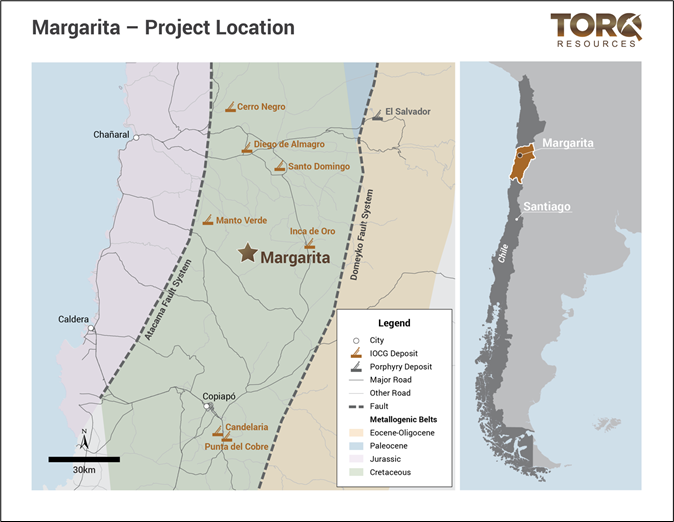

VANCOUVER, BC / ACCESSWIRE / June 30, 2021 / Torq Resources Inc. (TSXV:TORQ)(OTCQX:TRBMF) ("Torq" or the "Company") is pleased to announce that it has received its environmental permit from the Servicio Nacional de Geologia y Mineria for its Margarita iron-oxide-copper-gold project in northern Chile (Figure 1). The environmental permit allows Torq to drill from up to 39 drill platforms across the 1,045-hectare project area, which is centered on a 5 kilometre (km) by 6 km silica-clay hydrothermal alteration system that contains secondary copper oxide mineralization in historical drilling, with the primary target on the property being a copper sulphide source to the observed oxide mineralization (Figure 2) (see March 8, 2021 news release). The Company anticipates its first drill program at the project to commence during Q3, with an initial 4000 - 6000 metres planned.

A Message from Shawn Wallace, Executive Chairman & Director:

"We are very pleased to announce the receipt of our drill permit at Margarita. Our targeting work has made us very optimistic about the prospect of making a significant new discovery during the upcoming drill campaign, which is scheduled to commence near the end of Q3. This, coupled with ongoing assessment work in advance of drilling at the Andrea project, should be a very exciting period for all of our shareholders and stakeholders."

Exploration Update:

The Company has completed a 49-line km ground-based induced polarization (IP) survey to identify chargeability anomalies that have the potential to be associated with copper sulphide mineralization. To refine the targeting associated with these chargeability anomalies, Torq's technical team is conducting a property-wide geochemical soil survey and a 1:2000 geological mapping and rock sampling program to determine which structures show the strongest mineralization. Results from these programs are expected over the next several weeks and targeting is expected to be finalized in August.

Corporate Update:

The Company is also pleased to announce that it has promoted Natasha Frakes from Manager of Investor Relations to an officer role with Torq, as Vice President of Communications, effective immediately.

In addition, the Company has entered into two separate arrangements with Axiom Strategies LLC and SRC Swiss Resource Capital AG as consultants to provide investor relations services to the Company's investors based in the U.S.A. and Switzerland, respectively. Both arrangements are one year consulting contracts, with the option to extend the arrangement, for aggregate fees of approximately $140,000. Chris Henslee of Axiom Strategies LLC currently holds 100,000 share options, granted April 7, 2021, with an exercise price $0.77.

Figure 1: Illustrates the location of the Margarita project within the Cretaceous Coastal Cordillera belt and its proximity to major deposits in the area.

Figure 2: Illustrates the large-scale clay-silica alteration system that is centered on the Margarita property and the position of the copper oxide mineralization on the southwest corner of the project area.

Michael Henrichsen (Chief Geologist), P.Geo is the QP who assumes responsibility for the technical contents of this press release.

ON BEHALF OF THE BOARD,

Shawn Wallace

Executive Chairman

For further information on Torq Resources, please contact Natasha Frakes, Vice President of Communications at (778) 729-0500 or info@torqresources.com.

About Torq Resources

Torq is a Vancouver-based copper and gold exploration company with an established portfolio of premium holdings in Chile. The Company was built by a management team with prior success in monetizing two well-known exploration companies. Torq is further supported by a specialized technical team, recognized for their expertise and experience working with major mining companies. This includes the Company's Chile-based technical team with a noteworthy track record for major discovery in that country. Torq's invaluable local expertise has provided the leverage and connections for the Company to continue to acquire and explore highly prospective assets in the pursuit of a landmark discovery. For more information, visit www.torqresources.com.

Forward Looking Information

This release includes certain statements that may be deemed "forward-looking statements". Forward-looking information is information that includes implied future performance and/or forecast information including information relating to, or associated with, exploration and or development of mineral properties. These statements or graphical information involve known and unknown risks, uncertainties and other factors which may cause actual results, performance or achievements of the Company to be materially different (either positively or negatively) from any future results, performance or achievements expressed or implied by such forward-looking statements.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

SOURCE: Torq Resources Inc.

View source version on accesswire.com:

https://www.accesswire.com/653683/Torq-Obtains-Drill-Permit-for-the-Margarita-Iron-Oxide-Copper-Gold-Project-in-Northern-Chile