Historical results indicate a significant silver-rich polymetallic system

THUNDER BAY, ON / ACCESSWIRE / December 2, 2020 / Wolfden Resources Corporation (WLF.V) ("Wolfden" or the "Company") is pleased to announce it has signed an option agreement to earn a 100% interest in the Big Silver Project in Maine. Historical work on the property discovered a significant silver rich polymetallic system (Ag-Au-Cu-Pb-Zn) where 2,854 core samples averaged 28 g/t Ag and were locally as high as 2,245 g/t Ag. In addition, soil samples display significant silver enrichment where values up to 30 g/t Ag in soil are common. The Project occurs within a highly prospective belt of rocks that extends over 100 square kilometers (40 sq. miles).

"The addition of the Big Silver Project increases our exposure to precious metals and is still in keeping with our strategy of advancing high-margin mining projects that host a basket of specialty metals that are used to power the grid and needed to feed the E.V. revolution," said CEO, Ron Little. "Wolfden is the first public company to explore and develop mining projects in Maine under the 2017 Chapter 200 mining legislation and the addition of Big Silver reiterates our commitment to the State. Based on our successes to date at Picket Mountain, and the potential mineral endowment that Maine has to offer, we look forward to expanding our scope of exploration and continue to work transparently with all stakeholders to develop the sector using sound environmental and socio-economic practices."

"The previous work indicates the potential for grades and widths that could be extracted via underground mining techniques," stated Don Dudek, VP Exploration for Wolfden. "We hope to confirm and expand the potential limits and continuity of the higher-grade zones in order to determine the potential economic viability for an underground mining scenario on the project." Access to the area is excellent with paved roads to the edge of the optioned area. There are very few people living in the area where any deemed future impacts of the project on the community or environment would be considered to be very low.

Initial work on the project will include a compilation and evaluation of all the historical data in order to plan the next drill program. The total extent of the mineralized system at Big Silver is still unknown. Silver and base metal mineralization have been defined so far, to a depth of 300 metres and appears open at depth and along strike where it is expected to be structurally controlled.

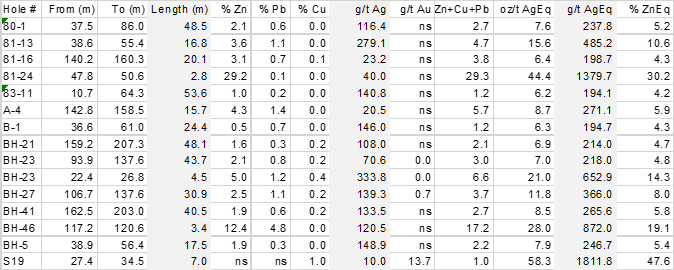

Highlights of the historical core hole intercepts include the following:

* These assays are based on historical, unvalidated assays and should not be relied upon prior to additional studies. The Ag and Zn Equivalents use US$ metal prices of $1.2/lb Zn, $3/lb Cu, $1/lb Pb, $18/oz Ag and $1500/oz Au.

** True widths appear to be 60 to 70% of length drilled; further analysis is required for certainty.

Historical Work - Further Upside

Although sampling for silver was reasonably consistent, the gold, copper, zinc and lead analyses were very limited and typically limited to only the obvious visual mineralization. Work on the of the copper-rich zones, shows local gold enrichment with one of 32 grab samples returning up to 16.15 g/t Au, 9 of 32 samples returning > 1.0 g/t Au and 18 of 32 samples returning >0.1 g/t Au. One core hole returned a high of 13.74 g/t Au and 1% Cu over 7 metres (true width unknown).

Previous work included diamond drilling, soil sampling, VLF, IP and magnetic ground geophysical surveys and airborne magnetic and EM surveys. This work was and will continue to be useful to identify those structures that control the mineralization.

A qualified person has not verified the data disclosed in respect of the property, including sampling, analytical and test data underlying this information. The data comes from historic reports prepared by previous owners.

About Wolfden

With the support of major investors Kinross Gold Corporation and Altius Minerals, Wolfden plans to explore and develop high-margin deposits in good jurisdictions. Its wholly owned Pickett Mountain Project in Maine, USA, one of the highest-grade polymetallic projects in North America (Zn, Pb, Cu, Ag, Au). This relatively advanced project is well-located near excellent infrastructure which will support straight forward development as detailed in a recently released Preliminary Economic Assessment date September 14, 2020.

