World Finance recommends steps toward financial recovery in 2021

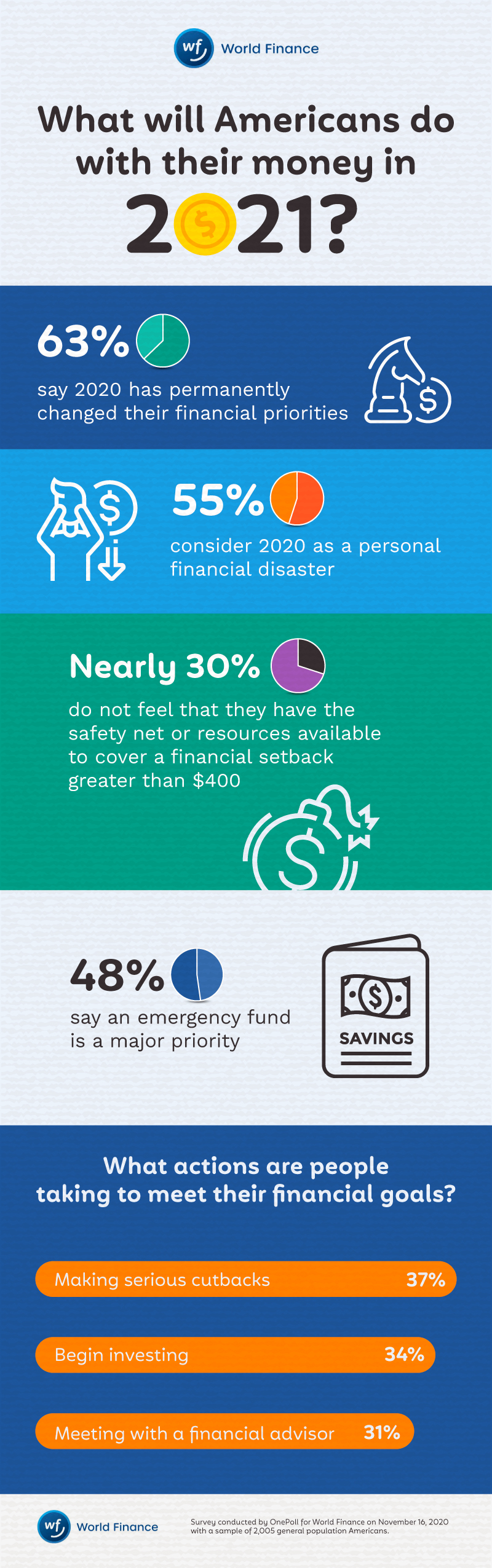

GREENVILLE, SC / ACCESSWIRE / January 15, 2021 / Half of Americans consider 2020 a financial disaster and 63% say the year permanently changed their financial priorities, according to recent research commissioned by World Finance. * With 2021 underway, it's the perfect time to be sure personal financial goals will support a more secure financial future, says the finance company.

"January is the time to reflect, learn, plan and act to ensure you are further ahead at the end of the year. This year was challenging for many, even with stimulus fund support, but there are resources available to help make this year more promising," said Chad Prashad, president and CEO of World Finance, a people-focused finance company that provides personal installment loan solutions and personal tax preparation services.

According to the research completed at the end of 2020, nearly 75% of Americans hope to improve their financial literacy in 2021 and 50% need advice on how to budget properly.

Improving one's financial literacy should be a top priority, according to Prashad. There are many tools available, including online resources, to help individuals better understand how they can improve their own financial security.

This approach is at the core of how World Finance conducts business. All World Finance associates are trained to work with customers to help them establish budgets and better understand their immediate and long-term financial goals and how to accomplish them. Additionally, World Finance partners with the American Financial Services Association (AFSA) to offer a free online personal finance course, MoneySKILL®, as a resource to those looking to improve their financial literacy.

World Finance also recommends several good goals to consider for those looking to improve their financial situation in 2021:

- Use federal stimulus payments and tax refunds to improve your financial health: The past, pending and future federal stimulus programs present a great opportunity to get your finances on the right track. Paying off past-due bills, paying down debt and creating a rainy-day fund are all great ways to invest in yourself and improve your financial health.

- Improve your credit score: Review your credit report for any past-due and charged-off accounts that may have a negative impact on your credit score. Bringing your bills up to date and even negotiating an amount to pay off an old, closed account can dramatically improve your credit score and reduce future interest rates.

- Meet with a financial advisor: A financial advisor can help provide a holistic view of one's finances and provide perspective on steps needed to meet financial goals.

- Set short-term and long-term financial goals: This can be an overwhelming process but breaking up financial resolutions into both short-term and long-term goals will make this less intimidating and more achievable.

- Make a budget: Creating a budget is a crucial step to provide a clear picture of exactly where money is going, what is flexible spending and what are fixed costs. This will also help manage debt repayment and avoid late fees or additional interest. A variety of different budgeting methods are available, including envelope budgeting, zero-based budgeting and the 50/30/20 rule.

- Build an emergency fund: Even as debt is being repaid, part of any budget should identify funds that contribute to a savings account for emergencies and unexpected expenses.

World's research showed that nearly 30% of Americans do not feel that they have the resources available to cover a financial setback greater than $400. However, a third of Americans fear high-interest rates and an inability to repay when taking out a short-term loan.

Unlike predatory lenders in the marketplace, especially those targeting subprime customers, World Finance works with customers to help them access the money they need while making sure manageable repayment plans fit into their budget. In fact, each year, over 200,000 World Finance customers improve their credit scores out of deep-subprime (550 or lower) or subprime (620 or lower) with consistent payment histories. Additionally, World Finance lends to nearly 100,000 new customers a year who don't have a credit score and helps them create and build their credit history. ** An improved credit score is important for a customer to be able to improve their purchasing power and expand their lending options with increased credit limits and reduced interest rates.

"When faced with a financial emergency, it is important to have a reputable partner to turn to for a quick solution but also to help assess your situation and prioritize your financial well-being so you can get back to the good in life," said Prashad.

For more information about World Finance, visit www.loansbyworld.com.

* Survey conducted by OnePoll for World Finance on November 16, 2020, with a sample of 2,005 general population Americans.

**World Acceptance Corporation's 2019 Annual Report.

About World Acceptance Corporation (World Finance)

Founded in 1962, World Acceptance Corporation (NASDAQ: WRLD), is a people-focused finance company that provides personal installment loan solutions and personal tax preparation and filing services to over one million customers each year. Headquartered in Greenville, South Carolina, the company operates more than 1,200 community-based World Finance branches across 16 states. The company primarily serves a segment of the population that does not have ready access to credit, but unlike many other lenders in this segment, World works with its customers to understand their broader financial pictures, ensures individuals have the ability and stability to make payments, and helps them achieve their financial goals. In its last fiscal year, the company helped more than 225,000 individuals improve their credit score out of subprime and deep subprime. For more information, visit www.loansbyworld.com.

MEDIA CONTACT:

Jessica Gallen

jgallen@laughlin.com

708-743-7505

SOURCE: World Acceptance Corporation (World Finance)

View source version on accesswire.com:

https://www.accesswire.com/624479/Financial-Recovery-Top-Priority-for-Most-Americans-In-2021-Half-Classify-2020-as-Financial-Disaster-New-Research-Shows