NEW YORK, NY / ACCESSWIRE / September 20, 2020 / In 2020, DeFi has become a new hot spot in the field of digital currency. Its lock-up capacity exceeded 11 billion US dollars in a short time, and the number of downloaded wallet APP exceeded 5,000. According to the actual market capacity of DeFi, it is only in the water testing stage of the industry at present. With the participation of famous players in digital currency, new opportunities in DeFi market have quietly come. Not only old players like Chainlink, MakerDAO, Compound, etc., but also up-and-coming youngsters like Combo have joined.

Combo is a brand-new decentralized financial derivative aggregation agreement based on Kuchain public blockchain "four-layer network" technology logic, including liquidity mining agreement, synthetic asset issuance agreement, pledge mining and oracle machine. It provides support for developing the underlying protocol for seamless mapping of traditional financial assets, aiming at making it easy for all users to participate, and providing solutions for traditional financial assets and more diverse and complex trading strategies.

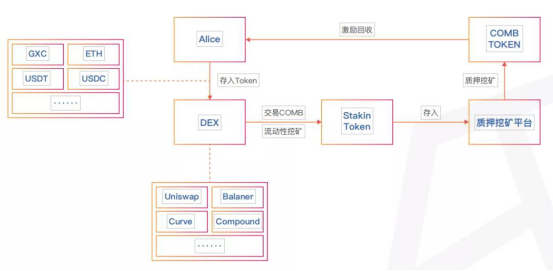

Liquidity mining

Liquidity mining aims to promote the circulation of decentralized cryptocurrency. At present, the liquidity mining of Combo mainly refers to products on the Ethereum blockchain. It is obtained by providing liquidity for Combo in DEX income. Simply put, deposit token assets to start mining.

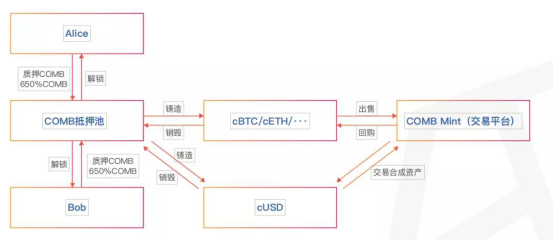

Synthetic asset issuance

Synthetic assets are financial instruments that simulate other instruments. It is based on the combination of one or more assets/derivatives in Ethereum. The operation of the Combo synthetic asset protocol is supported by Combo. When Combo holders enter the Combo-Mint platform (a synthetic asset platform that interacts with Combo smart contracts), they will mortgage their Combo as collateral at a mortgage rate of 650% (the mortgage rate will be determined by the votes of Combo users), and then they can generate synthetic assets.

Lock Asset Pool Mining

In the process of pledge mining, the nodes in the blockchain system do not require too high hash rate. Only a certain amount of tokens need to be pledged, and after a period of operation, new currency can be generated, which is the income obtained through the pledge. This is equivalent to the fact that people can get a certain amount of interest every year when people deposit their money in the bank.

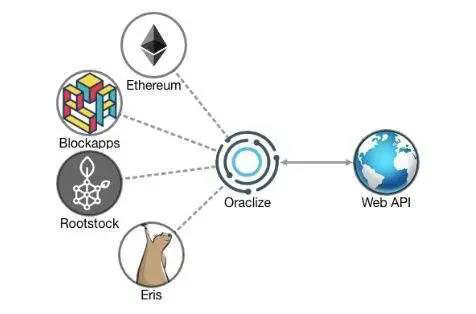

Oracle

Suppose that the "data source" in the real world and the "data interface" in the blockchain are two countries that use different languages. The oracle machine is the translator for them. They can communicate barrier-free with the data outside the blockchain through the oracle machine's intelligent contract.

Combo, as the first Defi ecological project of KuChain, provides a decentralized financial development platform in the industry, which includes four agreements: liquidity mining agreement, synthetic asset issuance agreement, pledge mining agreement and oracle machine. It will realize the value transfer among multiple blockchain assets. Thereby helping Combo to be in the leading position of DeFi project.

Combo media link:

Twitter: https://twitter.com/Combo02029769

Telegram group: https://t.me/combo_01

Media Contact:

Company Name: Combo

Contact: James Wang

Website: http://www.comboos.com

Email: deficombo20@gmail.com

SOURCE: Combo

View source version on accesswire.com:

https://www.accesswire.com/606903/Combo-Releases-a-Decentralized-Financial-Protocol-Based-on-Defi-20