COPENHAGEN, DENMARK / ACCESSWIRE / November 17, 2021 / Simple, the global insights and knowledge platform for family offices and private wealth owners just released its third annual Family Office Software & Technology industry review. In this year's review, they explore the technology landscape from an entirely new angle.

Key outtakes this year include:

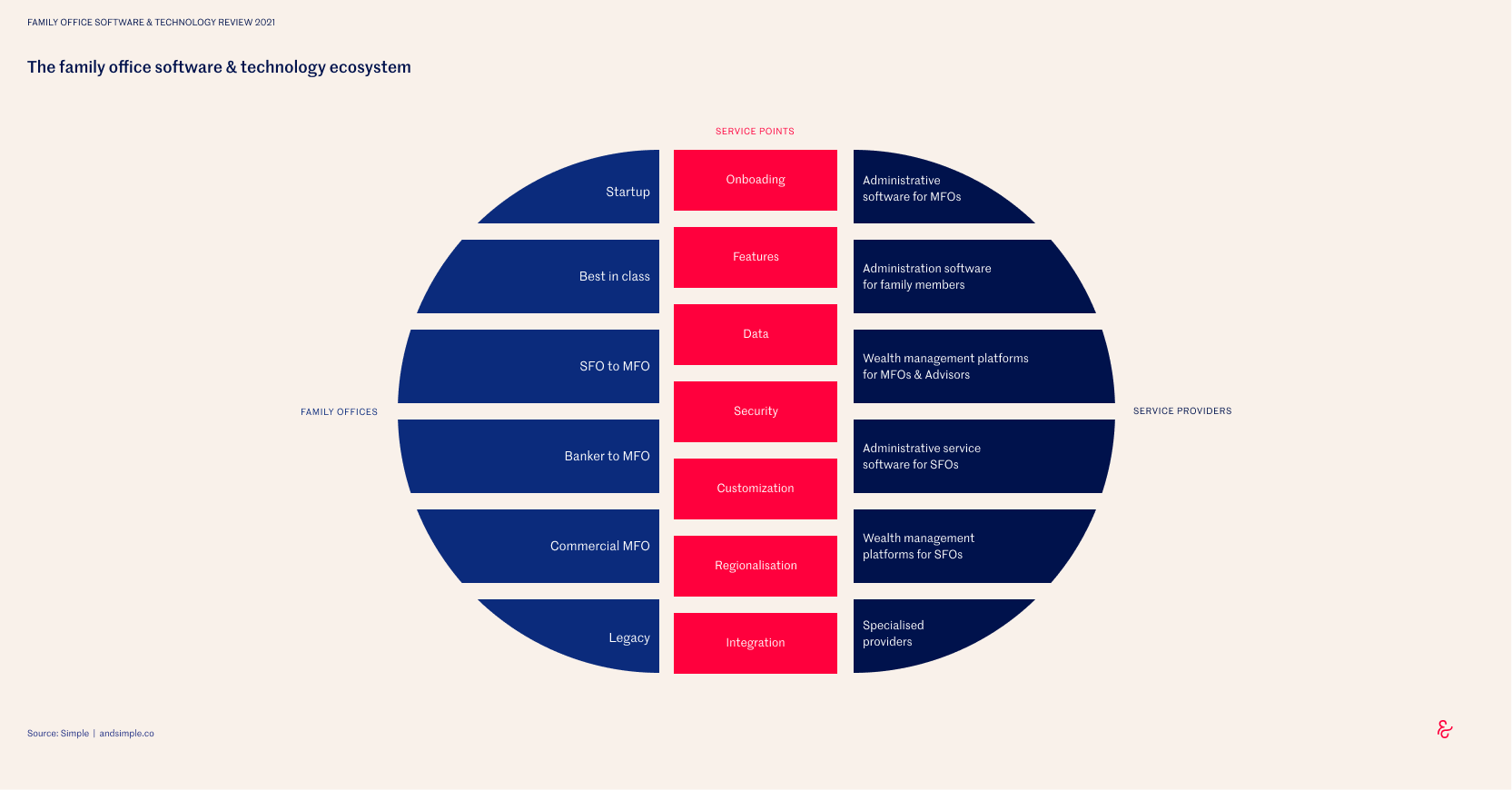

Archetypes for better understanding

As family offices around the world span a range of organizational structures and have varying technological needs, the report identified and shared six archetypes to help reveal software use trends and to locate commonalities and distinctions between offices. These archetypes include startup family offices, legacy organizations, best-in-class family offices, single-family offices transitioning to multi-family offices, bankers starting multi-family offices and commercial multi-family offices.

Five dimensions of data

Data can often be a complex discussion point when it comes to the need for privacy paired with regulatory requirements. The report highlights the topic of data jurisdictions and the accompanying aspects of data regulation, compliance and localization. Beyond the practicalities, there is also a focus on the value of true data independence and how to achieve this.

New asset classes mean new technological demands.

The investment world and the family office sector, in particular, is seeing plenty of discussion around direct investments. Beyond venture capital and private equity, other asset classes are also increasingly included into the mix including better-understood ones such as cryptocurrency, or more abstract assets such as carbon futures and recurring revenue. All these assets have intricacies for how they are managed and what tech platforms need in order to support them.

Provider insights

Some key points from the annual provider survey:

- 77% of providers believe that the family office technology segment is growing.

- There is a growing expectation of better data management to drive decision-making.

- Most providers saw strong growth over the last year - some by as much as 50%

- High-touch services are on the increase and change management is crucial for focus

According to Simple founder, Francois Botha:

"We have seen an exponential increase in demand for technology as various macro- and market changes were accelerated throughout the past year. For that same reason, we went back-to-basics this year to provide a simple look at the landscape in a highly fragmented industry."

The annual review is led by Simple's research and data team and is accompanied by a Family Office Service Provider Directory. Companies included in this year's review include:

USA

Addepar, Asset Vantage, Backstop Solutions, Bill.com, Black Diamond, Clarity AI, Copia, Eton Solutions, FundCount, Masttro, Mirador, Nasdaq Asset Owners Solutions, Northern Trust Family Office Technology, Panda Connect, PCR Insights, Private Wealth Systems, Ruby, SEI Archway Platform, Sopact, SS&C Private Capital Group, Way2B1

Europe

Altoo, Assetgrip, Assure Wealth, Centtrip, Coryx, Elysys, Escali, Etops, Hemonto, IQEQ Cosmos, Lombard Odier Global Assets+, Orca, PaxFamilia, QPLIX GmbH, Quantilia, Sharpfin, Swimbird, Tindeco, WealthArc, WIZE by Teamwork

Asia-Pacific

Canopy, Hatcher+, Valuefy

Simple publishes new deep-dive reviews on a regular basis. These are accompanied by guides that provide actionable support on the various operational challenges that family offices face.

About Simple

Simple is a next-generation data provider and insights lab focused on helping family offices and private investors to professionalize and be future-fit. We publish cutting-edge insights and reviews which are co-created with our global network of experts.

These insights range from entry-level questions such as "What is a family office" to more specific matters relating to operations, technology and infrastructure. The Simple platform provides access to this ready-to-use content, as well as our global expert community.

Connect with Simple on LinkedIn, Instagram or Twitter

Contact: Francois Botha

Phone Number: +45 25 64 04 38

Email: hi@andsimple.co

SOURCE: Simple

View source version on accesswire.com:

https://www.accesswire.com/673330/Simple-Releases-Annual-Family-Office-Software-Technology-Review