VANCOUVER, BC / ACCESSWIRE / February 16, 2023 / iMetal Resources, Inc. (TSXV:IMR)(OTC PINK:ADTFF)(FRANKFURT:A7V) ("iMetal" or the "Company") is pleased to announce receipt of final results and interpretation of a drone magnetics survey at its 565-hectare Shining Tree block, 3.75 kilometres west of iMetal's Gowganda West property. The survey was completed in October and November 2022. Results of the survey have identified four priority target areas for gold exploration.

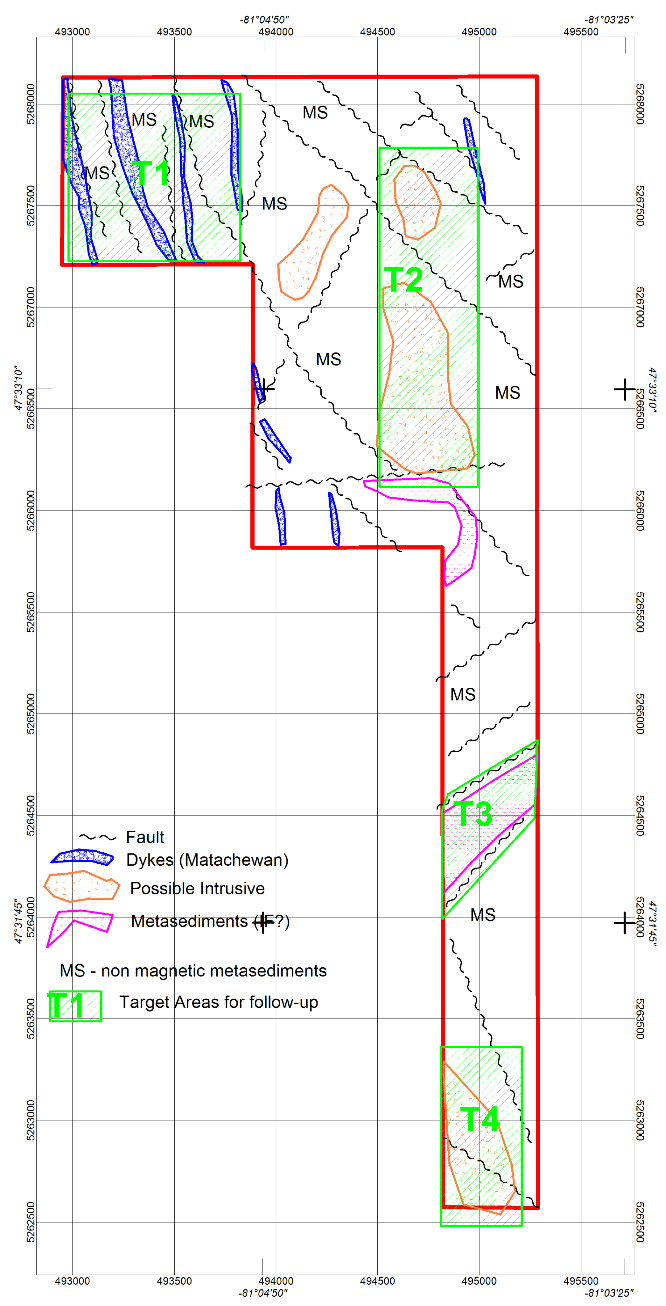

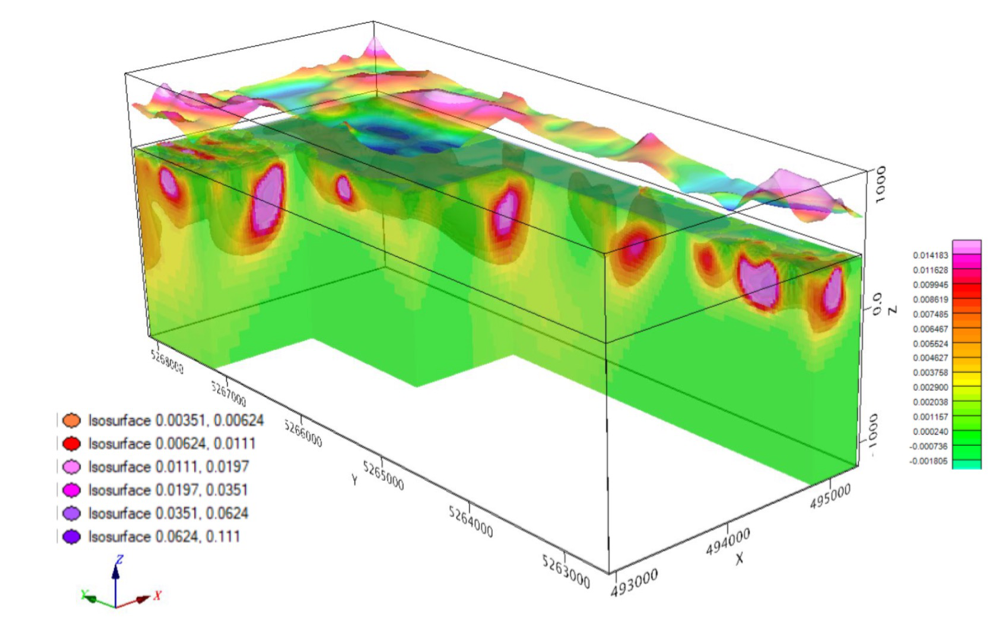

The key target area is Target 2, interpreted to be a structurally controlled potential intrusive (metavolcanic) complex, offset by NNW faults and possibly controlled by NNE family of faults. The interpretation of the results included a geophysical interpretation of the bedrock (Figure 1) and the 3D inversions (for example Figure 2).

Saf Dhillon, Chief Executive Officer, stated: "Our recent financings have allowed iMetal to begin exploring our additional Shining Tree District holdings adjacent to our flagship Gowganda West property. We are very pleased with the initial drone magnetic results from our Shining Tree block and the Company plans to ground truth all anomalies, initially concentrating on Target 2, in preparation for mechanical trenching and drilling, as soon as the snow clears."

The survey included a total of 224-line kms of data. A thorough Quality Control process was performed, and then the following advanced processing was applied to the data:

- Total Magnetic Intensity (TMI)

- TMI reduced to the north magnetic pole (RTP)

- TMI RTP Calculated 1st vertical derivative (1VD)

- Calculated Analytic Signal (AS) of the TMI

- Tilt Derivative (TDR) of the TMI

- Total Horizontal Derivative (THDR) of the TMI

- 3D inversion by two methodologies: Inversion for magnetic susceptibility distribution, and magnetic vector inversion.

Figure 1 - Geophysical Interpretation East Shining Tree Block

Figure 2 - 3D Magnetic Susceptibility Inversion (looking to the NE)

All processing and interpretation has been completed by Robert Hearst, P.Geo. of GeoFizX Geophysical Consulting.

The scientific and technical information contained in this news release has been reviewed and approved by Scott Zelligan, P. Geo (Ontario), VP Exploration of iMetal and a qualified person as defined in National Instrument 43-101.

