Independent study finds 228% ROI over three years with implementation of Quantexa's Decision Intelligence Platform

LONDON, Feb. 13, 2024 (GLOBE NEWSWIRE) -- Organizations need a trusted data foundation to enable effective decisions that allow them to operate efficiently, plan for the future, and grow. Yet many organizations continue to struggle with a lack of a single customer view, duplicated records, inefficient processes, and ineffective results.

Today, Quantexa has published The Total Economic Impact of The Quantexa Decision Intelligence Platform study, providing business value justification analysis to help organizations understand the financial impact of their technology investment. Quantexa commissioned Forrester Consulting to interview six customers in data-related leadership roles across banking, telecommunications, and the public sector to examine the potential return on investment and other benefits enterprises can realize with Decision Intelligence.

In this case, the study outlines a breakdown of the quantitative and qualitative benefits, potential financial impacts, and associated risks of implementing Quantexa's Decision Intelligence Platform for a composite organization based on the interviewed customers.

Customer benefits included:

- Three-year 228% Return on Investment

- Payback period less than eight months

- Estimated $34.8M Net Present Value in customer benefits over three years

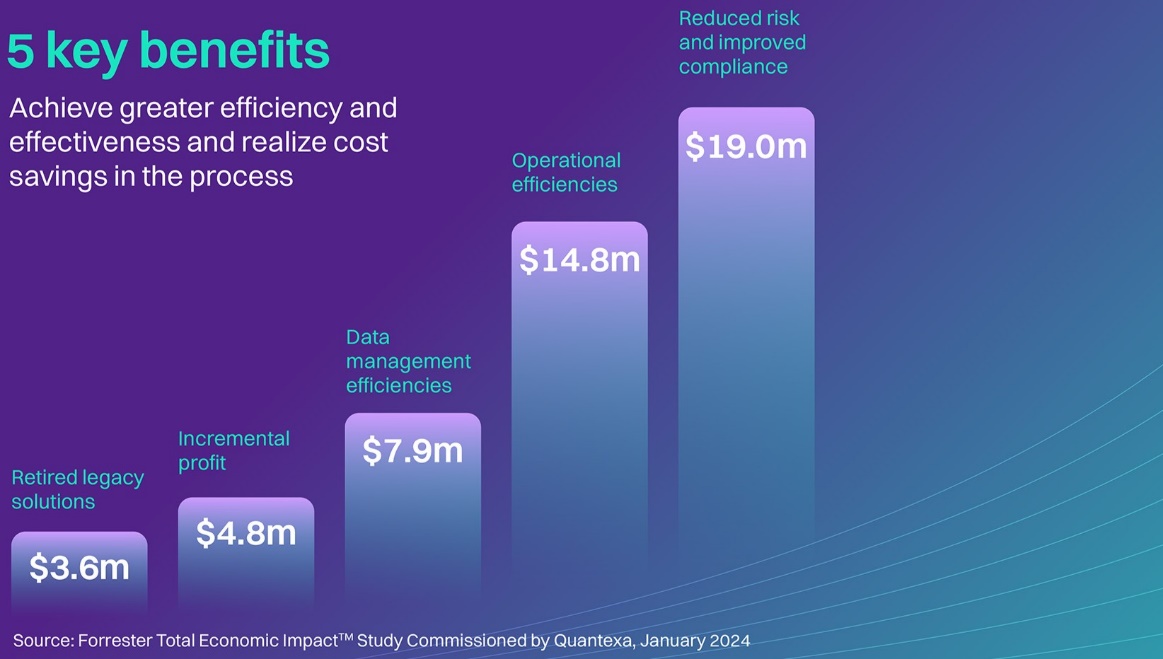

5 Key Benefits and how much was saved with Quantexa's Decision Intelligence Platform

A Global Head of Financial Crime Detection, Financial Services customer stated that, "Quantexa provides us the ability to source and fuse data in a flexible and scalable ecosystem and it provides a multi-dimensional view of the customer almost in real time. It enables us to use this model to reduce risk and to reduce the amount of infrastructure and human resources and monetize data assets."

For more information on the Total Economic Impact of Quantexa's Decision Intelligence Platform, please download the full 2024study.

About Quantexa

Quantexa is a global data and analytics software company pioneering Decision Intelligence that empowers organizations to make trusted operational decisions by making data meaningful. Using the latest advancements in big data and AI, Quantexa's Decision Intelligence platform uncovers hidden risk and new opportunities by providing a contextual, connected view of internal and external data in a single place. It solves major challenges across data management, KYC, customer intelligence, financial crime, risk, fraud, and security, throughout the customer lifecycle.

The Quantexa Decision Intelligence Platform enhances operational performance with over 90% more accuracy and 60 times faster analytical model resolution than traditional approaches. Founded in 2016, Quantexa now has more than 675 employees and thousands of users working with billions of transactions and data points across the world. The company has offices in London, Dublin, Brussels, Malaga, UAE, New York, Boston, Toronto, Sydney, Melbourne, and Tokyo.

Media Enquiries

C: Stephanie Crisp, Fight or Flight

E: Quantexa@fightorflight

OR

C: Adam Jaffe, SVP of Corporate Marketing

T: +1 609 502 6889

E: adamjaffe@quantexa.com

OR

E: RapidResponse@quantexa.com

An image accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/70409264-cd05-40a7-b809-66bbe5ff8e7e