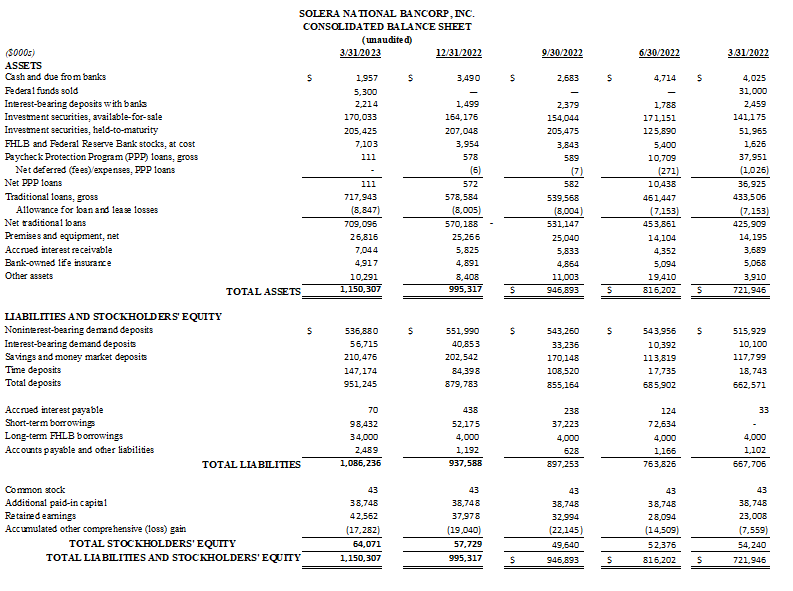

Solera increases deposits $71 million from 12/31/2022.

