NEW YORK, NY / ACCESSWIRE / November 2, 2021 / Innodata Inc. (NASDAQ:INOD), a leading data engineering company, today announced general availability of its Innodata Data Annotation Platform, a web-based, SaaS platform designed to reduce the cost of AI/ML projects while enabling users to develop more accurate models.

While the data annotation tools market is expected to cross $7 billion by 20271, data scientists often struggle to find the right combinations of tools for efficiently creating high-quality training data.

"At Innodata, we constantly listen to real-world pain points for inspiration and insight on how to innovate," said Rahul Singhal, Chief Product Officer of Innodata. "After conducting extensive research, we found data scientists were seeking easy-to-use workflow processes, KPIs, and automated annotation capabilities not available in other data annotation products on the market. We built our Annotation Platform to directly address these needs, enabling data scientists to increase focus on model development and, ultimately, accelerate AI production rate."

Advanced features of Innodata's Annotation Platform include:

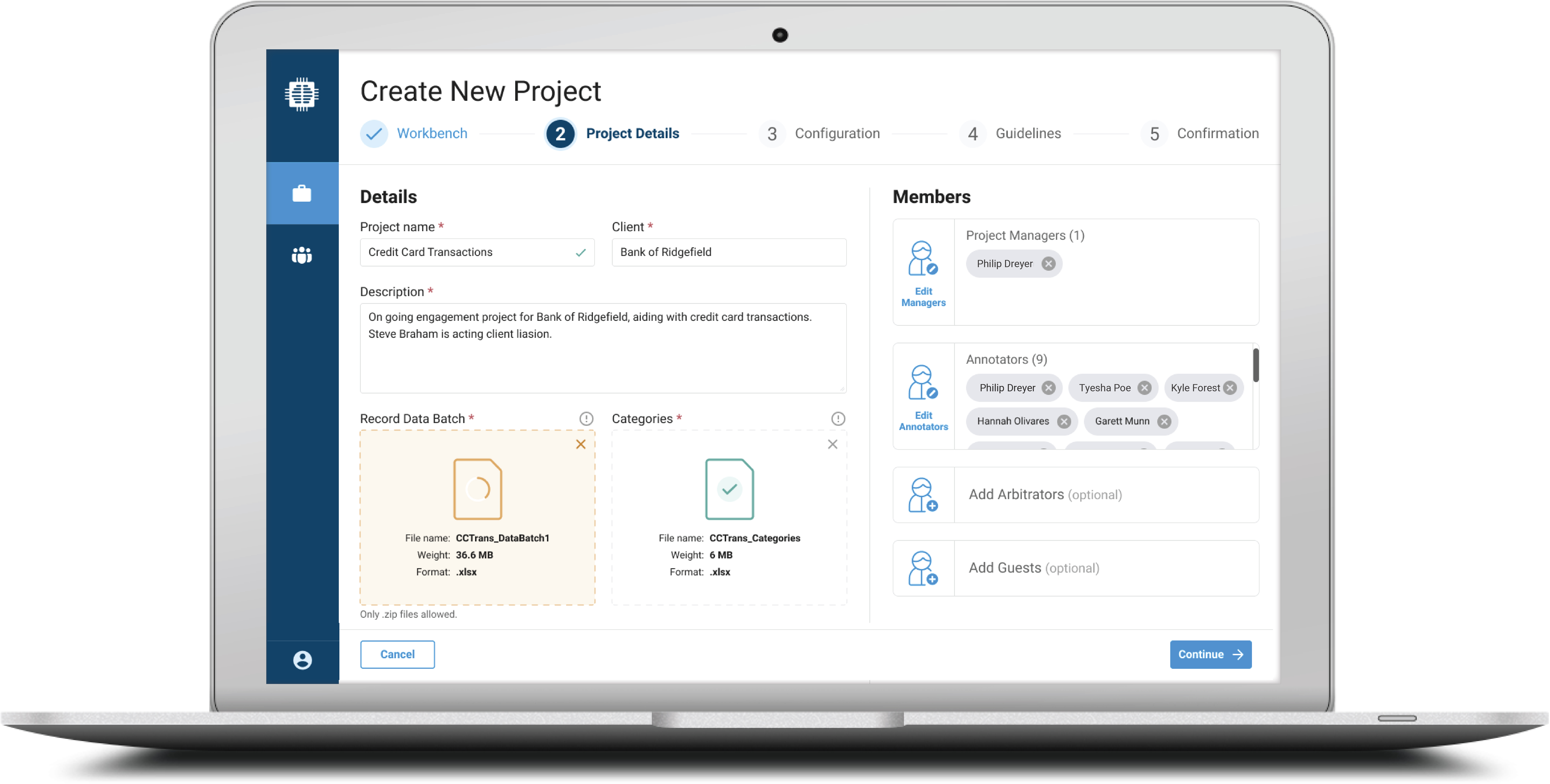

- Seamless Workflows centralize all data and project processes, so users can easily configure projects and allocate workloads all in one place.

