COLORADO SPRINGS, CO / ACCESSWIRE / August 24, 2021 / Fortitude Gold Corp. (OTCQB:FTCO) (the "Company") today announced exploration results from its 2021 Scarlet phase two drill program including 4.57 meters of 3.19 grams per tonne (g/t) gold within 19.81 meters grading 1.57 g/t gold. This mineralization is associated with the northwestern structural extensions of its Isabella Pearl mine located in Mineral County, Nevada. Fortitude Gold is a gold producer, developer, and explorer with operations in Nevada, U.S.A.

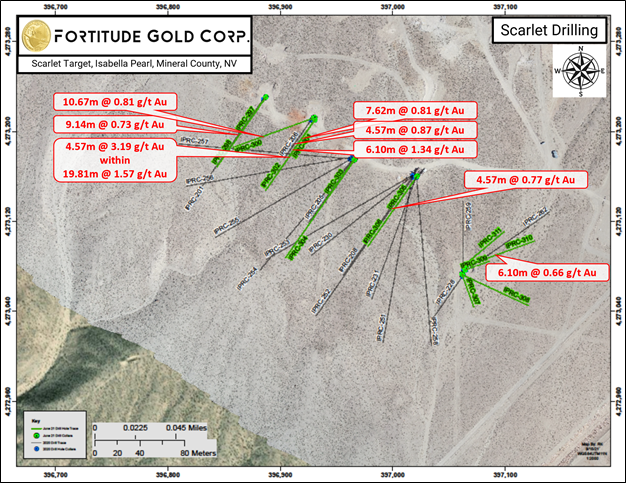

During the second quarter of 2021, a 15-hole reverse circulation program targeted the south Scarlet area located approximately 650 meters northwest of the Company's operating Isabella Pearl mine (see map below). This program was designed to build on first quarter Scarlet drill results released in April 2021. Substantial widths and gold grades intercepted oxide mineralization with potential to be processed at the Company's Isabella Pearl heap leach pad and gold process plant.

2021 Phase II Scarlet drill highlights include (m=meters, g/t=grams per tonne)

(drill table below):

Hole # IPRC-301

| 6.10m of 1.34 g/t gold | |

| incl. | 3.05m of 1.68 g/t gold |

Hole # IPRC-302

| 19.81m of 1.57 g/t gold | |

| incl. | 4.57m of 3.19 g/t gold |

2021 Phase I Scarlet drill highlights:

Hole # IPRC-254

| 19.81m of 1.56 g/t gold | |

| incl. | 3.05m of 3.19 g/t gold |

Hole # IPRC-257

| 16.76m of 2.23 g/t gold | |

| incl. | 3.05m of 4.52 g/t gold |

Hole # IPRC-262

| 24.38m of 1.60 g/t gold | |

| incl. | 3.05m of 3.94 g/t gold |

"This latest drill program at Scarlet was designed to further define the lower oxide-sulfide boundary, as well as test the margins of the know mineralization," stated Mr. Barry Devlin, Fortitude Gold's Vice President of Exploration. "Multiple holes again returned sizeable widths of oxide mineralization with grades as high as 3.19 grams per tonne gold. Scarlet remains a high priority target for additional delineation drilling. We plan to move a reverse circulation drill rig back to Scarlet early in the fourth quarter of 2021, once the current delineation drilling at Golden Mile is complete, to build on these positive Scarlet drill results."

