VANCOUVER, BC / ACCESSWIRE / October 27, 2023 / Foremost Lithium Resource & Technology Ltd. (NASDAQ:FMST)(CSE:FAT), a North American hard-rock lithium exploration firm, recently divulged the latest results from its rock sampling efforts on several properties. In particular, the Zoro and Jean Lake properties stood out, boasting high-grade lithium values and spodumene mineralization.

The rigorous surface exploration program encompassed four of Foremost's Lithium Lane properties located at the tip of the NAFTA superhighway: Peg North, Grass River Claims, Jean Lake and Zoro. All eyes were on the LCT (Lithium Cesium Tantalum) pegmatites during this initiative, managed by Dahrouge Geological Consulting Ltd. (DGC). Their concentrated efforts gravitated toward the high-priority targets at Zoro and Jean Lake Property, with assay values of up to 2.13% Li2O at the Zoro Property and 1.86% Li2O at the Jean Lake Property.

Foremost Lithium Recounts Exploration Results

Jason Barnard, President and CEO of Foremost Lithium, detailed the exploration results, stating, "The meticulous exploration, culminating in these promising results, is testament to Dahrouge's expertise in the field. We are steering our 2023 exploration with laser focus on our premium assets, fortified by the wealth of geological data at our disposal." Barnard went on to say, "Anticipating the forthcoming drill program, we are upbeat about outlining drill targets. We're committed to validating the potential of this rich terrain and ushering in groundbreaking results for our stakeholders."

Analytical Approach At SGS Laboratories

SGS Laboratories, located in Burnaby, handled the sample analysis. The company applied a comprehensive dissolution technique, leveraging sodium peroxide fusion, and finalized with an ICP-MS finish. This method stands as Foremost Lithium's hallmark approach for its Zoro and Jean Lake lithium projects. Assuring quality and accuracy, the company interspersed QAQC samples at a 5% rate, utilizing certified reference material along with quartz blanks.

