Charitable Organizations Gain Competitive Advantage, Respond Faster to Market Trends with THD lens

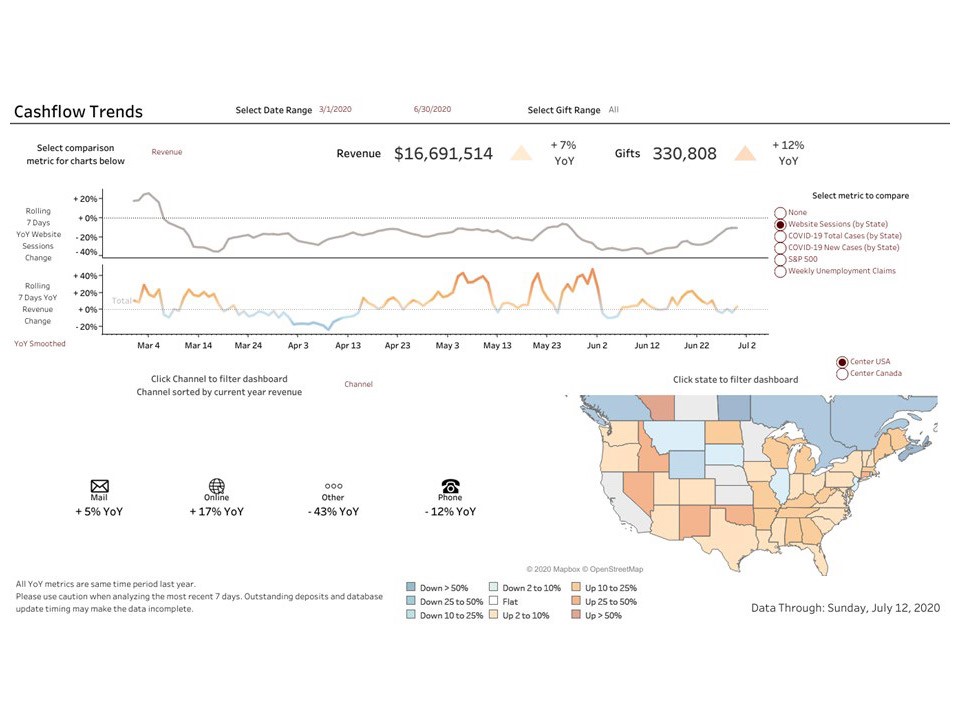

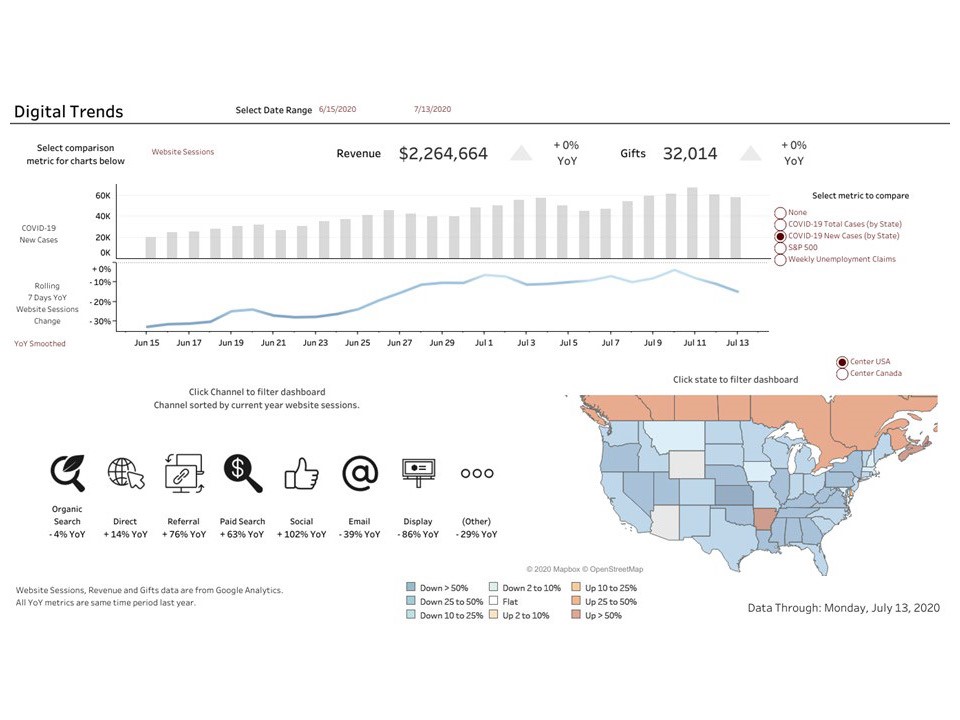

LINCOLN, MA / ACCESSWIRE / September 9, 2020 / THD, Inc., a social impact agency, today launched THD lens, new data visualization dashboards that raise the industry standard for how charitable organizations evaluate fundraising performance. It is now possible for non-profit decision makers to see the insights most critical to their goals with just a few clicks. These dashboards quickly demonstrate how an organization's fundraising efforts are performing overlaid with contextual data such as COVID cases by state, S&P 500 performance, unemployment claims, and more. The ability to easily visualize revenue streams and compare and contrast performance of fundraising programs, channels, and audience segments to spot trends leads to faster, more responsive decision making and ultimately more successful campaigns.

