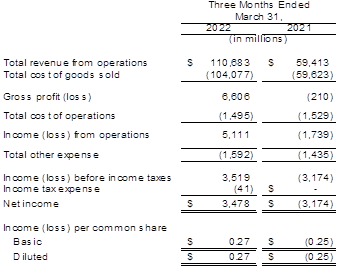

- Gross Profit $6.6 million ($6.8 million increase year over year)

- Net Income $3.5 million ($6.7 million increase year over year)

- Refining Operations Segment Contribution Margin $5.6 million ($7.0 million increase year over year)

- Positive Outlook for Refining Operations

HOUSTON, TX / ACCESSWIRE / May 16, 2022 / Blue Dolphin Energy Company ("Blue Dolphin") (OTCQX:BDCO), an independent refiner and marketer of refined petroleum products in the Eagle Ford Shale, announced its financial results for the first quarter of 2022. Blue Dolphin had gross profit of $6.6 million for the quarter ended March 31, 2022 (Q1-22) compared to a gross loss of $0.2 million for the quarter ended March 31, 2021 (Q1-21). Net income increased to $3.5 million, or $0.27 per share, for Q1-22 from a net loss of $3.2 million, or a loss of $0.25 per share, for Q1-21. Refining operations segment contribution margin, a non-GAAP financial measure, totaled $5.6 million for Q1-22 compared to a segment contribution deficit of $1.4 million for Q1-21. (See below for a reconciliation of non-GAAP financial measures to GAAP financial measures.)

"Blue Dolphin reported solid financial results for the first quarter of 2022 as refining fundamentals improved," said Jonathan P. Carroll, Chief Executive Officer of Blue Dolphin Energy Company. "In addition, the Nixon refinery operated well."

Reconciliation of Segment Contribution Margin (Deficit)

(1) General and administrative expenses within refinery operations include the LEH operating fee and accretion of asset retirement obligations.

Non-GAAP Financial Measures. This press release includes segment contribution margin, which, for refinery operations and tolling and terminaling business segments, represents net revenues (excluding intercompany fees and sales) attributable to the respective business segment less associated intercompany fees and sales less associated operation costs and expenses. We believe segment contribution margin is useful for investors to consider this measure in comparing the underlying performance of our business across periods. The presentation of this additional information is not meant to be considered in isolation or as a substitute for net income (loss) as prepared in accordance with U.S. GAAP.

About Blue Dolphin

Blue Dolphin is an independent downstream energy company operating in the Gulf Coast region of the United States. Subsidiaries operate a light sweet-crude, 15,000-bpd crude distillation tower with more than 1.2 million bbls of petroleum storage tank capacity in Nixon, Texas. Blue Dolphin was formed in 1986 as a Delaware corporation and is traded on the OTCQX under the ticker symbol "BDCO". For additional information, visit Blue Dolphin's corporate website at http://www.blue-dolphin-energy.com.

Contact:

Jonathan P. Carroll

Chief Executive Officer and President

713-568-4725

Cautionary Statements Relevant to Forward-Looking Information for the Purpose of "Safe Harbor" Provisions of the Private Securities Litigation Reform Act of 1995. This press release contains forward-looking statements relating to Blue Dolphin's operations that are based on management's current expectations, estimates and projections about the oil and gas industry. Words or phrases such as "anticipates," "expects," "intends," "plans," "targets," "advances," "commits," "drives," "aims," "forecasts," "projects," "believes," "approaches," "seeks," "schedules," "estimates," "positions," "pursues," "may," "can," "could," "should," "will," "budgets," "outlook," "trends," "guidance," "focus," "on track," "goals," "objectives," "strategies," "opportunities," "poised," "potential," "ambitions," "aspires" and similar expressions are intended to identify such forward-looking statements. These statements are not guarantees of future performance and are subject to certain risks, uncertainties, and other factors, many of which are beyond the company's control and are difficult to predict. Therefore, actual outcomes and results may differ materially from what is expressed or forecasted in such forward-looking statements. The reader should not place undue reliance on these forward-looking statements, which speak only as of the date of this press release. Unless legally required, Blue Dolphin undertakes no obligation to update publicly any forward-looking statements, whether as a result of new information, future events or otherwise.

For a discussion of risk factors that could cause actual results to differ materially from those in the forward-looking statements, please see the factors set forth under the heading "Risk Factors" in Blue Dolphin's 2021 Annual Report on Form 10-K and in subsequent filings with the U.S. Securities and Exchange Commission. Other unpredictable or unknown factors not discussed in this press release could also have material adverse effects on forward-looking statements.

SOURCE: Blue Dolphin Energy Company

View source version on accesswire.com:

https://www.accesswire.com/701641/Blue-Dolphin-Reports-First-Quarter-2022-Results