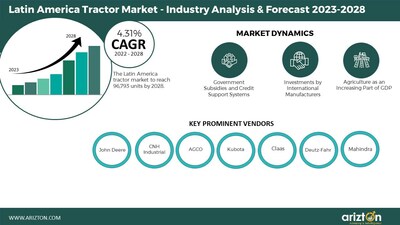

CHICAGO, May 17, 2023 /PRNewswire/ -- According to Arizton's latest research report, the Latin America tractor market will grow at a CAGR of 4.31% during 2022-2028

To Know More, Download the Free Sample Report: https://www.arizton.com/request-sample/3798

Browse In-Depth TOC on the Latin America Tractor Market???????

54 - Tables?????

68 - Charts????????

164 - Pages?

Agriculture equipment and machinery manufacturers are also increasingly entering the precision agriculture vertical. John Deere, one of the leading vendors in the Latin America tractor market, acquired Blue River. Blue River is a leading vendor of machine learning-based agriculture equipment. It manufactures intelligent spray systems that distinguish between crop plants and unwanted weeds and enables farmers and farm managers to reduce herbicide expenses and grow healthier crops.

A new frontier of innovation emerged as agriculture met digital technology, opening various paths to a smart agricultural future. Tractor manufacturers are competitive, and companies constantly strive to innovate and ensure product differentiation at affordable prices. State-of-the-art technology-based tractors are currently available in the market. GPS and remote sensing make farming more accurate and productive.

Governments must adopt efficient and sustainable farming practices to ensure food security and safety. Precision agriculture is practiced by developed nations to boost productivity. At the same time, developing nations still have a low level of agricultural mechanization. Crops are grown using the management concept of precision farming in accordance with the requirements of the soil. The emphasis on agricultural mechanization will boost demand for tractors and the sense of accuracy in farming in Latin America using cutting-edge tractors.

Latin America Tractor Market Report Scope

Report Scope | Details |

Market Size (2028) | 96,793 Units |

Market Size (2022) | 75,128 Units |

CAGR (2022-2028) | 4.31 % |

Historic Year | 2020-2021 |

Base Year | 2022 |

Forecast Year | 2023-2028 |

Market Segmentation | Horsepower, Drive Type, and Geography |

Largest Segment by Horsepower | 50 HP-100 HP |

Largest Segment by Drive Type | 2-Wheel Drive |

Largest Segment by Geography | Brazil |

Market Dynamics | ·Government Subsidies and Credit Support Systems ·Investments by International Manufacturers ·Agriculture as an Increasing Part of GDP ·Increased Farm Mechanization |

Looking for More Information? Download the Free Sample Report: https://www.arizton.com/request-sample/3798

Brazilian tractor sales are estimated to reach more than 46k units by 2028 with the increased demand for food production. For Brazilian governments, food self-sufficiency is the key agenda due to the decline in arable land due to urbanization, exploitation of natural resources, and a massive shift in food production and consumption patterns.

Climatic changes, which include increasing incidences of droughts, flash floods, unpredictable rainfall, and temperatures, are wreaking further havoc on the stressed agricultural output. In addition, human-driven factors such as the encroachment of forest land, indiscriminate water consumption and wastage, and unscientific use of pesticides and fertilizers to achieve short-term productivity are additional constraints to the agricultural value chain.

Mechanized feedlots typically characterize the agricultural scenario in Brazil to automatic irrigation systems and agricultural machinery. As the demand for food and associated resources from the Latin American largest economy rises, there has been a tremendous rise in input resources, such as the use of farm machinery to improve productivity and efficiency. Also, the agriculture sector in Brazil is typically marked by a tremendous decline in the labor force, a consistent rise in productivity, and the consolidation of smaller farms into medium and larger ones.

