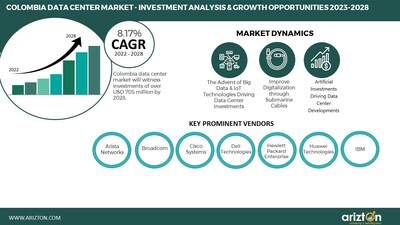

CHICAGO, Feb. 23, 2023 /PRNewswire/ -- According to Arizton's latest research report, the Colombia data center market will grow at a CAGR of 8.17% from 2022-2028. Colombia expects to invest significantly in data center development between 2023 and 2028. An increase in cloud migration, deployment of 5G technology, procurement of renewable energy, increase in submarine cable connectivity will increase investment opportunities. Retail colocation dominates the Colombia data center market by generating over 90% of revenue, followed by wholesale colocation. Colombia is likely to add around 628 thousand square feet of data center space between 2023 and 2028. Most data centers will be built by global colocation operators having a presence in the country.

Colombia Data Center Market Report Scope

Report Attributes | Details |

Market Size (2028) | USD 705 Million (2028) |

Market Size (Area) | 128 thousand sq. Feet (2028) |

Market Size (Power Capacity) | 26 MW (2028) |

CAGR Investment (2022-2028) | 8.17 % |

Historic Year | 2021-2022 |

Base Year | 2022 |

Forecast Year | 2023-2028 |

Market Dynamics | ·Improved Digitalization through Submarine Cables ·The Advent of Big Data & IoT Technologies Driving Data Center Investments |

Page Number | 95 |

Key Leading Vendors | IT Infrastructure Providers: Arista Networks, Broadcom, Cisco Systems, Dell Technologies, Hewlett Packard Enterprise, Huawei Technologies, IBM, Lenovo, and Pure Storage Data Center Construction Contractors & Sub-Contractors: AECOM, Fluor Corporation, ZFB Group, and Quark Support Infrastructure Providers: ABB, Alfa Laval, Armstrong Ceiling Solutions, Assa Abloy, Caterpillar, Cummins, Delta Electronics, Daikin Applied, Eaton, Flex, Generac Power Systems, Johnson Controls, Legrand, Mitsubishi Electric, Piller Power Systems, Rittal, Schneider Electric, Stulz, Siemens, and Vertiv Data Center Investors: Equinix, GlobeNet, HostDime, IPXON Networks, and ODATA New Entrants: Ascenty, DHAmericas, and Scala Data Centers |

Customization Available | If our report does not include the information you are searching for, you may contact us to have a report tailored to your specific business needs https://www.arizton.com/customize-report/3730 |

Click Here to Download the Free Sample Report

Market Insights

- The ongoing digital transformation and adoption of technologies such as big data, IoT, AI & ML by organizations in the country are driving huge investments from local and global colocation operators in the Colombia data center market.

- The capital Bogota hosts the maximum number of data centers in the country. The city has around 80% of Colombia's total existing data center capacity. The capital provides high-bandwidth capacity while great connectivity to the countries such as the U.S., making it a prominent location for data center investments.

- The country has a presence of colocation providers of both local and global scales, such as ODATA, HostDime, GlobeNet, and Equinix, among others. In 2022, Colombia witnessed the entry of many new operators, including DHAmericas, Scala Data Centers, and Ascenty.

- There is significant scope for 5G in Colombia. The increasing deployment of fiber optics is a prominent driver for implementing 5G services in the country. Currently, 5G is in the testing phase in the country, which will eventually drive edge data center deployments.

- The regional operators are procuring renewable energy for their operations. For instance, Scala Data Centers signed a PPA with Enel Americas for delivering 1.6 GW of renewable power in its data centers across Colombia, Chile, & Peru.

Why Should You Buy This Research?

- Market size available in the investment, area, power capacity, and Colombia colocation market revenue.

