TORONTO, ON / ACCESSWIRE / May 18, 2023 / SPETZ INC. (the "Company" or "Spetz") (CSE:SPTZ)(OTC:DBKSF) today reported its financial results for the first quarter ended March 31, 2023 ("Q1 2023").

Highlights:

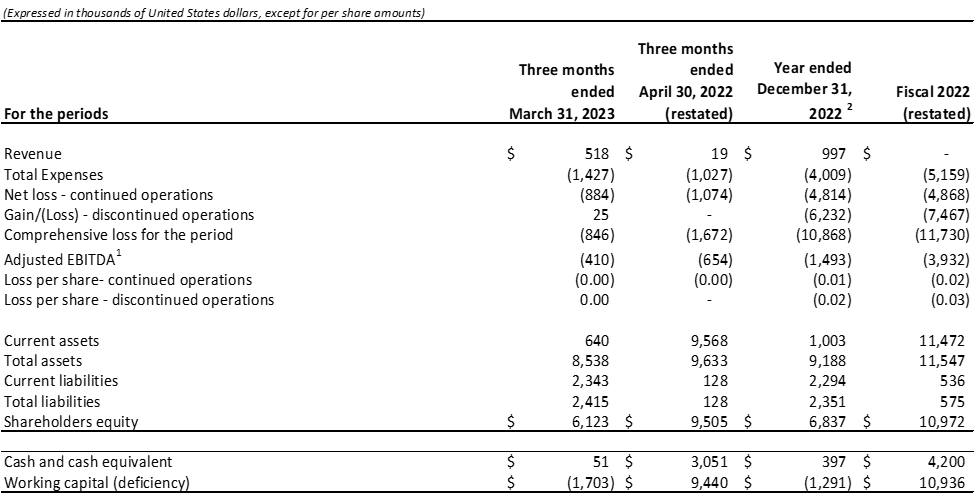

- Revenue increased by 2,726% to $518,000 for Q1 2023 compared to $19,000 in the three months ended April 30, 2022 ("Q1 2022"). The comparative period represents operations of DigiMax Global Inc. prior to the acquisition of Spetz Tech Ltd. on August 17, 2022, and subsequent focus on the current Spetz operations in the last quarter of 2022.

- Loss from continuing operations decreased by 17.6% to $884,000 for Q1 2023 compared to $1,074,000 in Q1 2022.

- Adjusted EBITDA loss, as defined in the management discussion and analysis, decreased by 37.3% to $410,000 for Q1 2023 from $654,000 in Q1 2022. The Company is actively reducing costs to achieve positive EBITDA as soon as possible.

The Company is fully committed to achieving positive cashflow as soon as possible as evidenced by reducing discretionary expenses and requesting certain consultants and the CEO being compensated in non-cash restricted share units.

Yossi Nevo, Spetz's CEO, commented: "We have decided to take 2023 and turn it into a year of efficiency, our intentions are to significantly decrease our expenses and increase our profitability, so we are focusing on the most profitable markets. We all know that it is not a favorable time, and the markets are challenging. We are determined to move forward and achieve our goals."

For full financial information, notes, and management commentary please refer to the Company's Management's Discussion and Analysis (MD&A) and Financial Statements posted on the Company's website and available on SEDAR. All financial information is provided in U.S. dollars, unless other indicated. In addition, all financial information provided herein is unaudited unless otherwise stated.

The comparative figures have been restated into US Dollars as the Company changed its reporting currency from Canadian dollars to US Dollars effective September 30, 2022.

About Spetz Inc.

Spetz is a multinational technology company that operates the Spetz application, a global, online, AI powered marketplace platform that dynamically connects consumers to nearby top-rated service providers in around 30 seconds. Spetz is available in the USA, United Kingdom, Australia, and Israel.

The Spetz vision is to reinvent how people around the world connect to services in their moment of need. Connecting them immediately with the top-matched service provider, for any need, anytime, anywhere.

For more information visit www.spetz.app.

Company Contact:

| Ofir Friedman | Daniel Mogil | |

| Director and Chief Marketing Officer | Investor Relations Manager | |

| ofir@spetz.app | Investors@spetz.app | |

| 437-826-4012 |

Cautionary Note Regarding Forward-looking Statements

NEITHER THE CANADIAN SECURITIES EXCHANGE, NOR THEIR REGULATION SERVICES PROVIDERS HAVE REVIEWED OR ACCEPT RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE

Certain information in this press release constitutes forward-looking statements under applicable securities laws. Any statements that are contained in this news release that are not statements of historical fact may be deemed to be forward-looking statements and are based on expectations, estimates and projections as at the date of this press release. Forward-looking statements are often identified by terms such as "may", "should", "anticipate", "plans" "expect", "potential", "believe", "intend" or negatives of these terms and similar expressions. In this press release, forward-looking statements relate, among other things, to: the ability of the Company to achieve positive cash flow and positive EBITDA in the near term or at all.

Forward-looking statements are based on certain assumptions. While the Company considers these assumptions to be reasonable based on information currently available, they are inherently subject to significant business, economic and competitive uncertainties and contingencies and they may prove to be incorrect. Such assumptions include, but are not limited to the Company's ability to continue to focus its energies on its operations, and the continued demand for the Company's services.

Forward-looking statements also necessarily involve known and unknown risks, including without limitation; risks associated with general economic conditions; increased competition in the mobile application and home-services market; and risks with respect the Company's ability to access sufficient capital and/or expand its business further, which may delay and/or render the Company incapable of achieving positive cash flow and positive EBITDA in the near term or at all.

Readers are cautioned that the foregoing is not exhaustive. Readers are further cautioned not to place undue reliance on forward-looking statements as there can be no assurance that the plans, intentions or expectations upon which they are placed will occur. Such information, although considered reasonable by management at the time of preparation, may prove to be incorrect and actual results may differ from those anticipated. Forward-looking statements are not guarantees of future performance. The purpose of forward-looking information is to provide the reader with a description of management's expectations, and such forward-looking information may not be appropriate for any other purpose. Except as required by law, the Company disclaims any obligation to update or revise any forward-looking statements, whether as a result of new information, events or otherwise. Forward-looking statements contained in this news release are made as to the date hereof and are expressly qualified by this cautionary statement. Except as required by law, the Company assumes no obligation to update the forward-looking statements of beliefs, opinions, projections, or other factors, should they change.

Cautionary Note Regarding Non-IFRS and other Financial Measures

In this document, the Company has used certain non-IFRS financial measures and supplementary financial measures to evaluate the performance of the Company. The terms "EBITDA" and "adjusted EBITDA", do not have any standardized meaning prescribed within IFRS and therefore may not be comparable to similar measures presented by other companies. Such measures should not be considered in isolation or as a substitute for measures of performance prepared in accordance with IFRS. "Adjusted EBITDA" is defined as adjusted earnings from operations, excluding depreciation and amortization Adjusted EBITDA in this draft relates to the change by the Company of their reporting currency to US Dollars as from Canadian dollars effective September 30, 2022.

SOURCE: Spetz Inc.

View source version on accesswire.com:https://www.accesswire.com/755909/Spetz-Announces-Results-from-First-Quarter-Ending-March-31-2023