VANCOUVER, BC / ACCESSWIRE / September 19, 2022 / Blue Lagoon Resources Inc. (the "Company") (CSE:BLLG; FSE:7BL; OTCQB:BLAGF) is pleased to announce significant mineralized intercepts from the first holes of the Phase Two 2022 drill program on its all year-round and road accessible Dome Mountain Gold Project, located a short 50-minute drive from Smithers, British Columbia. Drill results include 126 g/t Au and 404 g/t Ag over 0.41 meters from the Chance Structural Zone (CSZ) in hole DM-22-247.

"While drilling the mineralized flat structural zone in the CSZ ("Flat Chance") we have encountered what we believe to be a new vein system of higher grade than those hosted in the Flat Chance Structure", said Bill Cronk, Chief Geologist for Blue Lagoon Resources. "The Flat Chance Structure has been drilled down dip for 400 meters and along strike for 200 meters and the structure has been hit in all holes so far. This structural zone ranges from less than 1 meter up to 15 meters thick which may host multiple gold mineralized veins and attendant alteration. Our drilling to extend along strike also intersected a new structure that lies orthogonal to the Flat Chance Structure and appears, at least initially, much higher grade, and offers another opportunity to develop additional mineralized resources at Dome Mountain."

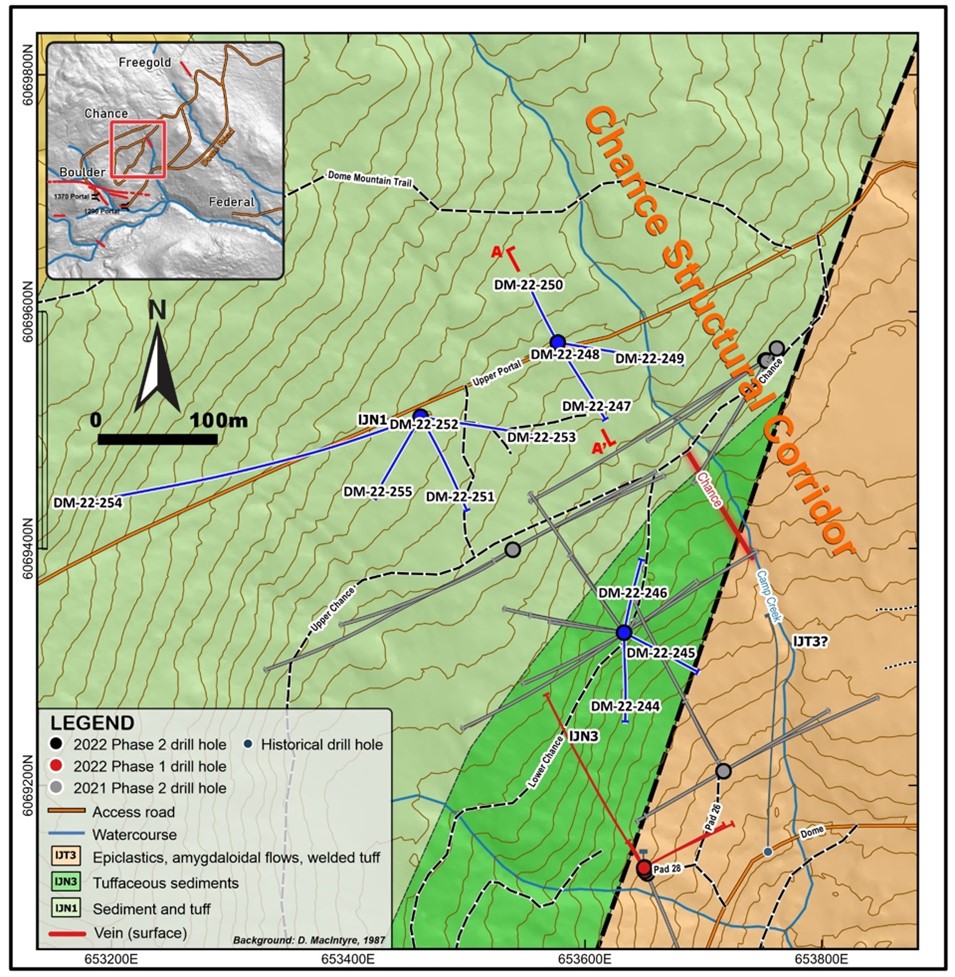

Figure 1 Drilling on the chance Structural Zone. Not a-a' cross sections for figure 3

