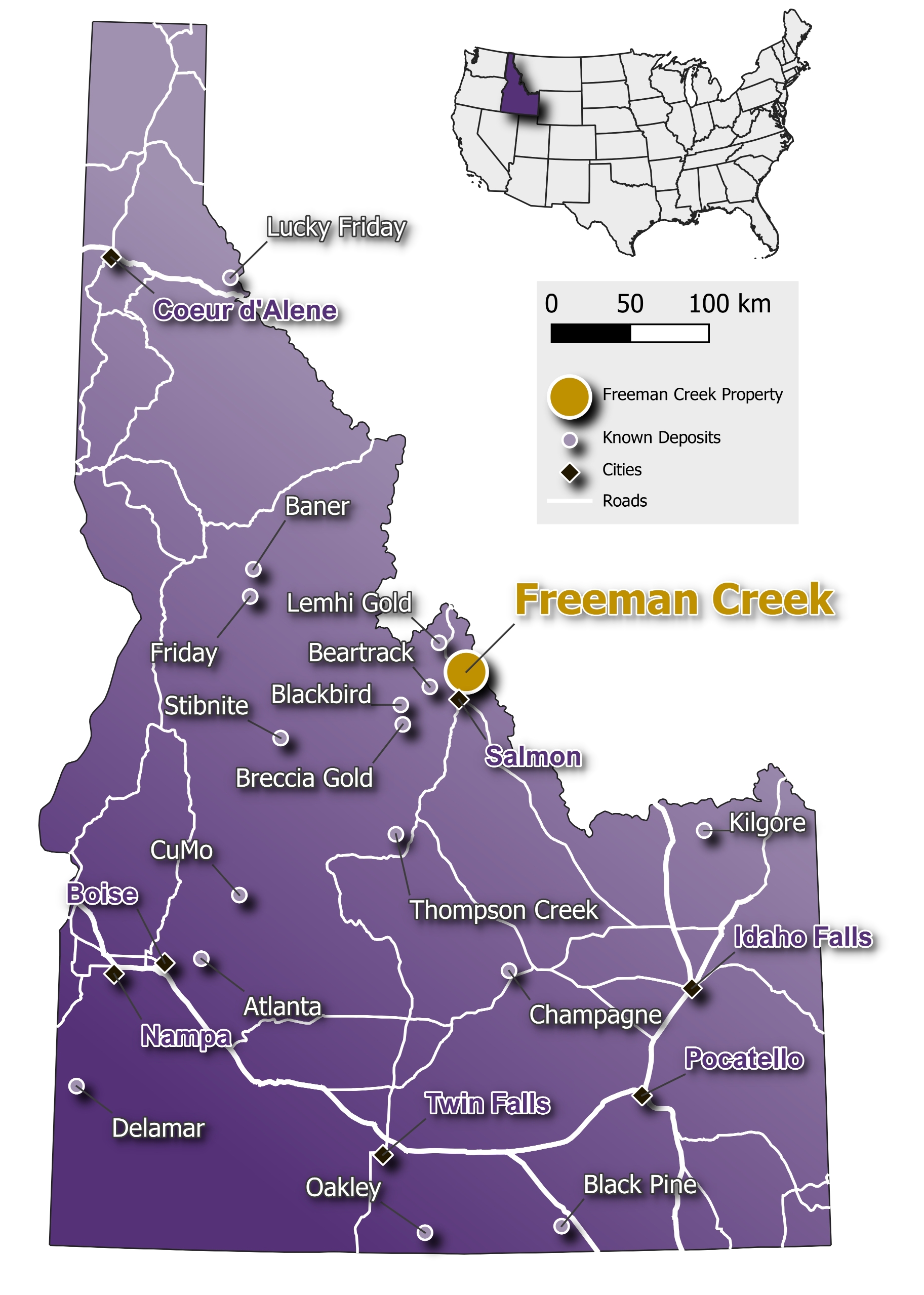

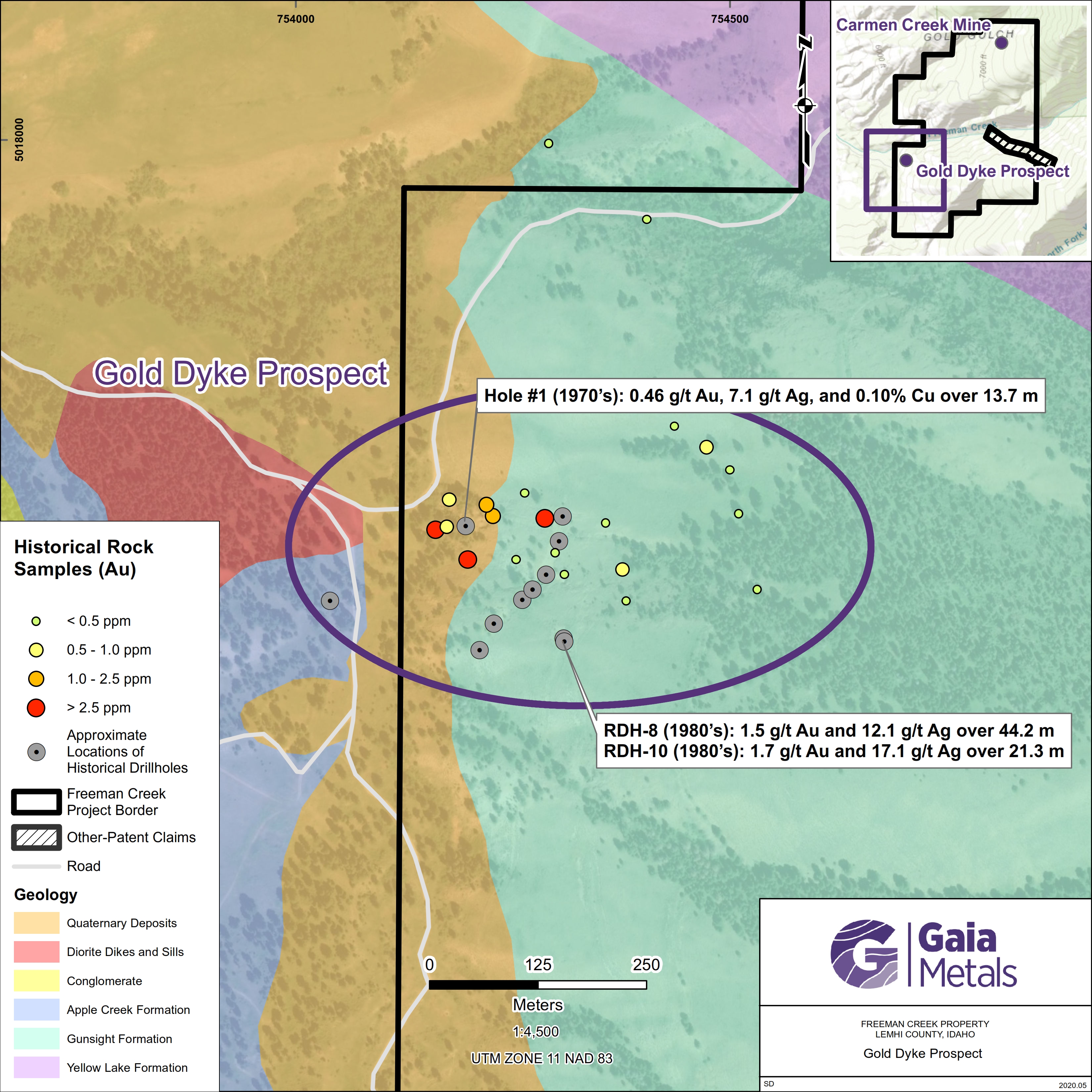

The Freeman Creek Property is located approximately 15 km northeast of Salmon, Idaho, and is accessible via paved highway and a network of gravel roads and trails. The Property hosts two major advanced targets; the Gold Dyke Prospect, with an historical drill intercept of 1.5 g/t Au and 12.1 g/t Ag over 44.2 m, and the Carmen Creek Mine Prospect, with an historical outcrop sample assay of 14.15 g/t Au, 63 g/t Ag, and 1.2% Cu (see Figures 1 and 2 below).

Adrian Lamoureux, President, CEO, and Director of Gaia Metals Corp. comments, "We are very pleased to have now executed this definitive Agreement for Freeman Creek. The project offers the Company an excellent opportunity in the gold space at a time when prices continue to advance towards all-time highs. The historical work has already highlighted the potential of the Property and the relatively straight-forward permitting process will allow us to aggressively explore and unlock the value of this opportunity for our shareholders".

Immediate exploration plans for the Property include a Phase I program of ground mapping and sampling of historical occurrences, confirmation of historical drill collar locations, prospecting, as well as potential soil sampling, and ground geophysics. The Phase I program is anticipated to be followed shortly thereafter by a drill program (Phase II). The objective of the work will be to verify and expand upon historical results.

Transaction

Under the terms of the Agreement, the Company may acquire a 100% interest in the Property by paying a total of $90,000, issuing an aggregate 4,000,000 common shares (the "Consideration Shares") and 2,000,000 transferable common share purchase warrants, exercisable at $0.10 and expiring three years from issuance (the "Consideration Warrants") as follows:

- $10,000 upon signing the Agreement;

- $40,000, 2,000,000 Consideration Shares and 1,000,000 Consideration Warrants upon receipt of TSX Venture Exchange ("Exchange") approval of the Agreement; and

- $40,000, 2,000,000 Consideration Shares and 1,000,000 Consideration Warrants on the one-year anniversary of Exchange approval of the Agreement.

In the event that a gold equivalent resource of more than 1 million ounces is outlined within a NI 43-101 Resource Estimate on the Property, the Company shall pay $1,000,000, payable in shares or cash or a combination of both, at the Company's discretion. In the case of a share issuance, the shares shall be issued at a price using the average market price of the previous 30 trading days preceding the share issuance.

The vendors shall retain a 2.5% net smelter return royalty ("NSR") on the Property, of which the Company shall have the right to purchase half (1.25%) for $1,500,000.