- Customizable Workbenches manage complex information at scale with high quality and precision, including record and document classifications with inline text classification expected to be available by year-end.

- Real-Time KPIs track quality, progress, and productivity against benchmarks to help keep projects on course.

- Auto Annotation allows data scientists and annotators to accelerate annotation by integrating Innodata ML models, third-party ML models, and custom models.2

- Cloud-based and On-Premises deployments supported.

"Harnessing complex raw data for training AI is a major time and cost impediment for companies building quality machine learning models," said Jack Abuhoff, Chief Executive Officer of Innodata. "Last year, we supported 30+ companies with data annotation managed services. Now we can support customers that need a user-friendly version of our proprietary production platform to generate high-quality output while leveraging automation."

Learn more about Innodata's Annotation Platform and its available packages here, or simply book a demo or request a free 30-day trial today.

About Innodata

Innodata (NASDAQ:INOD) is a leading data engineering company. Prestigious companies across the globe turn to Innodata for help with their biggest data challenges. By combining advanced machine learning and artificial intelligence (ML/AI) technologies, a global workforce of over 3,500 subject matter experts, and a high-security infrastructure, we're helping usher in the promise of digital data and ubiquitous AI. Visit www.innodata.com to learn more.

Forward Looking Statements

This press release may contain forward-looking statements within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended, and Section 27A of the Securities Act of 1933, as amended. Words such as "project," "believe," "expect," "can," "continue," "could," "intend," "may," "should," "will," "anticipate," "indicate," "forecast," "predict," "likely," "goals," "estimate," "plan," "potential," or the negatives thereof and other similar expressions generally identify forward-looking statements, which speak only as of the date hereof.

These forward-looking statements are based on management's current expectations, assumptions and estimates and are subject to a number of risks and uncertainties, including without limitation, the expected or potential effects of the novel coronavirus (COVID-19) pandemic and the responses of governments, the general global population, our customers, and the Company thereto; that contracts may be terminated by clients; projected or committed volumes of work may not materialize; continuing Digital Data Solutions segment reliance on project-based work and the primarily at-will nature of such contracts and the ability of these clients to reduce, delay or cancel projects; the likelihood of continued development of the markets, particularly new and emerging markets, that our services support; continuing Digital Data Solutions segment revenue concentration in a limited number of clients; potential inability to replace projects that are completed, canceled or reduced; our dependency on content providers in our Agility segment; difficulty in integrating and deriving synergies from acquisitions, joint venture and strategic investments; potential undiscovered liabilities of companies and businesses that we may acquire; potential impairment of the carrying value of goodwill and other acquired intangible assets of companies and businesses that we acquire; changes in our business or growth strategy; a continued downturn in or depressed market conditions, whether as a result of the COVID-19 pandemic or otherwise; changes in external market factors; the ability and willingness of our clients and prospective clients to execute business plans that give rise to requirements for our services; changes in our business or growth strategy; the emergence of new or growth in existing competitors; various other competitive and technological factors; our use of and reliance on information technology systems, including potential security breaches, cyber-attacks, privacy breaches or data breaches that result in the unauthorized disclosure of consumer, client, employee or Company information, or service interruptions; and other risks and uncertainties indicated from time to time in our filings with the Securities and Exchange Commission.

Our actual results could differ materially from the results referred to in forward-looking statements. Factors that could cause or contribute to such differences include, but are not limited to, uncertainty around the COVID-19 pandemic and the effects of the global response thereto and the risks discussed in Part I, Item 1A. "Risk Factors," Part II, Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations, and other parts of our Annual Report on Form 10-K, filed with the Securities and Exchange Commission on March 15, 2021, as updated or amended by our other filings with the Securities and Exchange Commission. In light of these risks and uncertainties, there can be no assurance that the results referred to in the forward-looking statements will occur, and you should not place undue reliance on these forward-looking statements. We undertake no obligation to update or review any guidance or other forward-looking statements, whether as a result of new information, future developments or otherwise, except as may be required by the Federal securities laws.

1Global Market Insights, Inc., Data Annotation Tools Market Worth over $7bn by 2027 (May 2021).

2Feature coming soon.

Contact:

Jessie Schnurr

jschnurr@innodata.com

201-371-8189

SOURCE: Innodata Inc.

View source version on accesswire.com:

https://www.accesswire.com/670767/Innodatas-SaaS-Data-Annotation-Platform-Now-Generally-Available