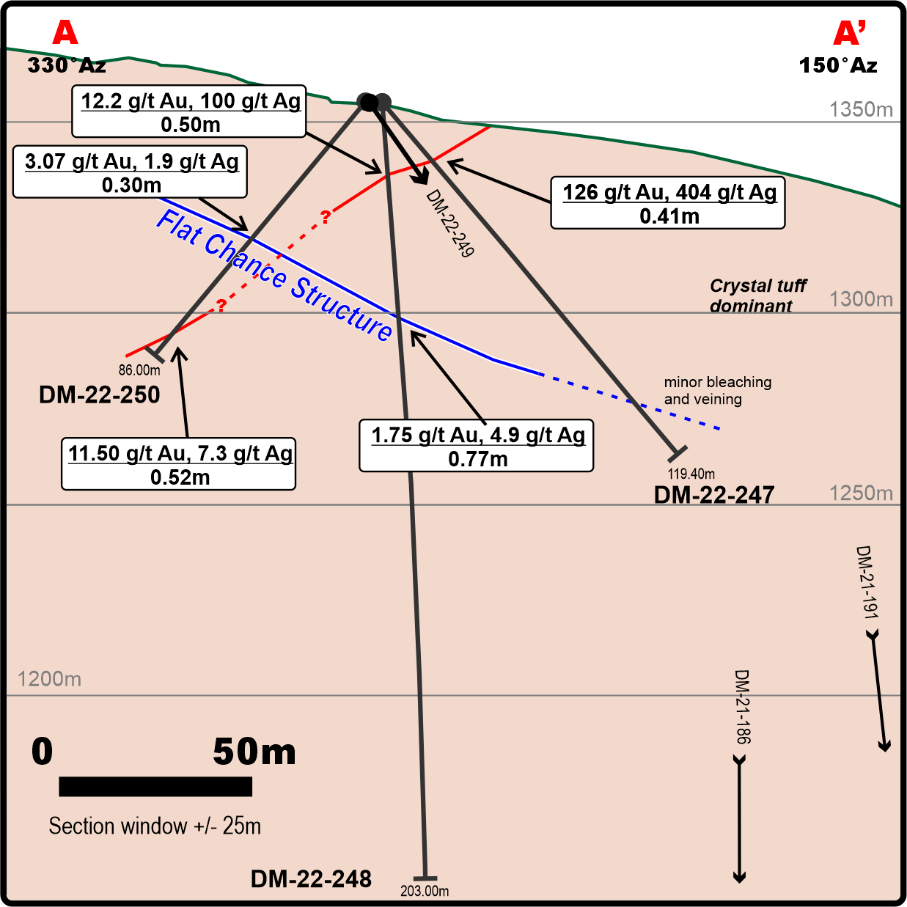

As mentioned, the Flat Chance is a shallow-dipping to flat-lying structural zone extending at least 400 meters down dip at about 12°dip (Figure 2). Thickness of the structural zone ranges from 1 to 15 metres. Hole DM-22-247 (Figure 1 and Figure 3) was intended to target this structure but also encountered an upper vein which ran 126 grams/tonne gold and 404 grams/tonne silver over 0.41 meters (core length) and, along with other holes which have hit this structure, points to another mineralized structure which can be defined by drilling in the near future.

Figure 2

Map shows drilling at Chance and highlights flat lying mineralized structure ( Fl;at Chance).

Flat Chance is defined downdip and open along strike. Sufficient drilling has yet to be performed to delineate resource.

Hole DM-22-247, 248 and 250 were all successful hitting the Flat Chance Structure as well as this new mineralized structure. (Figure 3). This new mineralized vein structure has a thickness of up to 1.73 meters including the vein itself and mineralized wallrock. * (Table 1).

