Financial Highlights

BRUSSELS, July 16, 2021 /PRNewswire/ --

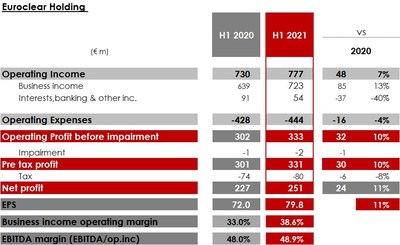

- Operating income increased 7% to EUR 777 million (H1 2020: EUR 730 million) as a result of:

- Business Income rose 13% to EUR 723 million (H1 2020: EUR 639 million)

- Banking and Other Income decreased 40% to EUR 54 million (H1 2020: EUR 91) million), as a result of lower interest rates

- Operating costs were up 4% to EUR 444 million (H1 2020: EUR 428 million) as technology investments continued to enhance business resilience and the customer proposition

- Net profit rose 11% to EUR 251 million (H1 2020: EUR 227 million), EPS increased 11% to EUR 79.8 per share (H1 2020: EUR 72.0)

- As previously announced, the Board intends to approve the dividend related to 2020 results for payment in September 2021. The dividend will be stable compared to the one of March

Key Operating Metrics remain Strong

- Assets under custody reached EUR 35.2 trillion at the end June (H1 2020:EUR 31.1 trillion, an increase of 13% year-on year

- Record number of netted transactions settled in the Euroclear group of 149 million, an increase of 6% (H1 2020: 141 million)

- Euroclear's Collateral Highway mobilised a record EUR 1.7 trillion (H1 2020: EUR 1.5 trillion), benefiting from fixed income securities growth

Continued progress of Strategic Plans

Acquisition of MFEX group

- On track to close MFEX acquisition in second half 2021, as planned.

- Issuance of €350m 30-year corporate hybrid bond by Euroclear Investments provides funding towards MFEX transaction

- Integration streams established and progressing well

Strengthening Euroclear's Network

- Business drivers remain strong across asset classes leading to business income growth of 13%, driven by business gains, increased volumes, record issuance in fixed income securities and increased equity valuations

- Fund assets under custody, up 24% year on year, to €2.8 trillion, before the inclusion of MFEX financials

- Continued investment in systems and infrastructure to enhance business resilience

Growing and Reshaping Euroclear's Network

- Business income in "Grow and Reshape" segments grew by 15% year on year

- Collateral Management including securities lending and borrowing business income grew, up 12% year on year

- Euroclear's global and emerging markets network, Global Reach, increased business income by 18% year on year

- Euroclear Bank and the Ministry of Finance of Chile have partnered to facilitate access to Chilean corporate debt through the market's Euroclearable link

- Continued rollout of InvestorInsight solution for issuers, including shareholder identification services to support issuers' efforts to enhance corporate governance

- Supporting projects to explore central bank digital currencies, such as proof of concept with Banque de France and a consortium of actors to test use of central bank digital currency to settle the issuance of a French Government Bond by Agence France Trésor

Governance reforms completed

- Francesco Vanni d'Archirafi appointed as Chairman of the Euroclear Holding and Euroclear SA/NV boards

- Reforms have been implemented to strengthen Euroclear's corporate governance, including alignment of membership of the two boards

Embracing hybrid working

- Progressing implementation of a new hybrid working model, combining attendance in Euroclear offices with continued remote working

- Gradually reopening offices in line with local government guidelines

- Ensuring business continuity and the health and safety of employees remain important priorities

Commenting on the results, Lieve Mostrey, Chief Executive Officer said:

"I am pleased to report that Euroclear achieved a record business performance in the first half of 2021. Our consistent strategy has delivered a growing financial performance, despite a business environment that remains uncertain.

By continuing to invest in our people and technology, we are supporting our clients' and the broader market's need for robust infrastructure, across asset classes, as they access our global network of financial market participants."

About Euroclear

Euroclear group is the financial industry's trusted provider of post trade services. Euroclear provides settlement and custody of domestic and cross-border securities for bonds, equities and derivatives to investment funds. Euroclear is a proven, resilient capital market infrastructure committed to delivering risk-mitigation, automation and efficiency at scale for its global client franchise.

The Euroclear group comprises Euroclear Bank, the International CSD, as well as Euroclear Belgium, Euroclear Finland, Euroclear France, Euroclear Nederland, Euroclear Sweden and Euroclear UK & Ireland. The Euroclear group settled the equivalent of EUR 897 trillion in securities transactions in 2020, representing 276 million domestic and cross-border transactions, and held EUR 32.8 trillion in assets for clients by end 2020. For more information about Euroclear, please visit www.euroclear.com.

Photo: https://mma.prnewswire.com/media/1574870/Table_1.jpg

Photo: https://mma.prnewswire.com/media/1574871/Table_2.jpg