$1.29 million in fiscal second quarter revenue

Clinics see continued surge in demand for mental health services

Ongoing expansion of clinic capacity

TORONTO, ON / ACCESSWIRE / March 1, 2021 / Novamind Inc. (CSE:NM)(OTC PINK:NVMDF) ("Novamind" or "the Company"), a leading mental health company specialized in psychedelic medicine, today reported its fiscal second quarter results for the three months ended December 31, 2020 ("Fiscal Q2 2021"). The Company's fiscal year-end is June 30th. All results are reported under International Financial Reporting Standards ("IFRS") and in Canadian dollars, unless otherwise specified.

Fiscal Q2 2021 Highlights and Subsequent Developments

Financing and Public Listing

Novamind successfully closed an oversubscribed $10,000,000 financing on November 23rd, 2020. The funds were made available to the Company upon the completion of its reverse takeover ("RTO") transaction and conditional listing approval from the Canadian Securities Exchange ("CSE"). The company ended the quarter with a cash balance of $10,868,742. With its strong cash position, Novamind is well-positioned to execute on its growth strategy to expand its network of mental health clinics, retreats and clinical research sites.

On January 5th, 2021, Novamind began trading on the CSE under the stock symbol "NM". Less than two months after going public on the CSE, Novamind achieved the milestone of being included in the underlying index of the Horizons Psychedelic Stock Index ETF (NEO: PSYK) through a "Fast Entry" category, further increasing its profile with retail and institutional investors in the psychedelic medicine sector.

The Company announced on February 19th, 2021, that its common shares commenced trading under the symbol "NVMDF" on the OTC Market. In the near future, Novamind intends to apply to list its common shares on the OTCQB Market, an established marketplace in the United States for promising, innovative companies.

Operational Highlights

On January 28th, 2021, Novamind announced that it had reached two significant milestones at its Cedar Psychiatry mental health clinics: administering over 5,000 ketamine treatments since its opening in 2016, and administering over 2,000 Spravato treatments since the product became available in 2019. These milestones position Novamind as one of North America's top providers of ketamine-assisted psychotherapy and Spravato.

On January 13th, 2021, the Company announced the expansion and optimization of its Layton, Utah clinic. The redesigned Layton Clinic now offers improved treatment rooms to accommodate a higher number of ketamine and Spravato treatments. The Layton Clinic expansion comes in response to a significant increase in demand for ketamine therapies across Novamind's mental health clinics. In 2020 alone, the Cedar Psychiatry clinic network facilitated over 20,000 client visits, an increase of over 100 percent compared to the same period in 2019.

On January 19th, 2021, Novamind announced the expansion of its leadership team with the appointment of Pierre Bou-Mansour, P.Eng., to the role of Chief Operating Officer. Mr. Bou-Mansour assumes the responsibility for ensuring operational excellence as Novamind develops its network of clinics, retreats, and research sites. An accomplished senior executive and leader, he brings a wealth of experience managing large and complex healthcare organizations. Prior to joining Novamind, Pierre served as the Chief Operating Officer of LifeLabs, a diagnostic laboratory services company he helped to scale into an industry leader with 5,700 employees and 370 patient access sites in Canada. Most recently, he served as the Chief Laboratory Operations Officer of Public Health Ontario, serving Canada's largest province with over 14 million residents. In this role, Bou-Mansour successfully led the expansion of Public Health Ontario's testing capacity for the COVID-19 response.

Strategic Investment in Bionomics

On February 11th, 2021, the Company announced that it had made a strategic investment of AU$827,486 (approximately CAN$810,000), in Bionomics Limited ("Bionomics") (ASX: BNO, OTCQB: BNOEF, Germany: AU000000BNO5), a biopharmaceutical company dedicated to developing better treatments for central nervous system disorders. In addition, Cedar Clinical Research, a wholly owned subsidiary of Novamind, will be evaluated by Bionomics as a clinical research site to conduct Bionomics' phase IIb clinical trial examining BNC210, a drug that has received Fast Track Designation from the U.S. Food and Drug Administration for the treatment of post-traumatic stress disorder (PTSD).

Impact of COVID-19

Novamind has not been significantly affected by the COVID-19 pandemic. As reported across multiple media outlets, the COVID-19 pandemic has resulted in a significant increase in the incidence of mental health problems, in particular anxiety and depression, conditions that are commonly treated by Novamind. The Company's Cedar Psychiatry network of clinics continues to experience steady demand for mental health services, and this demand is anticipated to continue despite COVID-related restrictions.

