VANCOUVER, BC / ACCESSWIRE / April 21, 2021 / Torq Resources Inc. (TSXV:TORQ)(OTCQX:TRBMF) ("Torq" or the "Company") is pleased to announce initial results from its ongoing exploration program at the Margarita Iron-Oxide-Copper-Gold (IOCG) project located in northern Chile, approximately 65 kilometres (km) north of the city of Copiapo and within the prolific Coastal Cordillera belt that hosts the world-class Candelaria (Lundin Mining Corp.) and Manto Verde (Mantos Copper Holding) IOCG mines, and porphyry-skarn deposits such as Santo Domingo (Capstone Mining Corp.) and Inca de Oro (PanAust/Codelco). Torq's primary objective is to discover a large-scale copper sulphide source for the abundant copper oxide mineralization observed on the southern region of the property. Results from a ground-based induced polarization (IP) geophysical survey have outlined two north-northwest trending chargeability anomalies, approximately 3 km by 500 metres (m) in size, which Torq's technical team believes are associated with sulphide mineralization (Figure 1).

A Message from Michael Henrichsen, Chief Geologist:

"The initial IP chargeability results from Margarita confirm our belief that there is excellent potential to discover a large-scale copper sulphide system on the property. The strength of the anomalies is consistent with sulphide mineralization and we look forward to developing additional geological and geophysical exploration vectors to compliment the chargeability targets in the coming weeks, as we move to drill stage."

Margarita Property IP survey:

The IP survey at the Margarita project consists of a total of 49-line km with lines spaced every 250 m. The results of the program have demonstrated two north-northwest trending chargeability anomalies that are approximately 3 km by 500 m in dimension at a threshold of 30 millivolts, which is consistent with the presence of sulphide minerals (Figure 1). Importantly, these chargeability anomalies spatially overlap with resistivity lows that are consistent with hydrothermal alteration and form the basis of geophysical targeting at the project (Figure 2).

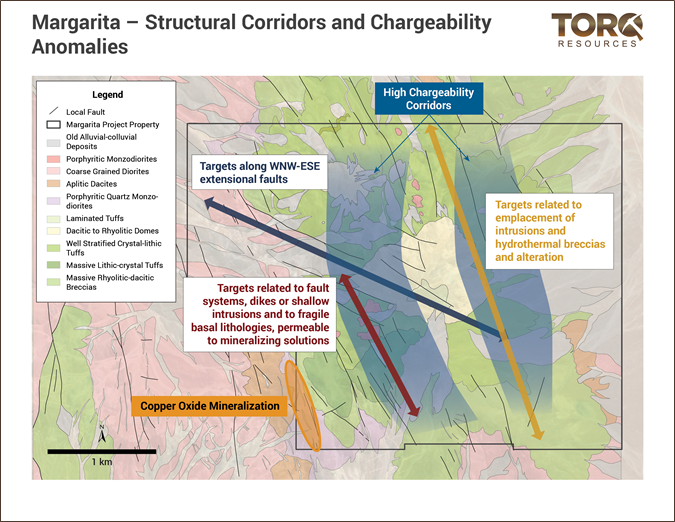

Torq also recently completed 1:5000 scale geological mapping and has defined two major structural trends, north-northwest and west-northwest. The Company believes these structures control the emplacement of copper oxide mineralization, hydrothermal breccias, intrusive bodies and alteration that is consistent with IOCG/porphyry deposits (Figure 3). The areas of chargeability highs and resistivity lows are aligned in north-northwest structural corridors. Additional data layers of detailed geological mapping and geochemical surveys will complete the targeting process at the project as the Company prepares to drill the project in Q3 of this year.

Figure 1: Illustrates two north-northwest oriented high chargeability corridors that are approximately 3 km by 500 m in dimension. These high chargeability corridors are interpreted to be associated with sulphide mineralization and spatially overlap with resistivity lows that are interpreted to be associated with hydrothermal alteration.

Figure 2: Illustrates the 3D inversion model of the chargeability highs and overlapping resistivity lows at shallow depths from the central region of the project.

Figure 3: Illustrates the primary structural corridors and their relationship to the north-northeast trending chargeability corridors.

Michael Henrichsen (Chief Geologist), P.Geo is the QP who assumes responsibility for the technical contents of this press release.

ON BEHALF OF THE BOARD,

Shawn Wallace

Executive Chairman

For further information on Torq Resources, please visit www.torqresources.com or contact Natasha Frakes, Manager of Corporate Communications at (778) 729-0500 or info@torqresources.com.

About Torq Resources

Torq is a junior exploration company focused on establishing a top-tier mineral portfolio. The Company's management team has raised over $550 million and monetized successes in two previous exploration companies. Torq is continually reviewing mineral targets in pursuit of acquisition, strategic exploration and significant discovery. For more information, please visit www.torqresources.com.

Forward Looking Information

This release includes certain statements that may be deemed "forward-looking statements". Forward-looking information is information that includes implied future performance and/or forecast information including information relating to, or associated with, exploration and or development of mineral properties. These statements or graphical information involve known and unknown risks, uncertainties and other factors which may cause actual results, performance or achievements of the Company to be materially different (either positively or negatively) from any future results, performance or achievements expressed or implied by such forward-looking statements.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

SOURCE: Torq Resources Inc.

View source version on accesswire.com:

https://www.accesswire.com/641507/Torq-Identifies-Large-Scale-Geophysical-Anomalies-at-the-Margarita-Copper-Gold-Project-in-Chile