VANCOUVER, BC / ACCESSWIRE / November 30, 2021 / GREAT ATLANTIC RESOURCES CORP. (TSXV:GR) (the "Company" or "Great Atlantic") is pleased to announce that it has closed the first tranche of a non-brokered private placement originally announced on November 17, 2021, consisting of 3,201,250 flow-through shares at a price of $0.40 per share for gross proceeds of $1,280,500. Each Flow-Through unit consists of one common share that qualifies as a "flow-through share" as defined in subsection 66(15) of the Income Tax Act and one share purchase warrant. Each whole warrant will entitle the holder to purchase one additional non-flow common share at the price of $0.75 for 36 months after closing. The net proceeds from the Offering will be used for exploration expenses on the Company's mineral properties in Atlantic Canada.

The Company paid a cash commission of $70,000 and issued 175,000 finders warrants to Qwest Investment Fund Management Ltd. The finder warrants are valid for 3 years from closing with an exercise price of $0.40. The Company also paid a cash commission of $2,800 and issued 7,000 finder warrants to Haywood Securities Inc. and paid a cash commission of $7,385 and issued 18,463 finder warrants to Arthur Perna. These finder warrants are valid for 3 years from closing with an exercise price of $0.75

All securities issued in connection with the flow through Offering will be subject to a hold period expiring March 25, 2022. The closing of this private placement financing is subject to final TSX-V approval.

On Behalf of the board of directors

"Christopher R Anderson"

Mr. Christopher R. Anderson

"Always be positive, strive for solutions, and never give up"

President CEO Director

Investor Relations:

Andrew Job

1-416-628-1560

IR@GreatAtlanticResources.com

Office Line 604-488-3900

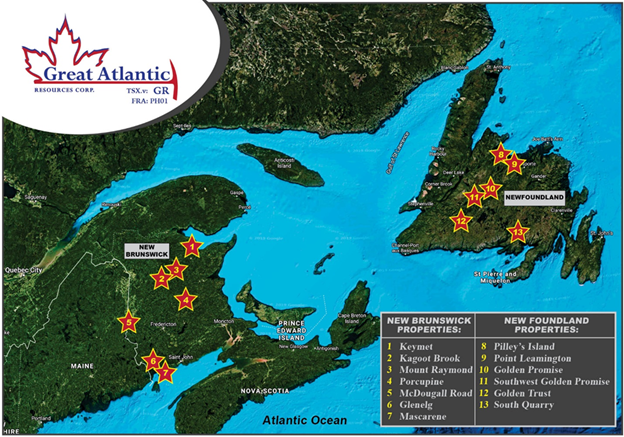

About Great Atlantic Resources Corp.: Great Atlantic Resources Corp. is a Canadian exploration company focused on the discovery and development of mineral assets in the resource-rich and sovereign risk-free realm of Atlantic Canada, one of the number one mining regions of the world. Great Atlantic is currently surging forward building the company utilizing a Project Generation model, with a special focus on the most critical elements on the planet that are prominent in Atlantic Canada, Antimony, Tungsten and Gold.

This press release includes certain statements that may be deemed "forward-looking statements". All statements in this release, other than statements of historical facts, that address future exploration drilling, exploration activities and events or developments that the Company expects, are forward looking statements. Although the Company believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results or developments may differ materially from those in forward-looking statements. Factors that could cause actual results to differ materially from those in forward-looking statements include exploitation and exploration successes, continued availability of financing, and general economic, market or business conditions.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Great Atlantic Resource Corp

888 Dunsmuir Street - Suite 888, Vancouver, B.C., V6C 3K4

SOURCE: Great Atlantic Resources Corp.

View source version on accesswire.com:

https://www.accesswire.com/675290/Great-Atlantic-Resources-Closes-First-Tranche-of-Financing-1280500