- An assessment of the data center investment in Colombia by colocation, hyperscale, and enterprise operators.

- Investments in the area (square feet) and power capacity (MW) across states in the country.

- A detailed study of the existing Colombia data center market landscape, an in-depth industry analysis, and insightful predictions about industry size during the forecast period.

- Snapshot of existing and upcoming third-party data center facilities in Colombia

- Facilities Covered (Existing): 19

- Facilities Identified (Upcoming): 5

- Coverage: 04+ Locations

- Existing vs. Upcoming (Area)

- Existing vs. Upcoming (IT Load Capacity)

- Data center colocation market in Colombia

- Colocation Market Revenue & Forecast (2022-2028)

- Wholesale vs. Retail Colocation Revenue (2022-2028)

- Retail Colocation Pricing

- Wholesale Colocation Pricing

- Colombia's market investments are classified into IT, power, cooling, and general construction services with sizing and forecast.

- A comprehensive analysis of the latest trends, growth rate, potential opportunities, growth restraints, and prospects for the industry.

- Business overview and product offerings of prominent IT infrastructure providers, construction contractors, support infrastructure providers, and investors operating in the industry.

- A transparent research methodology and the analysis of the demand and supply aspects of the industry.

The report includes the investment in the following areas:

- IT Infrastructure

- Servers

- Storage Systems

- Network Infrastructure

- Electrical Infrastructure

- UPS Systems

- Generators

- Switches & Switchgears

- PDUs

- Other Electrical Infrastructure

- Mechanical Infrastructure

- Cooling Systems

- Rack Cabinets

- Other Mechanical Infrastructure

- Cooling Systems

- CRAC & CRAH Units

- Chiller Units

- Cooling Towers, Condensers & Dry Coolers

- Economizers & Evaporative Coolers

- Other Cooling Units

- General Construction

- Core & Shell Development

- Installation & commissioning Services

- Engineering & Building Design

- Fire Detection & Suppression Systems

- Physical Security

- Data Center Infrastructure Management (DCIM)

- Tier Standard

- Tier I & Tier II

- Tier III

- Tier IV

Major Vendors

IT Infrastructure Providers

- Arista Networks

- Broadcom

- Cisco Systems

- Dell Technologies

- Hewlett Packard Enterprise

- Huawei Technologies

- IBM

- Lenovo

- Pure Storage

Data Center Construction Contractors & Sub-Contractors

- AECOM

- Fluor Corporation

- ZFB Group

- Quark

Support Infrastructure Providers

- ABB

- Alfa Laval

- Armstrong Ceiling Solutions

- Assa Abloy

- Caterpillar

- Cummins

- Delta Electronics

- Daikin Applied

- Eaton

- Flex

- Generac Power Systems

- Johnson Controls

- Legrand

- Mitsubishi Electric

- Piller Power Systems

- Rittal

- Schneider Electric

- Stulz

- Siemens

- Vertiv

Data Center Investors

- Equinix

- GlobeNet

- HostDime

- IPXON Networks

- ODATA

New Entrants

- Ascenty

- DHAmericas

- Scala Data Centers

Click Here to Download the Free Sample Report

Check Out Some of the Top-Selling Research Related Reports:

Brazil Data Center Market - Investment Analysis & Growth Opportunities 2023-2028: The Brazil data center market is expected to reach USD 4.43 billion by 2028, growing at a CAGR of 8.26% from 2022-2028. Brazil contributes around 50% of data center investments in the Latin American region. In Brazil, São Paulo is the most connected city, with the high availability of digital business and financial centers in the country, making the city a favorable location for facility development.

Mexico Data Center Market - Investment Analysis & Growth Opportunities 2022-2027: Mexico data center market is projected to reach USD 1,082 million by 2027, growing at a CAGR of 9.37% during 2022-2027. Mexico is one of the leading data center markets among Latin American countries. Querétaro is the primary location in Mexico for the development of colocation data center facilities, hyperscale facilities, and cloud regions.

