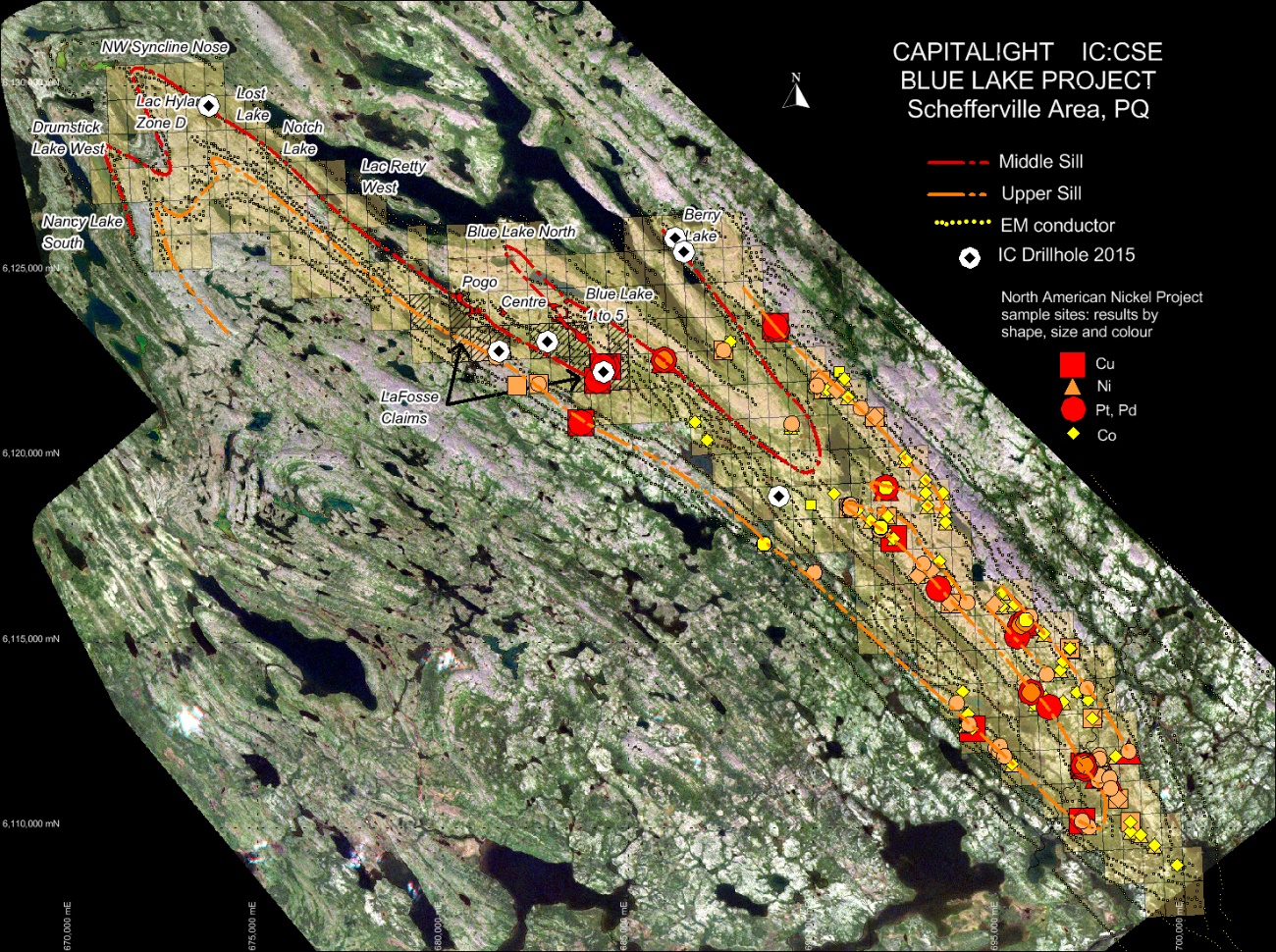

TORONTO, ON / ACCESSWIRE / May 19, 2023 / IC Capitalight Corp. (CSE:IC) ("Capitalight" or "the Company"), is pleased to announce it has acquired through purchase from a vendor and new staking, all of the mineral claims covering the historical resources on the former La Fosse Platinum Group special mining lease ("LaFosse Special Mining Leases"). The Blue Lake Property is 60km northeast of Schefferville, Quebec, and now consists of a group of 281 contiguous claims covering 13,834 hectares along a 37 km long by 3-to-5 km wide corridor on one of the most under explored and prospective Pt-Pd-Cu-Ni belts in Canada. Schefferville provides regional access including railroad to the port at Sept-Îles.