Figure 3: Map showing cross section A-A' from figure 1. High grade vein cutting Flat Chance Zone

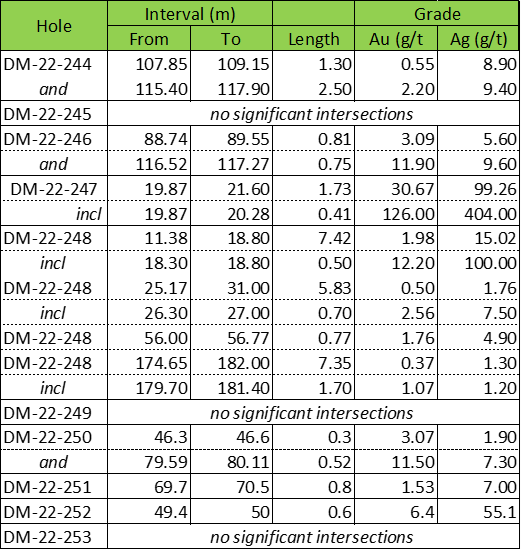

TABLE 2 Significant intercepts in 2022 Phase 2 drilling at Chance. Yellow highlights maximum thickness of new high grade mineralized zone drilled to date. Drilling in this area will continue as part of the 2022 Phase 2 Program.

*All intersection widths are drill indicated lengths as insufficient work has been done to determine orientations

A second drill has been added to the program. Drilling will continue to the Christmas break.

In addition to drilling, Blue Lagoon has completed a ground-based IP and CSAMT geophysical survey over the Chance Structural Zone and the Freegold Intrusion. The final report is yet to be delivered.

Soil sampling has been completed on the 2022 Dome Mountain Summer program. A total of 2,453 soil samples have been collected with results for 53% yet to be received. It is expected that the final results will be returned by mid October.

QUALITY ASSURANCE AND CONTROL

Core selected for sampling was cut in half with a core saw or split with a hydraulic splitter with one half bagged for shipping. Strict chain of custody storing, and shipping protocol was maintained. All core preparation and analyses were completed by Activation Laboratories Ltd. located in Kamloops, BC. Core was crushed, split, and pulverized with 250 grams passing 200 mesh. Each sample was analyzed for gold by fire assay with ICP-OES finish (Act Labs Code 1A2-ICP) and for multi-elements by 4-acid total digestion ICP with OES finish.(Act Labs Code 1F2) Any gold overlimits (>30 ppm Au) were analyzed by gravimetric fire assay. Standards and blanks were inserted by Company staff. The sampling program was undertaken by Company personnel and under the direction of Ted Vanderwart, P.Geo.

The scientific and technical disclosure in this news release was approved by William Cronk, P.Geo, a Qualified Person as defined in NI 43-101 and a consultant to the Company.

For further information, please contact:

Rana Vig

President and Chief Executive Officer

Telephone: 604-218-4766

Email: rana@ranavig.com

The CSE has not reviewed and does not accept responsibility for the adequacy or accuracy of this release.

Statement Regarding Forward-Looking Information: This release includes certain statements that may be deemed "forward-looking statements". All statements in this release, other than statements of historical facts, that address events or developments that Blue Lagoon Resources Inc. (the "Company") expects to occur, are forward-looking statements. Forward-looking statements are statements that are not historical facts and are generally, but not always, identified by the words "expects", "plans", "anticipates", "believes", "intends", "estimates", "projects", "potential" and similar expressions, or that events or conditions "will", "would", "may", "could" or "should" occur. Although the Company believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results may differ materially from those in the forward-looking statements. Factors that could cause the actual results to differ materially from those in forward-looking statements include results of exploration activities may not show quality and quantity necessary for further exploration or future exploitation of minerals deposits, volatility of gold and silver prices, and continued availability of capital and financing, permitting and other approvals, and general economic, market or business conditions. Investors are cautioned that any such statements are not guarantees of future performance and actual results or developments may differ materially from those projected in the forward-looking statements. Forward-looking statements are based on the beliefs, estimates and opinions of the Company's management on the date the statements are made. Except as required by applicable securities laws, the Company undertakes no obligation to update these forward-looking statements in the event that management's beliefs, estimates or opinions, or other factors, should change.

SOURCE: Blue Lagoon Resources Inc.

View source version on accesswire.com:

https://www.accesswire.com/716456/Blue-Lagoon-Hits-126-gt-Au-and-404-gt-Ag-at-Chance