VANCOUVER, BC / ACCESSWIRE / April 7, 2021 / Kingman Minerals Ltd. ("Kingman" or the "Company") (TSXV:KGS)(FSE: 47A1) is pleased to announce that the Company MH-03 was completed at a total depth of 457 ft (139.2 m). It was drilled at an angle of -60 degrees to horizontal. It contained two incredibly significant mineralized intercepts, both of which were adjacent to and on either side of the rhyolite dike, as anticipated from historic reports.

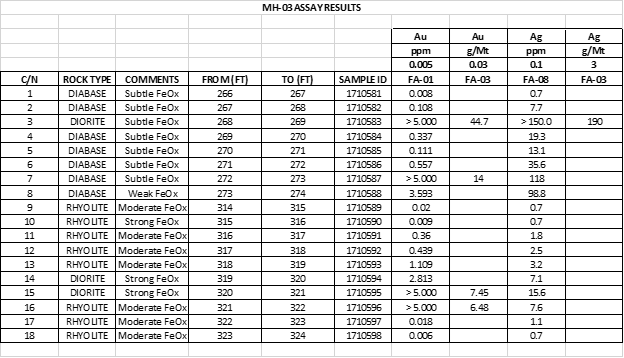

The first intercept occurred at 267-274 ft (81.4-83.5 m) for an intercept of 7 ft (2.1 m) with an average grade of 9.06 g/t Au and 68.9 g/t Ag. This intercept had a calculated true width of 2.6 ft (0.8 m). The intercept included two high grade intervals at 268-269 ft (82.7-83.0 m) grading 44.7 g/t Au and 190 g/t Ag and 272-274 ft (82.9-83.5 m) grading 8.8 g/t Au and 108.4 g/t Ag.

The second intercept was at 318-322 ft (96.9-98.1 m) for an intercept length of 4 ft (1.2 m) that assayed 4.46 g/t Au and 8.4 g/t Ag. The interval had a calculated true width of 1.5 ft (0.46 m). Within this intercept was a higher-grade interval at 320-322 ft (97.5-98.1 m) grading 6.97 g/t Au and 11.6 g/t Ag.

Figure 1 - Diabase showing prominent hydrothermal alteration (light green-gray + oxidation) against a rhyolite intrusion in drill hole MH-03.

Figure 3 - Summary of gold and silver assay results from MH-03.

Samples were sent to Skyline Laboratories in Tucson, Arizona on a rush basis and assays for gold and silver analysis were completed using Skyline's FA-1 method for gold (Fire Assay- AA (Geochem) 5-5,000 ppb, 30g, with gravimetric finish for over-limits) and FA-8 for silver (Aqua Regia/AA (Geochem)).

"MH-03 was what we anticipated and more. The assay results we are continuing to see are impressive and suggestive of a large amount of hydrothermal activity in the area; a much larger system may exist. Consequently, the Phase II drill program will be a much larger more aggressive program; testing the size and the extent of the mineralization that may be present," stated Sandy MacDougall, Chairman and Director.

The technical information contained in this news release has been reviewed and approved by Brad Peek., M.Sc., CPG, who is a Qualified Person with respect to Kingman's Mohave Project as defined under National Instrument 43-101.

About Kingman

Kingman Minerals Ltd. is currently engaged in the business of precious metal mineral exploration for the purpose of acquiring and advancing non grass roots mineral properties located in mining friendly jurisdictions of North America.

The Mohave Project (the "Project") is located in the Music Mountains in Mohave County, Arizona and is comprised of 71 lode claims which are inclusive of the past producing Rosebud Mine (the "Rosebud"). High grade gold and silver veins were discovered in the area in the 1880's and were mined mainly in the late 20's and 30's. Underground development on the Rosebud property included a 400-foot shaft and approximately 2,500 feet of drifts, raises and crosscuts.

For further information please contact:

Sandy MacDougall, Chairman & Director

(604) 685-7720

smacdougall@kingmanminerals.com

www.kingmanminerals.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release. This news release may contain forward-looking information which is not comprised of historical facts. Forward-looking information involves risks, uncertainties and other factors that could cause actual events, results, performance, prospects and opportunities to differ materially from those expressed or implied by such forward-looking information. Forward-looking information in this news release includes statements regarding, among other things, the completion transactions completed in the Agreement. Factors that could cause actual results to differ materially from such forward-looking information include, but are not limited to, regulatory approval processes. Although Kingman believes that the assumptions used in preparing the forward-looking information in this news release are reasonable, including that all necessary regulatory approvals will be obtained in a timely manner, undue reliance should not be placed on such information, which only applies as of the date of this news release, and no assurance can be given that such events will occur in the disclosed time frames or at all. Kingman disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise, other than as required by applicable securities laws.

SOURCE: Kingman Minerals Ltd.

View source version on accesswire.com:

https://www.accesswire.com/639137/Kingman-Assays-Hole-MH-03-Confirming-Historical-Data-High-Grade-Interval-of-447-gt-Gold-190-gt-Silver-from-268-269-ft-827-830-m