Upcoming Milestones

- Additional Pickett Mt. drill results designed to further expand resources are pending

- Approval of the ongoing Pickett Mt. rezoning petition in 2021 would be a significant milestone

- Securing additional high-grade projects and exploration drill targets in Maine

Pickett Mt. Mineral Resources dated Sept 14, 2020 using a 7% ZnEq* cut-off

- 2.2 Mt at 18.23% ZnEq of Indicated (9.3% Zn, 3.7% Pb, 1.3% Cu, 96 g/t Ag & 0.9 g/t Au)

- 2.3 Mt at 18.62% ZnEq of Inferred (9.8 % Zn, 3.9% lead, 1.2% Cu, 101 g/t Ag & 0.9 g/t Au)

Pickett Mt. Preliminary Economic Assessment dated Sept 14, 2020

- $198 million After-tax NPV8% to Wolfden for an underground mine plan scenario

- 37% After-tax IRR with a 2.4 year payback

- $147 million Initial capital expenditure including closure costs and 20% contingency

Note: The PEA Mineral Resources estimate used metal price assumptions of US$1.20/pound for zinc, US$1.00/pound for lead, US$2.50/pound for copper, US$16.00/troy ounce for silver, and US$1200/troy ounce for gold. The PEA financial model used consensus metal prices assumptions of $1.15/lb Zinc, $1.00/lb Lead, $3.00/lb Copper, $18.00/oz Silver and $1,500/oz Gold. All financial figures are in US dollars.

For further information please contact Ron Little, President & CEO, at (807) 624-1136 or Rahim Lakha, Corporate Development at (416) 414-9954.

The information in this news release has been reviewed and approved by Don Dudek, P. Geo., VP Exploration, Jeremy Ouellette, P.Eng, VP Project Developments, and Ron Little P.Eng., President and CEO, who are Qualified Persons' under National Instrument 43-101. The metal prices used to determine Zinc Equivalent (ZnEq)* grades are US$1.20/pound for zinc, US$1.00/pound for lead, US$2.50/pound for copper, US$16.00/troy ounce for silver, and US$1200/troy ounce for gold. For further information on the project, see technical report entitled "National Instrument 43-101 Technical Report, Preliminary Economic Assessment Pickett Mountain Project, Penobscot County, Maine, USA" dated September 14, 2020 on Sedar.

Cautionary Statement Regarding Forward-Looking Information

This press release contains forward-looking information (within the meaning of applicable Canadian securities legislation) that involves various risks and uncertainties regarding future events. Such forward-looking information includes statements based on current expectations involving a number of risks and uncertainties and such forward-looking statements are not guarantees of future performance of the Company, and include, without limitation, statements relating to metal price assumptions, cash flow forecasts, projected capital and operating costs, metal or mineral recoveries, mine life and production rates, and other assumptions used in Preliminary Economic Assessment dated September 14, 2020, infill drill results since 2019 that are expected to upgrade resources and could potentially lead to an increase in resources, information about future activities at the Pickett Mountain Project that include plans to complete additional drilling and pre-permitting (rezoning petition), the results of the Preliminary Economic Assessment dated September 14, 2020 and potential upside of the Pickett Mt. Project and the Big Silver Project. There are numerous risks and uncertainties that could cause actual results and the Company's plans and objectives to differ materially from those expressed in the forward-looking information in this news release, including without limitation, the following risks and uncertainties: (i) risks inherent in the mining industry; (ii) regulatory and environmental risks; (iii) results of exploration activities and development of mineral properties; (iv) risks relating to the estimation of mineral resources; (v) stock market volatility and capital market fluctuations; and (vi) general market and industry conditions. Actual results and future events could differ materially from those anticipated in such information. This forward-looking information is based on estimates and opinions of management on the date hereof and is expressly qualified by this notice. Risks and uncertainties about the Company's business are more fully discussed in the Company's disclosure materials filed with the securities regulatory authorities in Canada at www.sedar.com. The Company assumes no obligation to update any forward-looking information or to update the reasons why actual results could differ from such information unless required by applicable law.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

SOURCE: Wolfden Resources Corporation

View source version on accesswire.com:

https://www.accesswire.com/619104/Wolfden-Adds-Big-Silver-Project-in-Maine