Acquisition Expected to Increase Current Revenues by up to $10 Million With Potentially $7 Million Gross Profit

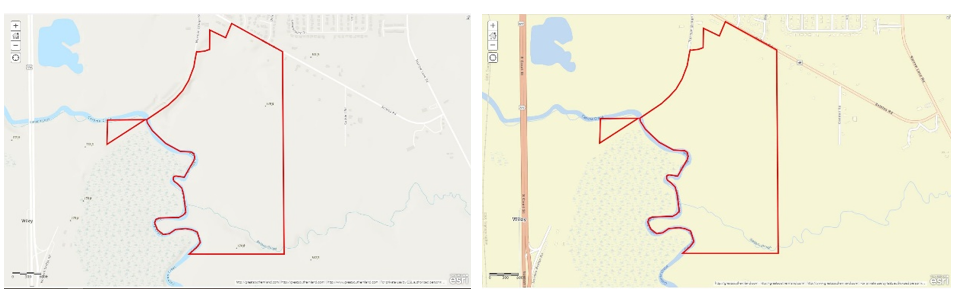

TAIPEI, TAIWAN / ACCESSWIRE / September 12, 2022 / Nocera, Inc. (NASDAQ:NCRA) ("Nocera" or the "Company"),a fully integrated sustainable seafood company focusing on manufacturing and operating land-based Recirculatory Aquaculture Systems (RAS), announced today it entered into a purchase agreement to acquire 229 acres of agricultural land for US land based fish farms in Montgomery, Alabama.

The purchase agreement was executed on September 8, 2022, and the acquisition is anticipated to close by October 31, 2022. The purchase price for the parcel is $865,000. The Company in the process of obtaining up to 85% financing from local banking institutions.

The 229 acres of land is in the city limits of Montgomery, Alabama. It comes with a house, a manufactured home and a building site with sewer and power which the company will develop into an office and dormitory for Nocera's employees.

Jeff Cheng, Nocera's CEO, commented, "This land acquisition in Alabama would be our first entry into fish farming business in the United States. We anticipate that our technology and design in Recirculating Aquaculture Systems will provide us with a substantial advantage. Being strategically located in the city of Montgomery, we will have access to a significant and skilled labor force along with a robust student population from the Montgomery area. With the price of fish hitting an all-time high, this land purchase will give us a considerable opportunity to become increasingly profitable. Our investment in Alabama is sustainable and green and we will be providing increased sustainable aquaculture in the United States and offering the American Family the best choice in seafood."

The closing of the purchase agreement is contingent on the Company satisfying the terms and conditions of the purchase agreement, including, but not limited, obtaining the necessary financing.

About Nocera, Inc.

Nocera (NASDAQ:NCRA) is a fully integrated sustainable seafood company that provides land-based recirculation aquaculture systems (RAS) for both fresh and saltwater fish and invests in fish farms by building high-tech RASs. The Company's main business operation consists of the design, development, and production of large-scale RAS fish tank systems, (aquaculture) for fish farms along with expert consulting, technology transfer, and aquaculture project management services to new and existing aquaculture facilities and operators. For more information, please visit the company's website at www.nocera.company.

Cautionary Note Regarding Forward-Looking Statements

This press release contains forward-looking statements that are inherently subject to risks and uncertainties. Any statements contained in this document that are not historical facts are forward-looking statements as defined in the U.S. Private Securities Litigation Reform Act of 1995. Words such as "anticipate," "believe," "estimate," "expect," "forecast," "intend," "may," "plan", "project", "predict," "should," "will" and similar expressions as they relate to Nocera are intended to identify such forward-looking statements. There can be no assurance that the Company will obtain the necessary funding for the purchase of the land or that the closing will occur. These risks and uncertainties include, but are not limited to, general economic and business conditions, effects of continued geopolitical unrest and regional conflicts, competition, changes in methods of marketing, delays in manufacturing or distribution, changes in customer order patterns, changes in customer offering mix, and various other factors beyond the company's control. Actual events or results may differ materially from those described in this press release due to any of these factors. Nocera is under no obligation to update or alter its forward-looking statements whether as a result of new information, future events or otherwise.

Investor Contacts:

Hanover Int'l

Jh@hanoverintlinc.com

TraDigital IR

Christine Petraglia

christine@tradigitalir.com

SOURCE: Nocera, Inc.

View source version on accesswire.com:

https://www.accesswire.com/715410/Nocera-Inc-Enters-Agreement-to-Purchase-229-Acres-of-Agricultural-Land-for-US-Land-Based-Fish-Farms-in-Montgomery-Alabama