Gold Dyke Prospect

Gold and silver mineralization at the Gold Dyke Prospect is hosted by Precambrian Lemhi Group sediments and has seen early development and sporadic exploration from about 1910 to 1986. The base and precious metal mineralization is associated with a gossan at surface and has been traced over 1500 feet (457 m) along strike and 600 feet (183 m) vertical.

Historical exploration, circa 1910, included the completion of several open cut trenches and adits into the known mineralization. Sampling from these trenches returned 6.86 g/t Au and 199 g/t Ag over 7.0 m, 5.49 g/t Au and 130 g/t Ag over 5.8 m, and 19.9 g/t Au, 65 g/t Ag, and 1.05% Cu over 3.7 m. In addition, a grab sample collected from one of the open cuts assayed 60.0 g/t Au and 1,440 g/t Ag.

During the 1970's and 1980's exploration included a limited number of drill holes along two north-south orientated fences, spaced less than 200 m apart. The mineralization remains open to the east of drill holes RDH 8 and RDH 10, both reverse circulation drill holes respectively, which are the eastern most holes completed to date at the Gold Dyke Prospect. A summary of historical drill results follows:

- Hole #1 (1970's): 0.46 g/t Au, 7.1 g/t Ag, and 0.10% Cu over 13.7 m

- RDH 8 (1980's): 1.5 g/t Au and 12.1 g/t Ag over 44.2 m

- RDH 10 (1980's): 1.7 g/t Au and 17.1 g/t Ag over 21.3 m

Subsequent to the drill testing in the 1980s, Cominco and BHP explored the Property in the 1990s for large-scale copper potential; however, records of this exploration have not been located.

Carmen Creek Mine Prospect

The Freeman Creek Property also hosts the past-producing Carmen Creek Mine, located approximately 3 km to the northeast of the Gold Dyke Prospect. A small mill was installed at the site in 1910 to process gold ore from the mine, initially discovered in 1904; however, few records exist detailing the Carmen Creek Mine's development, production, or head grade. Historical samples from surface outcrop and mine workings assayed 14.15 g/t Au, 63 g/t Ag, and 1.2% Cu, and 1.8 g/t Au, 43 g/t Ag, and 1% Cu, respectively

The style of mineralization at Carmen Creek is described as "a gold and copper bearing exhalate zone, a few tens of meters thick…". At the mine, the "gold and copper are concentrated in lenses of massive quartz and magnetite".

Figure 1: Location of the Freeman Creek Property

Figure 2: Summary of historical work at the Gold Dyke Prospect

NI 43-101 Disclosure

Darren L. Smith, M.Sc., P. Geo., Vice President of Exploration for the Company and Qualified Person as defined by National Instrument 43-101, supervised the preparation of the technical information in this news release.

About Gaia Metals Corp.

Gaia Metals Corp. is a mineral exploration company focused on the acquisition and development of mineral projects containing base and precious metals, including platinum group elements, and lithium.

The Company's primary assets are the wholly owned Corvette Property, and the FCI Property (held under Option from O3 Mining Inc., a recent spin-out from Osisko Mining Inc., for a 75% interest) located in the James Bay Region of Quebec. The properties are contiguous and host significant gold-silver-copper-PGE-lithium potential highlighted by the Golden Gap Prospect with grab samples of 3.1 to 108.9 g/t Au from outcrop and 10.5 g/t Au over 7 m in drill hole, the Elsass and Lorraine prospects with 8.15% Cu, 1.33 g/t Au, and 171 g/t Ag in outcrop, and the CV1 Pegmatite Prospect with 2.28% Li2O over 6 m in channel.

In addition, the Company holds the Pontax Lithium-Gold Property, QC; the Golden Silica Property, BC; and the Hidden Lake Lithium Property, NWT, where the Company maintains a 40% interest, as well as several other assets in Canada.

For further information, please contact Adrian Lamoureux, President & CEO at Tel: 778-945-2950, E-mail: adrian@gaiametalscorp.com or visit www.gaiametalscorp.com.

On Behalf of the Board of Directors,

"ADRIAN LAMOUREUX"

Adrian Lamoureux, President & CEO

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release.

Forward Looking Statements:

Statements included in this announcement, including statements concerning our plans, intentions and expectations, which are not historical in nature are intended to be, and are hereby identified as, "forward-looking statements". Forward-looking statements may be identified by words including "anticipates", "believes", "intends", "estimates", "expects" and similar expressions. The Company cautions readers that forward-looking statements, including without limitation those relating to the Company's future operations and business prospects, are subject to certain risks and uncertainties that could cause actual results to differ materially from those indicated in the forward-looking statements.

SOURCE: Gaia Metals Corp.

View source version on accesswire.com:

https://www.accesswire.com/598807/Gaia-Metals-Corp-Enters-into-Definitive-Agreement-to-Acquire-the-Freeman-Creek-Gold-Property-with-Historical-Drill-Intercept-of-15-gt-Au-and-121-gt-Ag-over-442-m-Idaho-USA