2020 Revenue Up 39% to Record $113.9M, Drives Net Income Over $6.4M

DALLAS, TX / ACCESSWIRE / March 23, 2021 / Envela Corporation (NYSE American:ELA) ("Envela" or the "Company"), today reported financial results for the fourth quarter and full year ended December 31, 2020, which included $113.9 million in revenue; $6,453,494 net income; and $0.24 earnings per diluted share.

Management Commentary

"We finished the year with strong financial results and continued service improvement, notwithstanding the challenges of a pandemic," said John Loftus, Envela's Chairman and CEO. "Going forward in 2021, we plan to continue our proven approach of making disciplined investments, controlling costs, scaling the business, and improving profitability," added Loftus.

2020 Operational Highlights

- Envela added to the Russell 2000 Index

- Subsidiary DGSE, LLC ("DGSE") relocated its Southlake, Texas location to Grapevine, Texas and opened a new retail location in Lewisville, Texas, each as port of the Company's plan to expand its retail footprint and provide consumers with immersive experiences.

- Subsidiary Echo Environmental Holdings, LLC named one of the Top 100 Places to Work in DFW

Fourth Quarter 2020 Financial Results

Total revenue for the fourth quarter of 2020 increased 29% to $28.7 million from $22.2 million in the same year-ago period.

Revenue related to the continuing operations of the Company's DGSE subsidiary for the fourth quarter of 2020 was $22.8 million (79% of total revenue), compared to $16.3 million in the same year-ago period. DGSE's resale revenue, including bullion, jewelry, watches, and rare coins, was $20.7 million (91% of DGSE total sales), compared to $14.4 million (88% of DGSE total sales) in the same year-ago period. DGSE's recycled-material sales were $2.1 million (9% of DGSE total sales), compared to $1.9 million (12% of DGSE total sales) in the same year-ago period.

Revenue related to the Company's ECHG, LLC ("ECHG") subsidiary for the fourth quarter of 2020 was $5.9 million (21% of total revenue), compared to $5.9 million in the same year-ago period. ECHG's resale revenue was $3.8 million (64% of ECHG total sales), compared to $3.6 million (61% of ECHG total sales) in the same year-ago period. ECHG's recycled-material sales were $2.1 million (36% of ECHG total sales), compared to $2.3 million (39% of ECHG total sales) in the same year-ago period.

Consolidated gross profit for the fourth quarter of 2020 was $6.1 million, compared to $5.5 million in the same year-ago period.

- DGSE's gross profit was $3.0 million, compared to $2.4 million in the same year-ago period.

- DGSE's resale gross profit was $2.6 million, compared to $2.1 million in the same year-ago period.

- DGSE's recycled-materials gross profit was $0.4 million, compared to $0.3 million in the same year-ago period.

- ECHG's gross profit was $3.1 million, compared to $3.1 million in the same year-ago period.

- Resale gross profit was $2.5 million, compared to $2.4 million in the same year-ago period.

- Recycled-material gross profit was $0.6 million, compared to $0.7 million in the same year-ago period.

Envela's net income for the fourth quarter of 2020 was $1.7 million, or $0.06 per basic and diluted share, compared to $0.8 million, or $0.03 per basic and diluted share, in the same year-ago period.

Fiscal Year 2020 Financial Results

Total revenue for 2020 increased 39% to $113.9 million from $82.0 million in 2019.

Revenue related to the continuing operations of the Company's DGSE subsidiary for 2020 was $85.7 million (75.2% of total revenue), compared to $67.5 million (82.3% of total revenue) in 2019. DGSE's resale revenue, including bullion, jewelry, watches, and rare coins, was $79.8 million (93.1% of DGSE total sales), compared to $60.1 million (89.0% of DGSE total sales) in 2019. DGSE's recycled-material sales were $5.9 million (6.9% of DGSE total sales), compared to $7.4 million (11.0% of DGSE total sales) in 2019.