Investments by International Manufacturers Driving the Market Growth

The business of domestic tractor manufacturers took a hit due to instability in governments and fluctuation in currencies, inflation, and closed markets. Domestic manufacturers manufacture tractors and other related machinery according to the need and use of farmers. Tractors and other related agricultural machinery perform regular and mundane field tasks. However, these machines are less efficient than those in developed countries, such as the US, Germany, France, and Italy, which are technologically advanced. The entry of international vendors, such as John Deere, and AGCO, changed the outlook of the tractor industry in Latin American countries. Farmers now have the option to choose products that fulfill their needs to the maximum. Small farmers can choose lower HP tractors, and large agriculture corporations can easily opt for higher HP tractors. International vendors that invested in Latin America brought their expertise to agriculture equipment. These players utilized their global presence and capabilities to invest in R&D to develop innovative farming activities. Thereby boosting the adoption of tractors in the market.

Buy the Report Now: https://www.arizton.com/market-reports/latin-america-tractor-market-size-share-growth-analysis

Post-Purchase Benefit

- 1hr of free analyst discussion

- 10% of customization

Recent Developments in The Latin America Tractor Market:

- In March 2022, John Deere launched the new electric variable transmission (EVT) for select 8 Series Tractors and a new JD14X engine for 9 Series.

- CNH Industrial partnered with Monarch Tractors in March 2021, a US-based agri-technology company, to improve long-term sustainability and raise awareness of the importance of zero-emission agriculture among farmers.

- In February 2022, New Holland North America, CNH industrial brand, announced the launch of the world's first production T6 Methane Power tractor in the US.

Why Should You Buy This Report?

This report is among the few in the market that offer outlook and opportunity analyses forecast in terms of:

- Market Size & Forecast Volume (Units) 2020-2028

- Segmentation by Horsepower

- Segmentation by Wheel Drive

- Segmentation by Geography

- Production and trade values

- Major current and upcoming projects and investments

- Competitive intelligence about the economic scenario, advantages in Latin America, industry dynamics, and market shares

- Latest and innovative technologies

- COVID-19 impact analysis of the industry

- Company profiles of major and other prominent vendors

- Market shares of major vendors

Key Company Profiles

- John Deere

- CNH Industrial

- AGCO

- Kubota

- Claas

- Deutz-Fahr

- Mahindra

- KIOTI

- Yanmar

Market Segmentation

Horsepower

- Less Than 50 HP

- 50 HP-100 HP

- Above 100 HP

Wheel Drive

- 2-Wheel-Drive

- 4-Wheel-Drive

Geography

- Brazil

- Mexico

- Argentina

- Colombia

- Peru

- Others

Check Out Some of the Top Selling Research Reports:

North America Tractor Market - Industry Analysis & Forecast 2023-2028: The North America agricultural tractor market to reach 391,799 units by 2028, growing at a CAGR of 4.43% during the forecast period.

Spain Tractor Market - Industry Analysis & Forecast 2022-2028: The Spain tractor market to reach 14,411 units by 2028, growing at a CAGR of 4.13% in the upcoming years.

Canada Tractors Market - Industry Analysis & Forecast 2022-2028: Canada tractor market to reach 43,766 units by 2028, growing at a CAGR of 3.91%.

Mexico Tractors Market - Industry Analysis & Forecast 2022-2028: Mexico tractors market will grow exponentially with a CAGR of 3.79%, reaching 14,058 units by 2028.

