3 February 2023 - Media Release

Ad hoc announcement pursuant to Article 53 of SIX Exchange Regulation Listing Rules

ONE swiss bank SA

H2 and full-year 2022 financial results

"After a challenging year in which global financial markets experienced unprecedented turmoil, we are pleased to report that ONE swiss bank's financial turnaround is now complete. When our merger was completed in June 2021, our baseline scenario was to achieve a net profit within 24 months. This goal was actually achieved in less than 18 months - despite the well-known series of shocks that severely impacted financial markets in 2022.

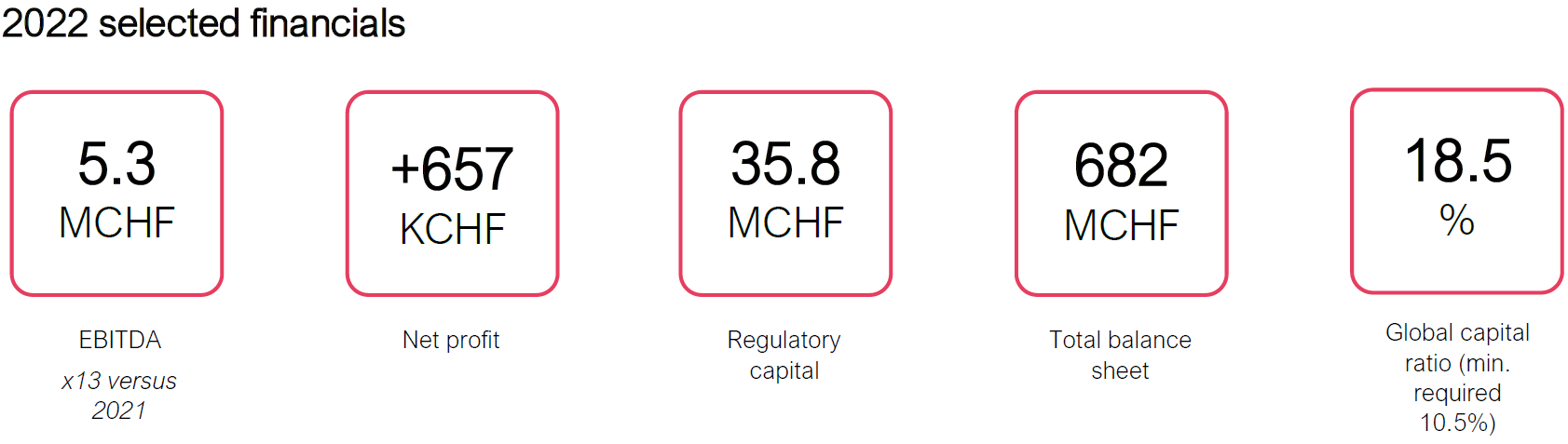

Full-year earnings before interest, taxes, depreciation and amortisation (EBITDA) totalled CHF 5.3 million, of which CHF 4 million was generated in H2 2022, resulting in a sustainable EBITDA margin of 18.7% as higher official interest rates helped our treasury activities. Our cost/income ratio, excluding depreciation and amortisation, similarly improved, decreasing to 75.2% in H2 2022 (81.3% in FY 2022), which was one of our main targets. The amortisation of intangibles continued to impact our net profit, reducing it by CHF 4.3 million. However, this charge has now peaked.

All in all, we are pleased to report a net profit of CHF 1.5 million for H2 2022, resulting in a full-year net profit of CHF 0.657 million, after four consecutive years of losses. Earnings per share for the second half of 2022 amounted to CHF 0.10. As a consequence, our regulatory capital strengthened by CHF 4.7 million to CHF 35.8 million, with a comfortable global capital ratio of 18.5%.

Nonetheless, falling asset prices across the board in 2022 combined with the strong Swiss franc to negatively impact our assets under management (AuM), which decreased by 11% to CHF 4.5 billion. This was entirely due to poor market performance and currency effects, as the net effect of new inflows and outflows was close to zero. As our AuM are predominantly invested, we believe that this decline - which is in line with what we have observed among our direct competitors - could be reversed in 2023. The current level of ONE's share price on the Swiss stock exchange is unsatisfactory - in my view, its underperformance mainly reflects the thin market for the share.

Last year we also consolidated our position among the leading players in the M&A field by completing two minor transactions, which helped ONE to maintain its reputation as a reliable and pragmatic partner for the timely execution of various types of deal structures. Last but not least, we were also pleased to become a signatory of the UN PRI (Principles for Responsible Investment) and to publish our first Sustainability Report. We remain fully committed to being a responsible corporate citizen for all our stakeholders.

This year marks a new phase for ONE, with the post-merger turnaround and integration complete. Despite a geopolitical and macroeconomic environment that remains unpredictable and calls for caution, we believe that 2023 will bring exciting opportunities that will accelerate our development and drive change."