Financial Highlights and Selected Consolidated Financial Information

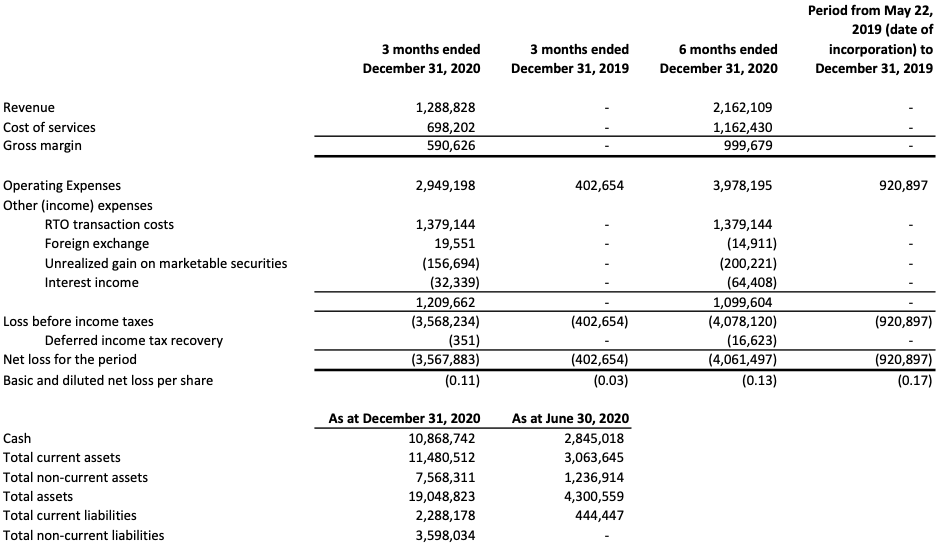

In Fiscal Q2 2021, Novamind reported revenue of $1,288,828 primarily composed of patient services revenue from its network of four Cedar Psychiatry outpatient mental health clinics in Utah. This represents a 47 percent increase over the previous quarter ended September 30th, 2020.

The Company reported a net loss of $3,567,883 for the three months ended December 31st, 2020, as compared to a net loss of $493,614 for the prior quarter ended September 30th, 2020. The net loss for the second fiscal quarter was primarily due to expenses related to the Company's listing on the CSE, and funding of capacity expansion at its Cedar Psychiatry clinics. This includes consulting expenses of $416,268, professional fees of $450,419, salaries and wages of $791,078, office and general expenses of $87,368, advertising and promotion expenses of $236,650, and stock-based compensation of $664,814. Additionally, there was $1,379,144 in RTO transaction costs in the quarter.

The following table presents selected financial information from the Company's unaudited condensed interim financial statements for the three and six months ended December 31st, 2020, and periods ended December 31st, 2019.

The following information should be read in conjunction with the financial statements and management's discussion and analysis, which are available under the Company's SEDAR profile at www.sedar.com.

About Novamind

Novamind is a leading mental health company enabling safe access to psychedelic medicine through a network of clinics, retreats, and clinical research sites. Novamind provides ketamine-assisted psychotherapy and other novel treatments through its network of Cedar Psychiatry clinics and operates Cedar Clinical Research, a contract research organization specialized in clinical trials and evidence-based research for psychedelic medicine. Both Cedar Psychiatry and Cedar Clinical Research are wholly owned subsidiaries of Novamind. For more information on how Novamind is enhancing mental wellness and guiding people through their entire healing journey, visit novamind.ca.

Contact Information

Novamind

Yaron Conforti, CEO and Director

Telephone: +1 (647) 953 9512

Bill Mitoulas, Investor Relations

Email: bill@novamind.ca

Forward-Looking Statements

This news release contains forward-looking statements. All statements other than statements of historical fact included in this release are forward-looking statements that involve risks and uncertainties. There can be no assurance that such statements will prove to be accurate and actual results and future events could differ materially from those anticipated in such statements. Important factors that could cause actual results to differ materially from the Company's expectations including the risks detailed from time to time in the Company's public disclosure. The reader is cautioned not to place undue reliance on any forward-looking information. Forward-looking statements contained in this news release are expressly qualified by this cautionary statement. The forward-looking statements contained in this news release are made as of the date of this news release and the Company will update or revise publicly any of the included forward-looking statements as expressly required by applicable laws.

SOURCE: Novamind Inc.

View source version on accesswire.com:

https://www.accesswire.com/632568/Novamind-Reports-Company-Highlights-and-Strong-Revenue-Growth-in-Fiscal-Second-Quarter