- A YouGov survey of over 1,000 UAE residents highlights notable appetite for cryptocurrencies as part of the portfolio mix

- Younger Emirati are much more bullish about the opportunities from exposure to crypto assets than Western expats

DUBAI, UAE, May 17, 2021 /PRNewswire/ -- The relatively volatile history of cryptocurrencies to date has not dampened appetite in the UAE for these assets, based on the results of a Holborn Assets-sponsored YouGov survey.

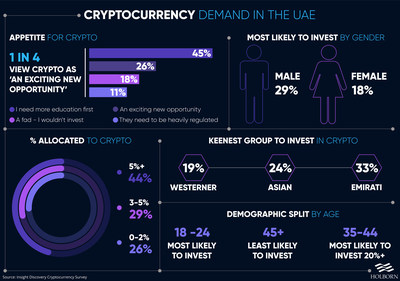

In particular, roughly one in four (26%) of the 1,000-plus respondents view these assets as offering 'exciting investment opportunities', and 45% seeking more education before they invest.

Reflecting this relatively robust demand, 44% of the 830 respondents to a question on asset allocation said they would feel comfortable with over 5% of their investment portfolio invested in cryptocurrencies in 2021. This figure was over 10% for nearly one in five (18%) UAE residents.

"There is clearly growing demand for this new and enticing asset class, especially given the returns it can potentially offer investors," said Stefan Terry, Global Senior Partner in the UAE office of Holborn Assets.

"The survey results also highlight the strong interest locally in more education about cryptocurrencies as a precursor for making portfolio allocations," added Terry, who was the winner of the 'Emerging Talent' award from International Investment in 2020.

Holborn Assets plans to create local programmes to deliver this later in the year. These will leverage demand in the UAE and build on the efforts in the firm's South African office, which is hosting some events in the coming weeks to educate investors about the pros and cons of cryptocurrencies.

Age and nationality create demographic divide

The differences in survey responses across different sections of society in the UAE are particularly noteworthy.

For instance, 18-24 year olds are the most bullish on cryptocurrencies, with a third of respondents considering them to be 'exciting investment opportunities', compared with 17% in the 45+ age group. Meanwhile, only 10% of the youngest age group wants these assets to be heavily regulated, versus 17% for older investors. And while just 12% of young respondents consider crypto assets to be a fad, this rises to 20% among the 45 year olds and above.

There are also some striking trends in terms of nationality. For example, Emiratis are the keenest group to invest in cryptocurrencies, at 33%, compared with Arab expats (23%), Asian residents (24%) and Westerners (19%).

This is consistent at the other end of the spectrum; only 7% of Emirati want crypto assets to be heavily regulated, whereas nearly one in four Western expats (24%) who responded to the survey chose this option.

There is also a marked gap in comfort levels among UAE investors when buying crypto assets. A third of Emirati respondents, for instance, said a 5-10% allocation would suit them, with 19% opting for a 0-2% holding.

For Western expats, by contrast, 51% of respondents said they would only allocate 0-2% to cryptocurrencies, and just 14% would be comfortable with a 5-10% allocation.

About Holborn Assets

Established in 1998, Holborn Assets is a leading, award-winning global financial services company that provides quality financial advice and wealth management solutions to the discerning international expatriate. As a British, family-owned and run company we pride ourselves on delivering a superior experience to roughly 20,000 clients, via our 11 international offices, all supported by over 450 personnel, including 200 financial advisers.

Photo - https://mma.prnewswire.com/media/1511508/Crypto_PR_01.jpg