About iMetal Resources Inc.

iMetal is a Canadian based junior exploration company focused on the exploration and development of its portfolio of resource properties in Ontario and Quebec. One of its Flagship properties Gowganda West, is an exploration-stage gold project that borders the Juby Deposit and is located within the Shining Tree Camp area in the southern part of the Abitibi Greenstone Gold Belt about 100 km south-southeast of the Timmins Gold Camp. The 665-hectare Kerrs Gold deposit comprises a series of gold-bearing pyritized quartz vein replacement breccias with a 2011 historic resource, 90 kilometres ENE of Timmins. The 220-hectare Ghost Mountain property, 42 kilometres NE of Kirkland Lake, lies 5 kilometres W of Agnico Eagle's Holt and Holloway Mine.

ON BEHALF OF THE BOARD OF DIRECTORS,

Saf Dhillon

President & CEO

iMetal Resources Inc.

info@imetalresources.ca

Tel. (604-484-3031)

Suite 550, 800 West Pender Street, Vancouver, British Columbia, V6C 2V6.

https://imetalresources.ca

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This news release may include forward-looking statements that are subject to risks and uncertainties. All statements within, other than statements of historical fact, are to be considered forward looking. Although the Company believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results or developments may differ materially from those in forward-looking statements. Factors that could cause actual results to differ materially from those in forward-looking statements include results of exploration, variations in results of mineralization, relationships with local communities, market prices, continued availability of capital and financing, and general economic, market or business conditions. There can be no assurances that such statements will prove accurate and, therefore, readers are advised to rely on their own evaluation of such uncertainties. We do not assume any obligation to update any forward-looking statements except as required under the applicable laws.

SOURCE: iMetal Resources, Inc.

View source version on accesswire.com:https://www.accesswire.com/739562/iMetal-Resources-Drone-Magnetics-Final-Interpretation-Received-for-Shining-Tree-Block-Near-Gowganda-West