Revenue related to the Company's ECHG subsidiary for 2020 was $28.3 million (24.8% of total revenue), compared to $14.5 million (17.7% of total revenue) in 2019. ECHG's resale revenue was $19.4 million (68.6% of ECHG total sales), compared to $8.7 million (60.1% of ECHG total sales) in 2019. ECHG's recycled-material sales was $8.9 million (31.4% of ECHG total sales), compared to $5.8 million (39.9% of ECHG total sales) in 2019.

Consolidated gross profit for 2020 was $23.1 million, compared to $16.3 million in the same year-ago period.

- DGSE gross profit was $10.4 million, compared to $8.9 million in the same year-ago period.

- DGSE resale gross profit was $9.2 million, compared to $7.8 million in the same year-ago period.

- DGSE recycled-materials gross profit was $1.2 million, compared to $1.2 million in the same year-ago period.

- ECHG gross profit was $12.7 million, compared to $7.3 million in the same year-ago period.

- Resale gross profit was $9.5 million, compared to $4.7 million in the same year-ago period.

- Recycled-material gross profit was $3.2 million, compared to $2.6 million in the same year-ago period.

Envela's net income for 2020 was $6.4 million, or $0.24 per basic and diluted share, compared to $2.8 million, or $0.10 per basic and diluted share, in the same year-ago period.

About Envela

Envela and its subsidiaries engage in diverse business activities within the recommerce sector. These include recommercializing luxury hard assets, consumer electronics and IT equipment; and end-of-life recycling solutions. Envela assesses its inventory of recommerce purchases for their potential to be refurbished and resold as whole goods, or to be recycled for component parts or precious-metal value. Envela also offers comprehensive recycling solutions for a variety of other companies seeking responsibly to dispose of end-of-life products. Envela operates primarily via two recommerce business segments. Through DGSE, the Company recommercializes luxury hard assets via Dallas Gold and Silver Exchange, and Charleston Gold & Diamond Exchange. Through ECHG, the Company operates Echo Environmental Holdings, ITAD USA Holdings, and Teladvance, which recommercialize primarily consumer electronics and IT equipment, and provide end-of-life recycling services for various companies across many industries. Envela conducts its recommerce operations at retail and wholesale levels, through distributors, resellers, dedicated stores and online. The Company also owns and operates other businesses and brands engaged in a variety of activities, as identified in its Form 10-K. Envela is a Nevada corporation, headquartered in Irving, Texas.

Additional information about Envela is available at its investor-relations sire, Envela.com.

Forward-Looking Statements

This press release includes statements that may constitute "forward-looking" statements, including statements regarding the potential future success of business lines and strategies. These statements are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements inherently involve risks and uncertainties that could cause actual results to differ materially from the forward-looking statements. Factors that would cause or contribute to such differences include, but are not limited to, market conditions and other risks detailed in the Company's periodic report filings with the Securities and Exchange Commission. By making these statements, the Company undertakes no obligation to update these statements for revisions or changes after the date of this release except as required by law.

Investor Relations Contact:

Julianne Jacobs

Investor Relations

Envela Corporation

1901 Gateway Drive Irving, TX 75238

972.587.4030

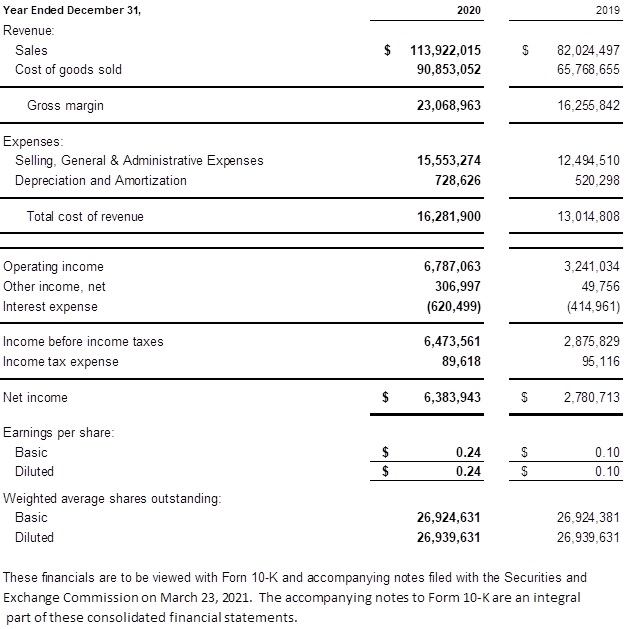

Envela Corporation

Condensed Consolidated Statements of Operations

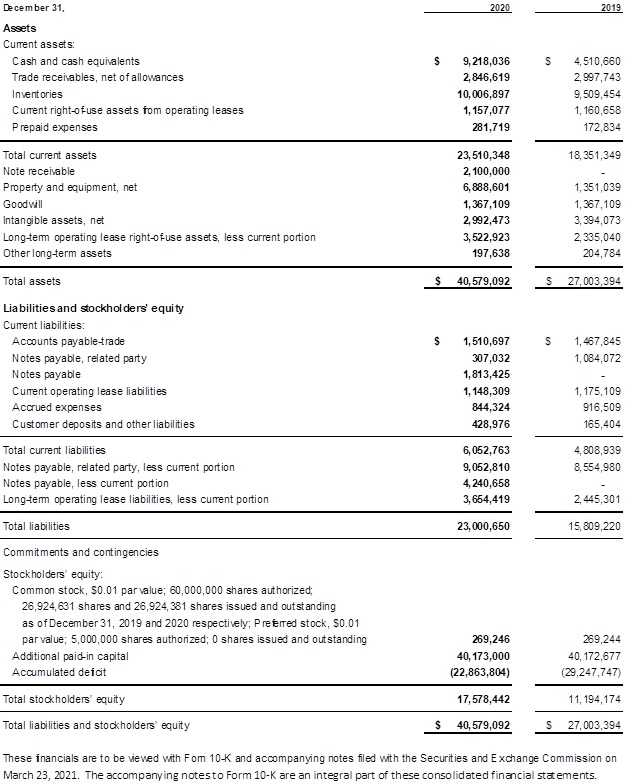

Envela Corporation

Condensed Consolidated Balance Sheets

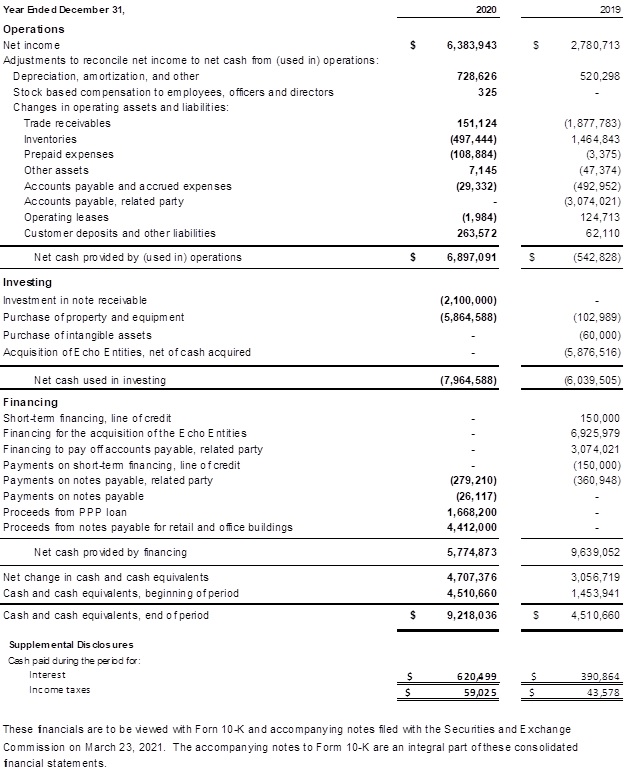

Envela Corporation

Condensed Consolidated Statement of Cash Flows

SOURCE: Envela Corporation

View source version on accesswire.com:

https://www.accesswire.com/636895/Envela-Reports-Fourth-Quarter-and-Fiscal-Year-2020-Financial-Results