CHICAGO, Sept. 14, 2023 /PRNewswire/ -- Arizton publishes the latest research report on Brazil data center colocation market - supply and demand analysis 2023-2028 & Mexico data center colocation market - supply and demand analysis 2023-2028.

Brazil & Mexico Data Center Colocation Market Report Scope

Report Attributes | Details |

Brazil Market Size (Colocation Revenue) | USD 1.50 Billion (2028) |

CAGR (2022-2028) | 11.05 % |

Brazil Market Size (Utilized Racks) | 106,980 units (2028) |

Mexico Market Size (Colocation Revenue) | USD 550 Million (2028) |

Mexico Market Size (Utilized Racks) | 46,750 units (2028) |

CAGR (2022-2028) | 17.78 % |

Base Year | 2022 |

Forecast Year | 2023-2028 |

Brazil Data Center Colocation Market to Takes Center Stage in Latin America

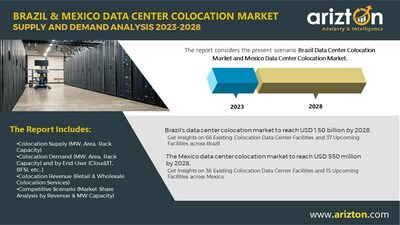

Brazil data center colocation market to reach USD 1.50 billion by 2028, growing at a CAGR of 11.05%. Get insights on 66 existing colocation data center facilities and 37 upcoming facilities across Brazil.

Brazil leads the Latin American region in terms of data center investments, bolstered by several key factors such as the rapid pace of digitalization, surging demand for data centers, and expanding connectivity.

Request for Free Sample Report Now: https://www.arizton.com/request-sample/3977

Global operators are adopting strategies like mergers and joint ventures to enter Brazil's data center colocation market. An example of this is Aligned Data Centers' recent acquisition of ODATA in May 2023. The growing demand for cloud storage is prompting cloud operators to invest in the Brazilian market, either by establishing new cloud regions or by establishing a presence in existing colocation data centers. Microsoft, for instance, announced plans in July 2023 to develop a data center in Sumare and Hortolandia, reflecting this trend. Moreover, Brazil is experiencing improvements in submarine connectivity. The country currently boasts approximately 15 operational submarine cables, and there is ongoing investment in an additional cable set to become operational in 2023.

Cloud Investment in Brazil

- In August 2023, Vultr, a cloud computing firm, announced the expansion of its capacity in the country by around 200%, along with the creation of a startup program for digital entrepreneurs.

- In July 2023, Microsoft announced plans for the development of a data center in Sumare and Hortolandia.

- In May 2023, China Telecom launched its first eSurfing cloud offering in the country through which enterprise in the country will be able to use latest cloud technologies.

- In August 2022, Sencinet collaborated with Nutanix to offer cloud services to its customers in Latin America, which includes Brazil. Sencinet provides its cloud services to its 400 customers in airlines, banks, retail, and essential services in Brazil.

Mexico Emerges as Latin America's Second Leading Data Center Colocation Hub with Robust Growth

The Mexico data center colocation market to reach USD 550 million by 2028, growing at a CAGR of 17.78%. Mexico has around 36 operational colocation data centers.

Get insights on 36 existing colocation data center facilities and 15 upcoming facilities across Mexico.

Request for Free Sample Report Now: https://www.arizton.com/request-sample/3976

Mexico has emerged as the second most prominent destination for data center development in the Latin American region. The country's strategic position makes it a crucial link connecting the United States with other Latin American nations. The expansion of the Mexico Data Center Colocation Market is being driven by sustained demand, which is supported by initiatives in digitalization, the entry of major cloud service providers, the deployment of 5G technology, the increased use of Big Data and IoT applications, among other contributing factors.

Mexico is currently experiencing significant advancements in submarine connectivity, boasting seven operational submarine cables and substantial investments in three additional cables scheduled for completion by 2026. The surging adoption of cloud-based services has attracted global cloud operators to establish dedicated cloud regions in Mexico. Notably, Google and Microsoft are actively engaged in developing new cloud regions expected to become operational by 2024.

Most of the colocation data centers in Mexico adhere to Tier III standards. The market features a diverse mix of both local and global operators, including prominent names such as KIO Networks, Ascenty (Digital Realty), TELMEX (Triara), México Telecom Partners (MTP), Equinix, ODATA (Aligned Data Centers), Nabiax (Actis), MetroCarrier, HostDime, and others. Global operators are employing mergers and joint venture strategies to enter the Mexican data center colocation market, as evidenced by Digital Realty's collaboration with Brookfield Infrastructure under the Ascenty brand. Moreover, Aligned Data Centers recently finalized its acquisition of ODATA in May 2023, underscoring the dynamic growth of Mexico's data center landscape.