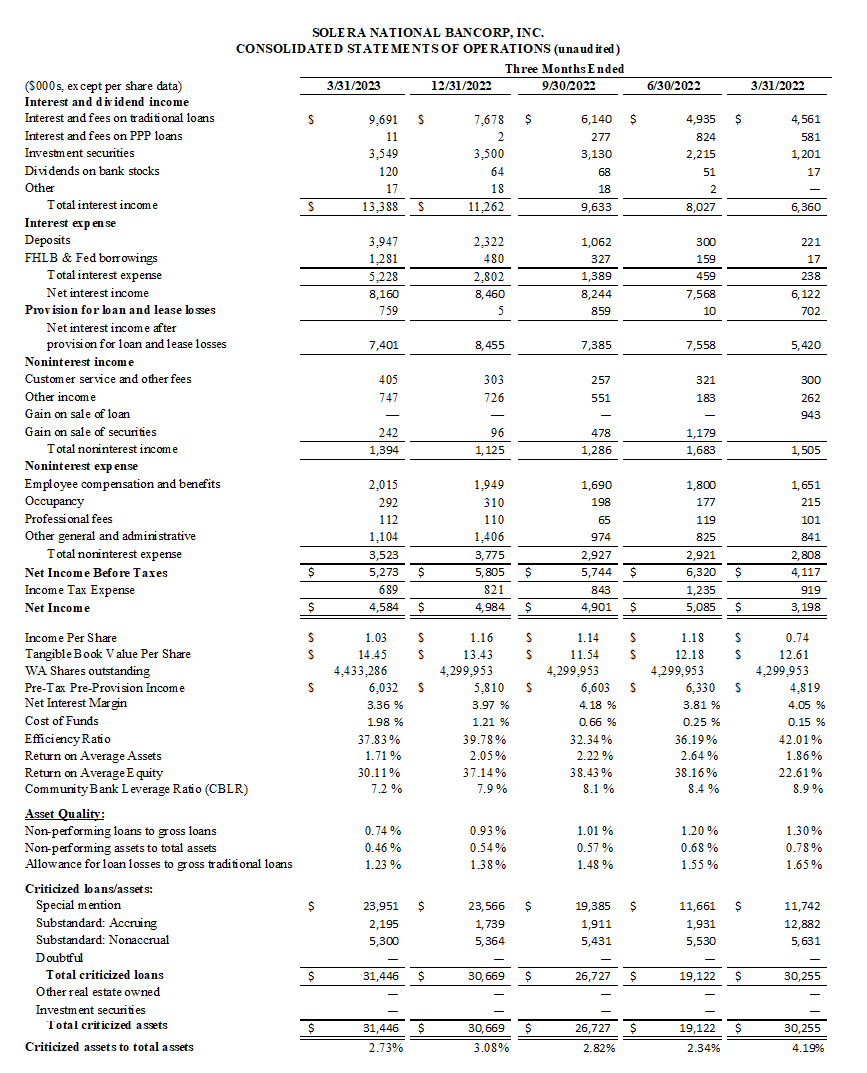

LAKEWOOD, CO / ACCESSWIRE / April 28, 2023 / Solera National Bancorp, Inc. (OTC PINK:SLRK) ("Company"), the holding company for Solera National Bank ("Bank"), a business-focused bank located in the Denver metropolitan area, today reported financial results for the three months ended March 31, 2023. For the first quarter of 2023, net income was $4.6 million ($1.03 per share), up 43% vs Q1 2022.

1Q23 Financial Highlights

(Comparison to 1Q22 unless otherwise noted)

- The Company had record pre-tax and pre-provision earnings of $6.1 million in the first quarter of 2023 compared to $4.8 million in the first quarter of 2022.

- Total assets were $1.2 billion.

- Efficiency ratio was 37.83% vs 42.01%.

- Return on equity increased to 30.11% vs 22.61%.

- ALLL remained strong at 1.23% including CECL and a loan pool purchase. Q1 2023 provision was $759 thousand.

Michael Quagliano, Executive Chairman of the Board, commented: "We have 25,000 deposit accounts with an average balance of $32,000 - all fully covered under FDIC insurance - that makes me sleep well at night. We built this bank to be extremely profitable in an 'up interest rate environment or 'down' interest rate environment. Current economic conditions have fully tested this theory, which I am proud to state has been an immense success. I am honored to be associated with Solera National Bank!"

Steve Snailum, COO, commented: "Our initiatives to improve efficiency, maximize security, and effectively manage risk have continued to help the bank achieve tremendous financial and customer outcomes. The employees at Solera continue to be our biggest competitive advantage. We are proud of our culture and our staff's constant commitment to making a positive difference every day."

Kreighton Reed, EVP, commented: "We exceeded expectations…AGAIN!"

Tim Pester, Controller, commented: "After a trying and unpredictable quarter in the financial sector, Solera National Bank is delighted to announce another strong quarter for income and returns on both equity and assets. Although the financial industry experienced unease in the market, Solera was prepared and ready for the uncertainty by increasing liquidity reserves and adding stable deposits. While protecting ourselves, we continue to see strong profitability now and in the future. This is once again, thanks to the hard and tireless work of the incredible Solera Team."

Jay Hansen, CFO, commented: "I am very excited to be a part of this amazing team and I believe my strong banking background will help continue the outstanding growth the Solera team has achieved. Solera's ROA and efficiency ratio are among the best in the banking industry. We are doing banking differently and other banks are starting to notice."

About Solera National Bancorp, Inc.

Solera National Bancorp, Inc. was incorporated in 2006 to organize and serve as the holding company for Solera National Bank, which opened for business in September 2007. Solera National Bank is a community bank serving the needs of emerging businesses and real estate investors. At the core of Solera National Bank is welcoming, attentive, and respectful customer service, a focus on supporting a growing and diverse economy, and a passion to serve our community through service, education, and volunteerism. For more information, please visit http://www.SoleraBank.com.

This press release contains statements that may constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. The statements contained in this release, which are not historical facts and that relate to future plans or projected results of Solera National Bancorp, Inc. and its wholly-owned subsidiary, Solera National Bank, are forward-looking statements. These forward-looking statements are subject to risks and uncertainties that could cause actual results to differ materially from those projected, anticipated, or implied. We undertake no obligation to update or revise any forward-looking statement. Readers of this release are cautioned not to put undue reliance on forward-looking statements.

Contacts:

Jay Hansen,

CFO

(303) 209-8600

FINANCIAL TABLES FOLLOW

SOURCE: Solera National Bank

View source version on accesswire.com:https://www.accesswire.com/751994/Solera-National-Bancorp-Announces-First-Quarter-2023-Financial-Results