Following the dissolution of the La Fosse Special Mining Lease, the Company was awarded five fractional mineral claims and purchased 12 mineral claims from Mssrs. Gauthier and Scott in return for $45,000 cash, 1 million common shares of the Company, and a 1% Net Smelter Returns royalty that can be repurchased at any time for $1,000,000. The common shares will be subject to a 4-month hold period under applicable securities legislation.

The Company will now focus on establishing an exploration program for the Blue Lake Property.

Historical Resources and Exploration

The historical resources on the former LaFosse Special Mining Lease consist of nine sulfide deposits outlined by approximately 550 drill holes and underground bulk sampling between 1950 and 1988 and were estimated to be 4.03 million tons at 0.85% Cu, 0.52% Ni, 0.84g/t Pt+Pd (as reported by T. Clark, 1994, and Clark and Wares, 2005). Grades up to 4.03g/t Pt, 16.5g/t Pd, 2.94% Cu, and 0.12% Ni were noted.

Readers are cautioned that sufficient work has not been completed to classify the historical estimate as Mineral Resources or Mineral Reserves (as defined by the Canadian Institute of Mining, Metallurgy and Petroleum definition standards) and that the Company is not treating the historical estimate as current Mineral Resources or Mineral Reserves in accordance with National Instrument 43-101 standards. The economic viability of historical deposits such as these has not been established. The historical estimates are included herein only as an example of the type and grade potential of PGE mineralization within the Blue Lake Property area.

The Blue Lake Property includes several Pt-Pd-Cu-Ni showings (Lac Hyland, Lost Lake, Notch Lake, Nancy Lake South, Lac Retty West, Blue Lake North, Blue Lake 1 through 5, Pogo, Centre, and Berry Lake) that cover the mineralized "middle and upper peridotite sill" units. These sills were outlined through several surveys consisting of 2,377 l/km of VTEM and magnetic data flown for Anglo American Exploration Canada in 2011 (part of their former North American Nickel project claims which are now part of the Blue Lake Property) and 1,767 l/km of ProspecTEM and magnetic data flown by Capitalight (f/k/a Rockland Minerals) in 2010 plus ground mapping, rock and soil sampling, and limited drilling (collectively "the Surveys").

The Surveys show strong anomalous EM responses spatially associated with the target middle and upper peridotite sills. The highly conductive pyrite-pyrrhotite rich sulphide horizon occurring immediately below the middle peridotite unit, is thought to be related to the early stages of voluminous basaltic volcanism (Frarey, 1967; Rohon, 1989). This pyrite-pyrrhotite rich unit plays a key role in localizing Pt-Pd-Cu-Ni mineralization at the Blue Lake Property and marks a stratigraphic timeline that localizes some of the largest Cu-Ni ± PGE deposits in the northern Labrador Trough (Clark and Wares, 2005).

In 2015 the Company completed a work program consisting of 73 l/km of total field magnetic and VLF surveys, 1109 portable XRF bedrock assays and 7 diamond drill holes totaling 708 m. Six of the seven holes intersected the targeted conductors, and four intersected zones of strongly disseminated to massive magmatic sulphides. Significant Pt-Pd-Cu-Ni bearing mineralization was intersected in two holes. This work program evaluated only a small fraction of the 119 km of highly prospective Middle and Lower sill interpreted EM anomalies that have been outlined.

Scientific and technical information contained in this news release has been reviewed and approved by Douglas R. MacQuarrie, P.Geo. (B.C.) Geology & Geophysics, Director of IC Capitalight Corp., who is a "qualified person" under NI 43-101.

ABOUT IC CAPITALIGHT CORP.

The company is listed on the CSE under the symbol "IC." To learn more about the Company please visit http://www.capitalight.co

For further information contact: +1.866.653.9223 or info@capitalight.co

SOURCE: IC Capitalight Corp.

View source version on accesswire.com:https://www.accesswire.com/756004/Capitalight-Acquires-100-of-Blue-Lake-Pt-Pd-Cu-Ni-Historical-Resources-near-Schefferville-Quebec