Grégoire Pennone, CEO

2022 key financials

| Reported results (in CHF unless otherwise specified) True and fair view principle | H1 2022 | | H2 2022 | | FY2022 | | FY2021 | ? FY | ||||||

| Income statement | ||||||||||||||

| Revenues | ||||||||||||||

| Net result from interest operations | 3'044'468 | 7'566'235 | 10'610'703 | 4'931'208 | ||||||||||

| Result from commission business and services | 8'699'216 | 8'237'872 | 16'937'088 | 18'629'018 | ||||||||||

| Result from trading activities and the fair value option | 1'384'360 | 621'288 | 2'005'648 | 3'745'125 | ||||||||||

| Result from ordinary activities | -895'650 | -11'267 | -906'917 | 270'777 | ||||||||||

| Total revenues | 12'232'394 | 16'414'129 | 28'646'523 | 27'576'128 | 4% | |||||||||

| Operating expenses | -10'957'540 | -12'343'813 | -23'301'353 | -27'127'112 | -14% | |||||||||

| Operating result (EBITDA) | 1'274'854 | 4'070'316 | 5'345'170 | 449'016 | 1090% | |||||||||

| EBITDA margin | 10.4% | 24.8% | 18.7% | 1.6% | 1046% | |||||||||

| Cost/income ratio (%) | 89.6% | 75.2% | 81.3% | 98.4% | -17% | |||||||||

| Depreciation, amortisation, extraordinary items & taxes (A) | -2'121'981 | -2'565'313 | -4'687'294 | -5'220'951 | -10% | |||||||||

| Net profit / (loss) | -847'127 | 1'505'003 | 657'876 | -4'771'935 | 825% | |||||||||

| Earnings per share | -0.06 | 0.10 | 0.04 | -0.32 | 825% | |||||||||

| Balance sheet | ||||||||||||||

| Total assets | 784'636'149 | 682'469'975 | 682'469'975 | 870'077'407 | -22% | |||||||||

| Total liabilities | 741'762'800 | 638'091'623 | 638'091'623 | 826'545'589 | -23% | |||||||||

| Total equity | 42'873'349 | 44'378'352 | 44'378'352 | 43'531'818 | 2% | |||||||||

| Regulatory ratio | ||||||||||||||

| CET1 ratio (%) | 15.7% | 17.7% | 17.7% | 16.1% | 10% | |||||||||

| Global capital ratio (%) | 16.5% | 18.5% | 18.5% | 17.0% | 9% | |||||||||

| Regulatory capital (CHF thousands) | 32'422 | 35'848 | 35'848 | 31'151 | 15% | |||||||||

| Liquidity coverage ratio (LCR) (Q average %) | 446% | 354% | 354% | 522% | -32% | |||||||||

| Clients assets (AuM) - (CHF million) | 4'693 | 4'514 | 4'514 | 5'054 | -11% | |||||||||

| (A): Including goodwill amortisation expenses resulting from the merger with One Swiss Bank SA completed on 1 June 2021. | ||||||||||||||

Net profit of CHF 657.876 in 2022explained by:

- A 4% increase in revenue to CHF 28.6 million (vs. CHF 27.5 million in 2021) despite lower AuM (-11%).

- AuM decreased mainly due to market effects across all business lines: Wealth Management -9.49%, Asset Management -15.15% and Asset Services -9.45%. The net effect of new inflows and outflows was close to zero.

- An increase in interest transactions in H2 2022 resulting from the positive rate environment. This was despite an unrealised loss of CHF -0.825 million on funds held by the Bank and negative interest costs supported by the Bank amounting to

CHF -0.679 million.

- A positive trend in the cost/income ratio throughout 2022, whereby it improved to 75.2% in H2 and 81.3% in 2022 as a whole (vs. 98.4% in 2021).

- A strong operating profit (EBITDA) of CHF 5.3 million, covering depreciation and amortisation costs of CHF 4.5 million, of which CHF 4.3 million related to goodwill.

Strong balance sheet with:

- Equity of CHF 44.3 million, up 2% relative to 2021.

- A 23% decrease in liabilities to CHF 638 million (vs. 826 at end-2021), mainly arising from reduced cash deposits following client investments.

Robust regulatory ratios with:

- A global capital ratio of 18.5% (vs 17.0% FY2021), reflecting a 15% increase in regulatory capital to CHF 35.8 million at end-2022.

- A liquidity coverage ratio (LCR) of 354%, versus the minimum requirement of 100%.

2022Annual Report

The 2022 Annual Report will be published on Thursday 9 March 2023 at 7:00) under "Investor relations".

2023Annual General Meeting

The invitation and the agenda for the Bank's 2023 Annual General Meeting will be published on Thursday 9 March 2023 at 7:00) under "Investor relations".

- END -

For further information, please contact:

Julien Delécraz

Head of Marketing & Communication

investorrelations@oneswiss.com

+41 58 300 78 13

ONE swiss bank SA

Attachment

- 20230203-ONE-H2-FY2022-results-media-release-en (https://ml-eu.globenewswire.com/Resource/Download/f1e9e25f-5610-40e6-9ee1-c6025dfb88b5)