Key Questions Answered in the Report:

- What is the count of existing and upcoming colocation data center facilities in Mexico?

- How much MW of IT power capacity is likely to be utilized in Mexico by 2028?

- What factors are driving the Mexico data center colocation market?

What's Included?

- A transparent research methodology and insights on the colocation demand and supply aspect of the market.

- Market size available in terms of utilized white floor area, IT power capacity, and racks.

- Market size available in terms of Full Build Vs Installed Vs Utilized IT Power Capacity along with the occupancy %.

- An assessment and snapshot of the colocation investment in Brazil & Mexico comparison between other countries in the Latin America region.

- The study of the existing Brazil & Mexico data center market landscape, and insightful predictions about Brazil & Mexico data center market size during the forecast period.

- An analysis of the current and future colocation demand in Brazil by several industries.

- The study on sustainability status in Brazil & Mexico.

- Analysis of current and future cloud operations in Brazil & Mexico

- The snapshot of upcoming submarine cables and existing cloud-on-ramps services in Brazil & Mexico

- Snapshot of existing and upcoming third-party data center facilities in Brazil & Mexico

- An analysis of the latest trends, potential opportunities, growth restraints, and prospects for the colocation data center industry in Brazil & Mexico.

- Competitive landscape including market share analysis by the colocation operators based on IT power capacity and revenue.

- The vendor landscape of each existing and upcoming colocation operator is based on the existing/ upcoming count of data centers, white floor area, IT power capacity, and data center location.

Target Audience

- Real Estate Investment Trusts (REIT)

- Construction Contractors

- Infrastructure Providers

- New Entrants

- Consultants/Consultancies/Advisory Firms

- Corporate & Governments Agencies

Check Out Some of the Top Selling Research Report:

Argentina Data Center Market - Investment Analysis & Growth Opportunities 2022-2027

Colombia Data Center Market - Investment Analysis & Growth Opportunities 2023-2028

Peru Data Center Market - Investment Analysis & Growth Opportunities 2022-2027

Latin America Data Center Market Landscape 2023-2028

Why Arizton?????

- 100%?Customer Satisfaction

- 24x7?availability - we are always there when you need us

- 200+?Fortune 500 Companies trust Arizton's report

- 80%?of our reports are exclusive and first in the industry

- 100%?more data and analysis

- 1500+?reports published till date

About?Us:???? ??????????????????

Arizton Advisory and Intelligence is an innovative and quality-driven firm that offers cutting-edge research solutions to clients worldwide. We excel in providing comprehensive market intelligence reports and advisory and consulting services.????????????????????????

We offer comprehensive market research reports on consumer goods & retail technology, automotive and mobility, smart tech, healthcare, life sciences, industrial machinery, chemicals, materials, I.T. and media, logistics, and packaging. These reports contain detailed industry analysis, market size, share, growth drivers, and trend forecasts.????????????????????????

Arizton comprises a team of exuberant and well-experienced analysts who have mastered generating incisive reports. Our specialist analysts possess exemplary skills in market research. We train our team in advanced research practices, techniques, and ethics to outperform in fabricating impregnable research reports.????????????????????????

Contact Us:?????? ??????????????????

Call: +1-312-235-2040??????????????????????????????

????????? +1 302 469 0707?????????????????????????????

Mail:?enquiry@arizton.com???????????????????????????????

Contact Us:?https://www.arizton.com/contact-us???????????????????????????????

Blog:?https://www.arizton.com/blog???????????????????????????????

Website:?https://www.arizton.com/?????????

Photo: https://mma.prnewswire.com/media/2210961/Brazil_Mexico_Data_Center__2022_2028.jpg

Logo: https://mma.prnewswire.com/media/818553/Arizton_Logo.jpg

![]() View original content:https://www.prnewswire.co.uk/news-releases/get-insights-on-brazil-data-center-colocation-demand--supply-and-mexico-data-center-colocation-demand--supply---arizton-301927876.html

View original content:https://www.prnewswire.co.uk/news-releases/get-insights-on-brazil-data-center-colocation-demand--supply-and-mexico-data-center-colocation-demand--supply---arizton-301927876.html