Chile Data Center Market - Investment Analysis & Growth Opportunities 2022-2027: Chile data center market size will witness investments of USD 617 million by 2027, growing at a CAGR of 5.84% during 2021-2027. Cloud adoption is driving demand across data centers in Chile. Cloud service providers such as Microsoft, Huawei Technologies, Google, and Oracle are operating/developing cloud regions in Chile.

Latin America Data Center Market - Industry Outlook & Forecast 2022-2027: Latin America data center market will witness investments of USD 9.11 billion by 2027, growing at a CAGR of 7.13% during 2022-2027. Latin America's data center market has been attracting significant investments in recent years, led by countries such as Brazil, Chile, Colombia, Mexico, Bolivia, And Argentina.

Table of Content

Chapter 1: Existing & Upcoming Third-Party Data Centers In Colombia

- Historical Market Scenario

- 19+ Unique Data Center Properties

- Data Center IT Load Capacity

- Data Center White Floor Area Space

- Existing Vs Upcoming Data Center Capacity by Cities

- Cities Covered

- Bogota

o Other Cities

· List of Upcoming Data Center Facilities

Chapter 2: Investment Opportunities in Colombia

· Microeconomic and Macroeconomic factors of the Colombia Market

- Data Center Investments

- Investment by Area

- Investment by Power Capacity

Chapter 3: Data Center Colocation Market in Colombia

- Colocation Services Market in Colombia

- Retail vs Wholesale Data Center Colocation

· Colocation Pricing (Quarter Rack, Half Rack, Full Rack) & Add-ons

Chapter 4: Market Dynamics

- Market Drivers

- Market Trends

- Market Restraints

Chapter 5: Market Segmentation

- IT Infrastructure: Market Size & Forecast

- Electrical Infrastructure: Market Size & Forecast

- Mechanical Infrastructure: Market Size & Forecast

- General Construction Services: Market Size & Forecast

Chapter 6: Tier Standard Investment

- Tier I & II

- Tier III

- Tier IV

Chapter 7: Key Market Participants

- IT Infrastructure Providers

- Construction Contractors

- Support Infrastructure Providers

- Data Center Investors

- New Entrants

Chapter 8: Appendix

- Market Derivation

- Quantitative Summary

About Us:??

Arizton Advisory and Intelligence is an innovative and quality-driven firm that offers cutting-edge research solutions to clients worldwide. We excel in providing comprehensive market intelligence reports and advisory and consulting services.

We offer comprehensive market research reports on consumer goods & retail technology, automotive and mobility, smart tech, healthcare, life sciences, industrial machinery, chemicals, materials, I.T. and media, logistics, and packaging. These reports contain detailed industry analysis, market size, share, growth drivers, and trend forecasts.?

Arizton comprises a team of exuberant and well-experienced analysts who have mastered generating incisive reports. Our specialist analysts possess exemplary skills in market research. We train our team in advanced research practices, techniques, and ethics to outperform in fabricating impregnable research reports.?

Click Here to Contact Us?

Call: +1-312-235-2040?

?????? ??? +1 302 469 0707?

Mail: enquiry@arizton.com

Photo: https://mma.prnewswire.com/media/2008668/Colombia_Data_Center_Market.jpg

Logo: https://mma.prnewswire.com/media/818553/Arizton_Logo.jpg

![]() View original content:https://www.prnewswire.co.uk/news-releases/colombia-data-center-market-investment-to-reach-705-million-in-2028-colombia-is-likely-to-add-around-628-thousand-sq-ft-of-data-center-space-between-2023--2028--arizton-301754487.html

View original content:https://www.prnewswire.co.uk/news-releases/colombia-data-center-market-investment-to-reach-705-million-in-2028-colombia-is-likely-to-add-around-628-thousand-sq-ft-of-data-center-space-between-2023--2028--arizton-301754487.html