MEMPHIS, TN / ACCESSWIRE / July 12, 2023 / BOK Financial Securities, Inc. (NASDAQ:BOKF) is enhancing its ability to serve the southeastern United States with the opening of a new office in Memphis, Tennessee. The office will be home to a 20-person team of experienced institutional sales officers, support staff and others.

"When this dynamic team is in place later this fall, we'll be better positioned to serve a part of the country that is seeing tremendous growth," said Scott Grauer, CEO of BOK Financial Securities and executive vice president of wealth management at BOK Financial. "We believe that our advice-driven, relationship-focused brand will be welcomed."

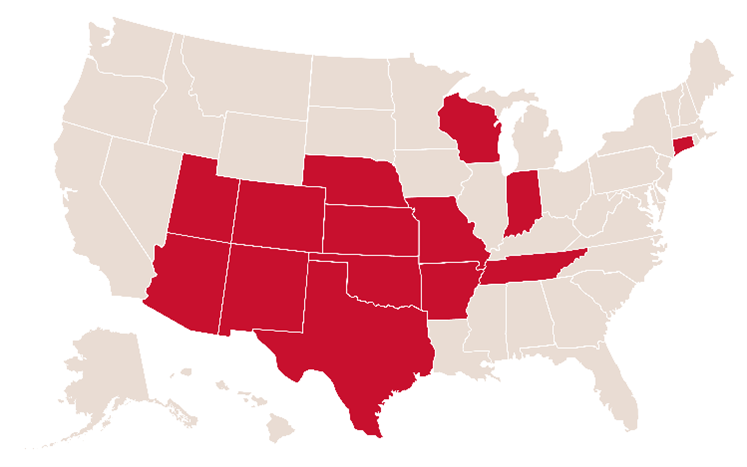

With more than 30 years in business, BOK Financial Securities offers a broad range of fixed-income portfolio management solutions as well as investment banking services. In 2022, the firm ranked 13th nationally for the number of municipal underwriting transactions. In addition to the new Memphis office, BOK Financial Securities serves clients nationwide from offices in Arizona, Arkansas, Colorado, Connecticut, Kansas, Nebraska, New Mexico, Oklahoma, Texas and Wisconsin.

BOK Financial Securities is a subsidiary of BOK Financial Corporation, a $46 billion regional financial services company with $102 billion in assets under management or administration. The company began offering wealth management services in 1918 and currently offers services ranging from specialty asset management and investment management to financial planning, insurance and trust services.

In June, the company announced plans to expand into San Antonio, Texas, leading with a focus on commercial, wealth and treasury banking services. The continued expansion is reflective of the company's disciplined growth focus, according to Stacy Kymes, president and CEO of BOK Financial.

"Although there has been some turbulence in the financial services industry this year, we believe the strength and stability of our franchise sets us apart," said Kymes. "We're pleased to welcome our Memphis team to BOK Financial and look forward to celebrating their success."

* * *

BOK Financial Corporation is a $46 billion regional financial services company headquartered in Tulsa, Oklahoma with $102 billion in assets under management or administration. The company's stock is publicly traded on NASDAQ under the Global Select market listings (BOKF). BOK Financial Corporation's holdings include BOKF, NA; BOK Financial Securities, Inc., BOK Financial Private Wealth, Inc. and BOK Financial Insurance, Inc. BOKF, NA's holdings include TransFund and Cavanal Hill Investment Management, Inc. BOKF, NA operates banking divisions across eight states as: Bank of Albuquerque; Bank of Oklahoma; Bank of Texas; and BOK Financial in Arizona, Arkansas, Colorado, Kansas and Missouri; as well as having limited purpose offices in Nebraska, Wisconsin and Connecticut. Through its subsidiaries, BOK Financial Corporation provides commercial and consumer banking, brokerage trading, investment, trust and insurance services, mortgage origination and servicing, and an electronic funds transfer network. For more information, visit www.bokf.com.

Contact:

Sue Hermann

Director, Corporate Communications

303-312-3488

SOURCE: BOK Financial Corp

View source version on accesswire.com:https://www.accesswire.com/767463/BOK-Financial-Securities-Expands-Operations-Into-Memphis