Table of Content

1 RESEARCH METHODOLOGY

2 RESEARCH OBJECTIVES

3 RESEARCH PROCESS

4 SCOPE & COVERAGE

4.1 MARKET DEFINITION

4.1.1 INCLUSIONS

4.1.2 EXCLUSIONS

4.1.3 MARKET ESTIMATION CAVEATS

4.2 BASE YEAR

4.3 SCOPE OF THE STUDY

5 REPORT ASSUMPTIONS & CAVEATS

5.1 KEY CAVEATS

5.2 CURRENCY CONVERSION

5.3 MARKET DERIVATION

6 MARKET AT A GLANCE

7 PREMIUM INSIGHTS

8 INTRODUCTION

8.1 OVERVIEW

8.1 VALUE CHAIN ANALYSIS

8.1.1 OVERVIEW

8.1.2 RAW MATERIAL & COMPONENT SUPPLIERS

8.1.3 MANUFACTURERS

8.1.4 DEALERS/DISTRIBUTORS

8.1.5 RETAILERS

8.1.6 END-USERS

8.2 TECHNOLOGICAL ADVANCES

9 MARKET OPPORTUNITIES & TRENDS

9.1 INCREASED FOCUS ON SMART & AUTONOMOUS TRACTORS

9.1.1 SWATH CONTROL AND VARIABLE RATE TECHNOLOGY (VRT)

9.1.2 HIGH DEMAND FOR AUTONOMOUS EQUIPMENT

9.2 SHORTAGE OF AGRICULTURAL LABORERS

9.3 PROSPECTS OF PRECISION FARMING

10 MARKET GROWTH ENABLERS

10.1 GOVERNMENT SUBSIDIES & CREDIT SUPPORT SYSTEMS

10.2 INVESTMENTS BY INTERNATIONAL MANUFACTURERS

10.3 GDP CONTRIBUTION OF AGRICULTURAL SECTOR

10.4 INCREASED FARM MECHANIZATION

11 MARKET RESTRAINTS

11.1 HIGH DEMAND FOR USED & RENTAL TRACTORS

11.2 UNFAVORABLE WEATHER CONDITIONS

11.3 LACK OF AWARENESS OF LATEST INNOVATIONS IN AGRICULTURAL TRACTORS

12 MARKET LANDSCAPE

12.1 MARKET OVERVIEW

12.2 MARKET SIZE & FORECAST

12.3 FIVE FORCES ANALYSIS

12.3.1 THREAT OF NEW ENTRANTS

12.3.2 BARGAINING POWER OF SUPPLIERS

12.3.3 BARGAINING POWER OF BUYERS

12.3.4 THREAT OF SUBSTITUTES

12.3.5 COMPETITIVE RIVALRY

13 HORSEPOWER

13.1 MARKET SNAPSHOT & GROWTH ENGINE

13.2 MARKET OVERVIEW

13.3 LESS THAN 50 HP

13.3.1 MARKET OVERVIEW

13.3.2 MARKET SIZE & FORECAST

13.3.3 MARKET BY COUNTRY

13.4 50-100 HP

13.4.1 MARKET OVERVIEW

13.4.2 MARKET SIZE & FORECAST

13.4.3 MARKET BY COUNTRY

13.5 ABOVE 100 HP

13.5.1 MARKET OVERVIEW

13.5.2 MARKET SIZE & FORECAST

13.5.3 MARKET BY COUNTRY

14 DRIVE TYPE

14.1 MARKET SNAPSHOT & GROWTH ENGINE

14.2 MARKET OVERVIEW

14.3 2-WHEEL DRIVE

14.3.1 MARKET OVERVIEW

14.3.2 MARKET SIZE & FORECAST

14.3.3 MARKET BY COUNTRY

14.4 4-WHEEL DRIVE

14.4.1 MARKET OVERVIEW

14.4.2 MARKET SIZE & FORECAST

14.4.3 MARKET BY COUNTRY

15 COUNTRY

15.1 MARKET SNAPSHOT & GROWTH ENGINE

15.2 OVERVIEW

15.3 BRAZIL

15.3.1 MARKET OVERVIEW

15.3.2 MARKET SIZE & FORECAST

15.3.3 MARKET BY HORSEPOWER

15.3.4 MARKET BY DRIVE TYPE

15.4 MEXICO

15.4.1 MARKET OVERVIEW

15.4.2 MARKET SIZE & FORECAST

15.4.3 MARKET BY HORSEPOWER

15.4.4 MARKET BY DRIVE TYPE

15.5 ARGENTINA

15.5.1 MARKET OVERVIEW

15.5.2 MARKET SIZE & FORECAST

15.5.3 MARKET BY HORSEPOWER

15.5.4 MARKET BY DRIVE TYPE

15.6 COLOMBIA

15.6.1 MARKET OVERVIEW

15.6.2 MARKET SIZE & FORECAST

15.6.3 MARKET BY HORSEPOWER

15.6.4 MARKET BY DRIVE TYPE

15.7 PERU

15.7.1 MARKET OVERVIEW

15.7.2 MARKET SIZE & FORECAST

15.7.3 MARKET BY HORSEPOWER

15.7.4 MARKET BY DRIVE TYPE