"The new dashboards developed by THD have been an incredible asset," said Tracey Dhani, director of annual giving and donor relations for the MS Society of Canada. "Having quick answers could not have come at a better time. There really is magic in seeing the ongoing changes to the curve."

IMAGE CAPTION: THD's Cashflow Trends Dashboard shows revenue changes by channel and state and allows marketers to compare these trends to changes in website sessions, COVID cases, the stock market index, and unemployment claims over the same time period - a particularly powerful and timely capability for marketers given the pandemic and attendant market volatility.

As non-profits compete for fundraising dollars in increasingly difficult market conditions, successful next-generation revenue strategy will depend on the ability to be agile and responsive. The clean, streamlined data visualization provided by THD lens allows teams to easily track Key Performance Indicators (KPIs) such as:

- Audience segment trends for the fiscal year and last twelve months

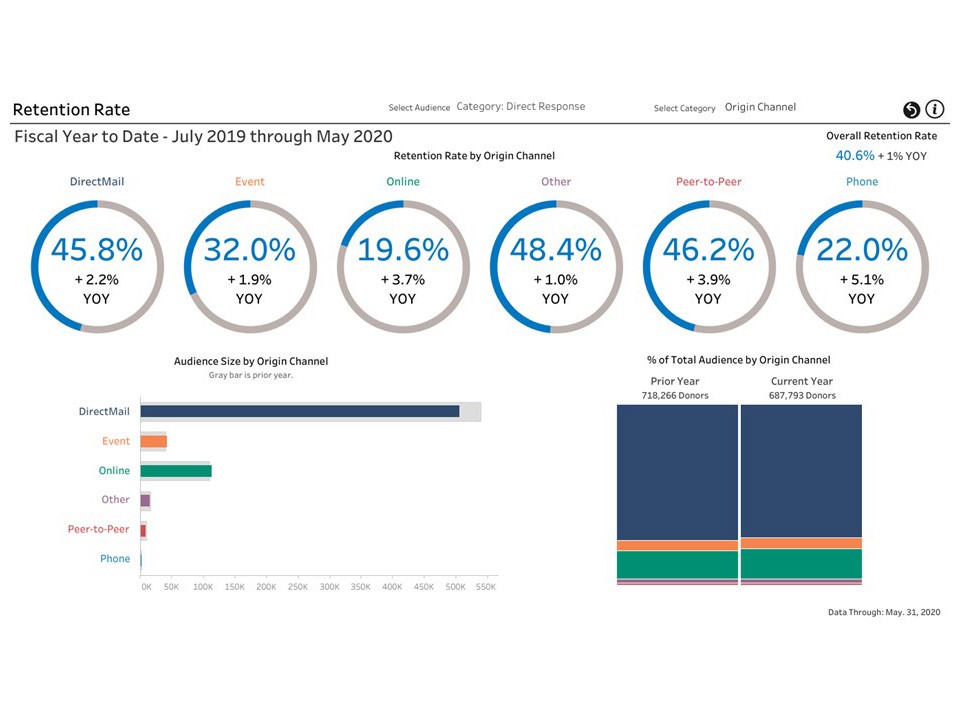

- Retention rate differences by lifecycle segments and channels

- Full year projections

- Budget vs. actual performance by month, channel, and campaign

With a distinct competitive advantage, THD's client partners now have 24/7 access to their data and in a striking visual format to draw out actionable insights quickly. Through the use of automated Application Programming Interfaces (APIs), information from outside sources is brought together with organization data from their programs and channels including direct mail, email, digital, and events. The data is easily downloaded for presentations to socialize the insights and collaborate with team members.

IMAGE CAPTION: THD's Retention Rate Dashboard gives fundraisers a clear line of sight to retention metrics by marketing channel.

"Our deep knowledge of the non-profit sector and donor behavior is the secret sauce behind our analytics," explained Linda Williams, chief strategy officer at THD. "We understand the most informative and meaningful context to present otherwise one-dimensional data so that insights pop and non-profit leaders can make informed decisions."

IMAGE CAPTION: With THD's Cashflow Trends Dashboard, you can also zero in on channel-specific performance metrics and trends and compare them to external influences like COVID cases, unemployment claims, and more.

Media Contact:

Karyn Martin

Golden Thread Agency

617-462-0108

karyn@goldenthreadagency.com

About THD

Founded in 1989, Thompson Habib Denison (THD) is a social impact agency committed to doing good by driving donors, dollars, engagement, and brand loyalty for top-ranked non-profit organizations. Leveraging core competencies in strategy, analytics, and marketing, THD develops insight-driven multichannel campaigns and experiences to create impact for meaningful causes that serve our communities, our nation, and our world. The company is headquartered in Lincoln, Massachusetts, with clients across the U.S. and Canada.

SOURCE: THD

View source version on accesswire.com:

https://www.accesswire.com/605233/THD-Launches-New-Data-Visualization-Tools-That-Enable-Non-Profits-to-Boost-Revenue