SCARLET PHASE TWO DRILL SUMMARY HIGHLIGHTS | ||||||

Hole # | Angle | Target | From | Interval | Au | |

deg | Meters | Meters | g/t | |||

IPRC-297 | -76 | Scarlet | 118.87 | 3.05 | 0.62 | |

IPRC-299 | -90 | Scarlet | 35.05 | 9.14 | 0.73 | |

incl. | 38.10 | 3.05 | 1.28 | |||

IPRC-300 | -60 | Scarlet | 21.34 | 7.62 | 0.58 | |

68.58 | 10.67 | 0.81 | ||||

incl. | 74.68 | 3.05 | 1.446 | |||

IPRC-301 | -75 | Scarlet | 25.91 | 7.62 | 0.81 | |

incl. | 27.43 | 1.52 | 2.78 | |||

38.10 | 3.05 | 0.42 | ||||

76.20 | 4.57 | 0.87 | ||||

incl. | 77.72 | 1.52 | 1.44 | |||

85.34 | 6.10 | 1.34 | ||||

incl. | 86.87 | 3.05 | 1.68 | |||

IPRC-302 | -60 | Scarlet | 62.48 | 19.81 | 1.57 | |

incl. | 73.15 | 4.57 | 3.19 | |||

IPRC-306 | -65 | Scarlet | 47.24 | 4.57 | 0.77 | |

incl. | 48.77 | 1.52 | 1.06 | |||

IPRC-309 | -75 | Scarlet | 22.86 | 6.10 | 0.66 | |

incl. | 24.38 | 1.52 | 1.26 | |||

IPRC-311 | -60 | Scarlet | 36.58 | 3.05 | 0.54 | |

Assays by ALS, Vancouver, B.C., Canada. Meters downhole, not true width | ||||||

Mr. Jason Reid, CEO and President of Fortitude Gold, stated, "We are excited with these continued high grade drill intercepts including 4.57 meters of 3.19 grams per tonne gold within a much wider interval of 19.81 meters, or 65 feet, grading 1.57 grams per tonne gold. This mirrors similar intercepts from the prior drill program which included 3.05 meters of 3.94 grams per tonne within the wider intercept of 24.38 meters, or 80 feet, of 1.60 g/t gold. In a world where many open pit mines chase an average 0.5 grams per tonne gold grade, these high-grade gold Scarlet drill results are very exciting."

Mr. Reid continued, "While we expected to find the margins of this mineralization to the southeast, in the direction where we previously completed condemnation drilling for the heap leach pad expansion, this high-grade mineralization remains open to the northwest along trend. We recently announced the permit receipt to expand the Isabella Pearl heap leach pad. Included in this permit was an expansion of the Isabella Pearl mine plan boundary to the northwest, which opens up additional acreage associated with the Scarlet target for exploration within the permitted mine plan. Scarlet is just one of multiple gold targets associated with our 9,800-acre Isabella Pearl property covering over six miles of an important mineralized fault corridor in the Walker Lane Mineral Belt."

About Fortitude Gold Corp.

Fortitude Gold is a U.S. based gold producer targeting projects with low operating costs, high margins, and strong returns on capital. The Company's strategy is to grow organically, remain debt-free and distribute substantial dividends. The Company's Nevada Mining Unit consists of five high-grade gold properties located in the Walker Lane Mineral Belt, with the Isabella Pearl gold mine in current production. Nevada, U.S.A. is among the world's premier mining friendly jurisdictions.

Cautionary Statements: This press release contains forward-looking statements that involve risks and uncertainties. If you are risk-averse you should NOT buy shares in Fortitude Gold Corp. The statements contained in this press release that are not purely historical are forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. When used in this press release, the words "plan," "target," "anticipate," "believe," "estimate," "intend" and "expect" and similar expressions are intended to identify such forward-looking statements. Such forward-looking statements include, without limitation, the statements regarding the Company's strategy, future plans for production, future expenses and costs, future liquidity and capital resources, and estimates of mineralized material are forward-looking statements. All forward-looking statements in this press release are based upon information available to the Company on the date of this press release, and the Company assumes no obligation to update any such forward-looking statements.

Forward-looking statements involve a number of risks and uncertainties, and there can be no assurance that such statements will prove to be accurate. The Company's actual results could differ materially from those discussed in this press release. In particular, the scope, duration, and impact of the COVID-19 pandemic on mining operations, Company employees, and supply chains as well as the scope, duration and impact of government action aimed at mitigating the pandemic may cause future actual results to differ materially from those expressed or implied by any forward-looking statements. Also, there can be no assurance that production will continue at any specific rate.

Contact:

Greg Patterson

719-717-9825

greg.patterson@fortitudegold.com

www.Fortitudegold.com

SOURCE: Fortitude Gold Corp.

View source version on accesswire.com:

https://www.accesswire.com/661031/Fortitude-Gold-Scarlet-Intercepts-Include-457-Meters-of-319-gt-Gold-within-1981-Meters-of-157-gt-Gold