NEW YORK, NY / ACCESSWIRE / April 2, 2022 / The SBA announced urgent news that has sent many small business owners scrambling. On Friday, the SBA sent an email stating that all COVID-19 EIDL loan funds are expected to be exhausted within the next two weeks, by mid-April 2022. All SBA EIDL loan increase requests, modifications, and reconsiderations will be processed in the order received and are subject to availability of funds. As a last chance to get much needed financial relief, this leaves businesses owners with one option - file as soon as possible.

Possibly the last chance to receive an SBA EIDL business loan due to COVID-19 economic injury. Image Credit: 123rf / Kritchanut.

"After the SBA announcement yesterday, company executives, entrepreneurs, and small business owners have quite possibly one last opportunity to tap the SBA's Economic injury Disaster Loan (EIDL) Program, but only if they act quickly," said Marty Stewart, Chief Strategy Officer of Disaster Loan Advisors (DLA).

Over the past two years, Disaster Loan Advisors have strategically assisted clients with expedited SBA EIDL loan filings. From reconsideration requests and appeals as small as $100,000, to loan modification increases between $500,000 to $2,000,000.

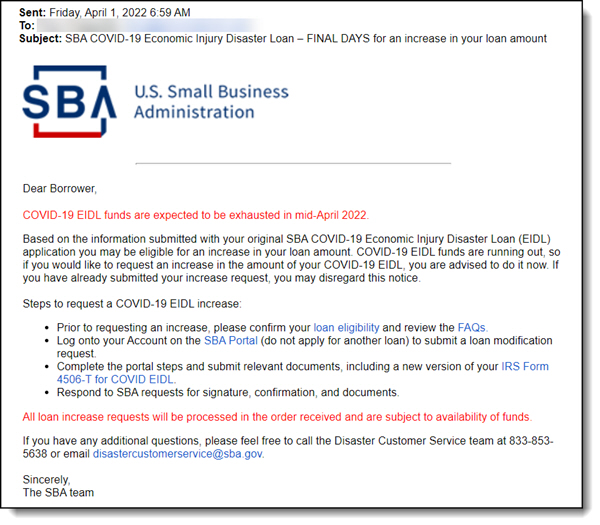

The U.S. Small Business Administration (SBA) Email Announcing COVID-19 EIDL Funds are Running Out Soon

In late February, it was thought there was an estimated $115 billion in EIDL funds that may still be available. However, many business owners woke up to this email from the SBA on Friday, April 1, 2022.

Subject: SBA COVID-19 Economic Injury Disaster Loan - FINAL DAYS for an increase in your loan amount

Dear Borrower,

COVID-19 EIDL funds are expected to be exhausted in mid-April 2022.

Based on the information submitted with your original SBA COVID-19 Economic Injury Disaster Loan (EIDL) application you may be eligible for an increase in your loan amount. COVID-19 EIDL funds are running out, so if you would like to request an increase in the amount of your COVID-19 EIDL, you are advised to do it now. If you have already submitted your increase request, you may disregard this notice.

Steps to request a COVID-19 EIDL increase:

- Prior to requesting an increase, please confirm your loan eligibility and review the FAQs.

- Log onto your Account on the SBA Portal (do not apply for another loan) to submit a loan modification request.

- Complete the portal steps and submit relevant documents, including a new version of your IRS Form 4506-T for COVID EIDL.

- Respond to SBA requests for signature, confirmation, and documents.

All loan increase requests will be processed in the order received and are subject to availability of funds.

Sincerely,

The SBA Team

SBA email announcing the COVID-19 EIDL funds are running out. Image Credit: SBA.gov.

Urgent Next Step for Business Owners to Receive COVID-19 EIDL Funds

"There is one best and only last shot at companies getting additional EIDL funds. Whether through an increase or a reconsideration, business owners should seek expert help immediately to get their requests filed and in the SBA queue before funds run out. We've been working with clients over the past two years to do just that," said Stewart.

About Disaster Loan Advisors

Disaster Loan Advisors is a trusted team of SBA loan consulting professionals dedicated to saving small businesses and companies from lost sales, lost customers, lost revenue to assist in rescuing your business from potential financial ruin from the COVID-19 / Coronavirus disaster, Delta and Omicron variants, and other declared natural disasters.

DLA specializes in assisting ownership groups with multiple business entities, multiple location restaurants and retail groups, and other complex situations that require an expert to be brought in to assess the situation and create the most strategic path forward.

Has Your Small Business or Company Suffered Financial Loss due to COVID-19, Hurricane Ida, or Other Natural Disaster? Was Your SBA Loan Application Denied for an EIDL Loan? Are You Looking for an Increase to Your Existing SBA EIDL Loan (up to $2 Million)? Need Strategic Guidance Before You Make Your Next Move with the SBA?

CONTACT:

Disaster Loan Advisors

Elena Goldstein

Director of Media Relations

877-463-9777 ext. 3

elena.goldstein@disasterloanadvisors.com

Connect with Disaster Loan Advisors via social media:

Linkedin, Facebook, Instagram, Twitter, and CrunchBase.

For a strategic exploratory conversation, schedule a free consultation call by visiting:

https://www.disasterloanadvisors.com/contact

SOURCE: Disaster Loan Advisors

View source version on accesswire.com:

https://www.accesswire.com/695766/SBA-EIDL-Loans-Last-Chance-for-Increase-or-Reconsideration