Insight Into Zoro Property

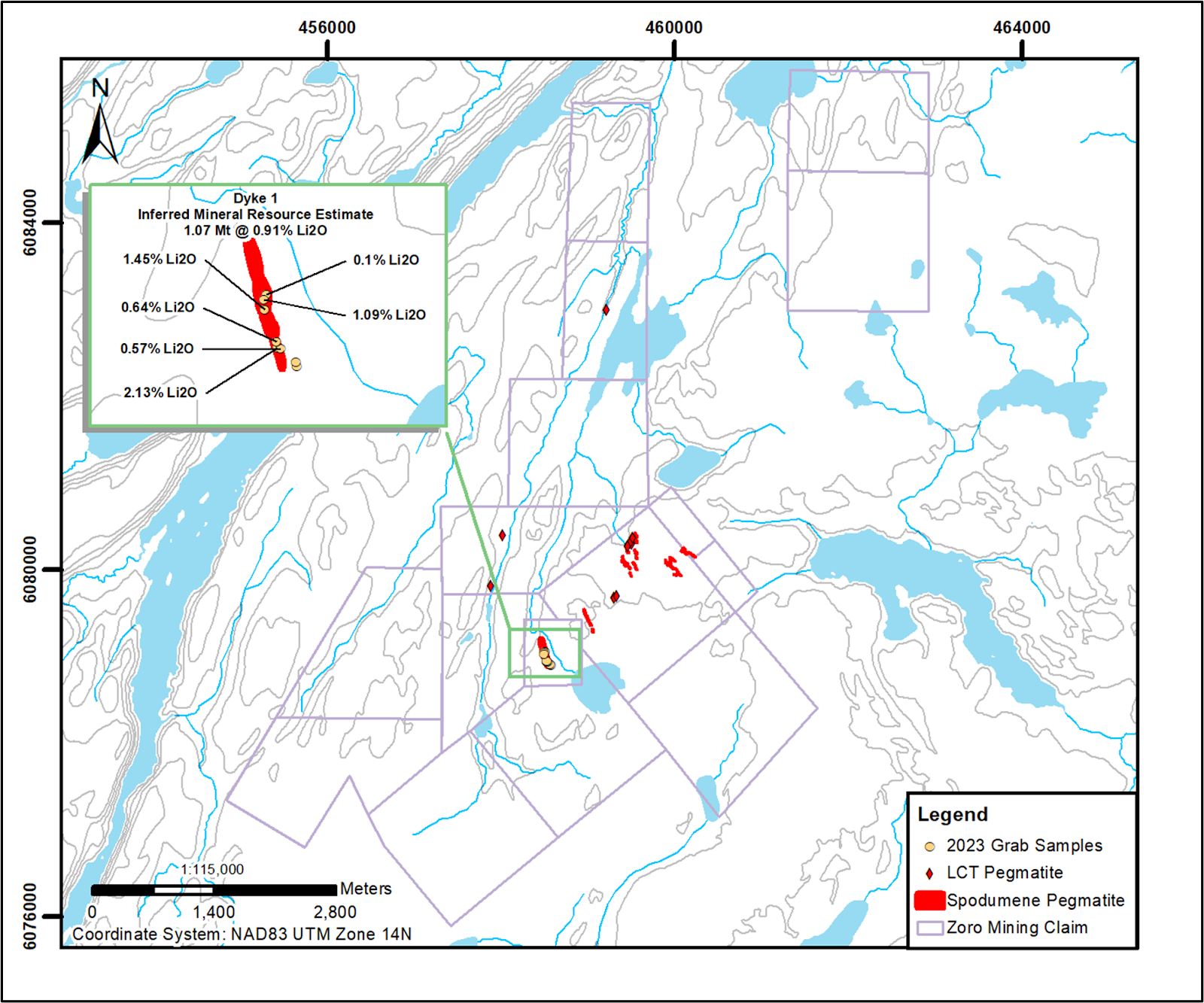

Zooming into the Zoro Property, the spotlighted spodumene occurrence at Dyke 1 underwent a revisit. This dyke was the focal point for re-sampling and structural mapping, hosting an inferred resource of 1,074,567 tons at a grade of 0.91% Li2O, with a cut-off of 0.3%, thus setting the stage for the impending winter drill season. During this undertaking, DGC confirmed the spodumene-mineralized pegmatite's presence at Dyke 1. A collection of eight pegmatite samples, of which five showcased spodumene, was harvested for assay (an investigative procedure for assessing quality).

Insight Into Jean Lake Property

Turning our attention to the Jean Lake Property, the Beryl Pegmatites (B1, B2 and B3) underwent rigorous sampling and mapping. The goal was to refine drill targeting for the next season. Notably, additional overburden removal from B1 and B2 revealed more spodumene mineralization. During the 2023 field operations, four chip samples were collected, three from the spodumene-bearing pegmatite. These samples from B1 showed pale green spodumene, with a range of 5cm to 0.70m, while those from B2 displayed an apple-green to yellow-green hue, spanning from 5cm to 15cm.

Gearing Up For Winter

As winter approaches, Foremost Lithium is gearing up for its drill program. Both the Zoro and Jean Lake Properties will witness this exploratory initiative. On the Zoro front, the plan is to bolster the existing resources on Dyke 1 and dig deeper into spodumene-bearing pegmatites on Dykes 8 and 16. Meanwhile, Jean Lake's drill program will build upon the winter 2023 outcomes, aiming to magnify the high-grade spodumene findings at B1 and B2.

Charging Forward: The Lithium Frontier Awaits

Foremost Lithium's recent findings underscore the potential of North America's hard-rock lithium exploration. As the world increasingly relies on renewable energy sources and electric vehicles, demand for high-quality lithium suitable to readily facilitate that transition is likely to continue alongside. With companies like Foremost Lithium leading the charge in North America, a continuation of positive exploration results improves its chances of becoming a leading supplier of the region's lithium feedstock.

Featured photo courtesy of Foremost Lithium.

Contact:

Investor Relations

MZ North America

+1 (737) 289-0835

FMST@mzgroup.us

SOURCE: Foremost Lithium

View source version on accesswire.com:https://www.accesswire.com/797119/rock-solid-results-foremost-lithium-reports-promising-exploration-results-with-potential-implications-for-north-american-lithium-mining-and-resource-independence