15.8 OTHERS

15.8.1 MARKET OVERVIEW

15.8.2 MARKET SIZE & FORECAST

15.8.3 MARKET BY HORSEPOWER

15.8.4 MARKET BY DRIVE TYPE

16 COMPETITIVE LANDSCAPE

16.1 COMPETITION OVERVIEW

16.1.1 MARKETING & PROMOTIONAL ACTIVITIES

16.1.2 RECENT DEVELOPMENTS BY TOP BRANDS

17 KEY COMPANY PROFILES

17.1 JOHN DEERE

17.1.1 BUSINESS OVERVIEW

17.1.2 PRODUCT OFFERINGS

17.1.3 KEY STRATEGIES

17.1.4 KEY STRENGTHS

17.1.5 KEY OPPORTUNITIES

17.2 CNH INDUSTRIAL

17.3 AGCO

17.4 KUBOTA

18 OTHER PROMINENT VENDORS

18.1 CLAAS

18.1.1 BUSINESS OVERVIEW

18.1.2 PRODUCT OFFERINGS

18.2 DEUTZ-FAHR

18.3 MAHINDRA

18.4 KIOTI

18.5 YANMAR

19 REPORT SUMMARY

19.1 KEY TAKEAWAYS

19.2 STRATEGIC RECOMMENDATIONS

20 QUANTITATIVE SUMMARY

20.1 MARKET BY COUNTRY

20.2 MARKET BY HORSEPOWER

20.3 MARKET BY DRIVE TYPE

21 APPENDIX

21.1 ABBREVIATIONS

About?Us:? ???????

Arizton Advisory and Intelligence is an innovative and quality-driven firm that offers cutting-edge research solutions to clients worldwide. We excel in providing comprehensive market intelligence reports and advisory and consulting services.??????????????

We offer comprehensive market research reports on consumer goods & retail technology, automotive and mobility, smart tech, healthcare, life sciences, industrial machinery, chemicals, materials, I.T. and media, logistics, and packaging. These reports contain detailed industry analysis, market size, share, growth drivers, and trend forecasts.??????????????

Arizton comprises a team of exuberant and well-experienced analysts who have mastered generating incisive reports. Our specialist analysts possess exemplary skills in market research. We train our team in advanced research practices, techniques, and ethics to outperform in fabricating impregnable research reports.??????????????

Contact Us:??? ????????

Call: +1-312-235-2040??????????????

?????????? +1 302 469 0707???????????????????

Mail:?enquiry@arizton.com?????????????????????

Contact Us:?https://www.arizton.com/contact-us?????????????????????

Blog:?https://www.arizton.com/blog?????????????????????

Website:?https://www.arizton.com/????????

Photo: https://mma.prnewswire.com/media/2079181/Latin_America_Tractor_Market.jpg

Logo: https://mma.prnewswire.com/media/818553/Arizton_Logo.jpg

![]() View original content:https://www.prnewswire.co.uk/news-releases/latin-america-to-witness-sales-of-more-than-96-700-units-of-tractors-in-the-next-6-years-entry-of-john-deere-and-agco-have-significantly-transformed-the-tractor-industry-in-latin-america---arizton-301827188.html

View original content:https://www.prnewswire.co.uk/news-releases/latin-america-to-witness-sales-of-more-than-96-700-units-of-tractors-in-the-next-6-years-entry-of-john-deere-and-agco-have-significantly-transformed-the-tractor-industry-in-latin-america---arizton-301827188.html