EDMONTON, AB / ACCESSWIRE / February 20, 2024 / In advance of issuing its audited year-end report for the fiscal year ended December 31, 2023 ("Fiscal 2023"), OneSoft Solutions Inc. (TSX-V:OSS)(OTCQB:OSSIF) ("OneSoft" or "Company") is providing a corporate update, preliminary unaudited summary of operations for Fiscal 2023 and an outlook for fiscal year ending December 31, 2024 ("Fiscal 2024").

- OneSoft's preliminary Fiscal 2023 revenue increased 51% year-over-year to $10.4 million, essentially in line with previous guidance of $10.1 million.

- OneSoft's preliminary Fiscal 2023 Adjusted EBITDA1 improved from a loss of $2.0 million to a loss of $85,000 year-over-year, essentially in line with previous guidance of a loss of $28,000.

- Fiscal 2023 growth was driven by continued and increasing consumption of the Company's Cognitive Integrity Management ("CIM") solution by existing customers and the addition of new customers.

- The Company expects revenue growth in 2024 to continue with similar year over year trends from existing and new customers and from sales of new software-as-a-service ("SaaS") modules, which is expected to increase revenue per mile of pipeline assets under SaaS agreements.

- OneSoft is issuing Fiscal 2024 guidance for revenue of $15 million to $16 million, Adjusted EBITDA1 between $1.6 million to $1.9 million, and forecasted cash at the end of 2024 of between $4.7 to $5.0 million

Fiscal 2023 Financial Performance Update (based on preliminary figures prior to completion of audit)

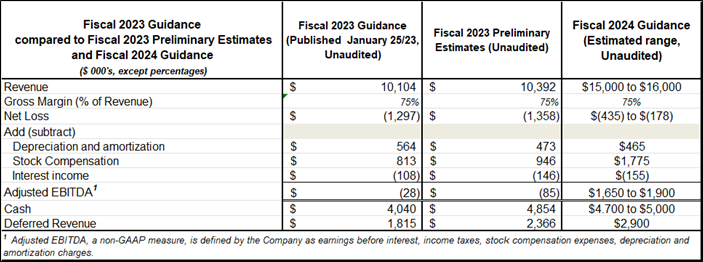

The Company published its Fiscal 2023 financial guidance on January 25, 2023. The following table reflects the estimated financial figures for Fiscal 2023, which are subject to finalization following completion of the Company's audit. Actual audited figures will be published in the Company's year end financial statements and MD&A prior to April 30, 2024.

"With revenue growth of approximately 51% over Fiscal 2022, OneSoft essentially met expectations for Fiscal 2023, with no material differences from the guidance we published at the beginning of the year," said Dwayne Kushniruk, OneSoft CEO. "Revenue, cash and deferred revenue exceeded the guidance we provided, and net loss and Adjusted EBITDA loss were slightly higher than projected at the beginning of the year, due to higher costs resulting from expansion of our development team during 2023. Looking forward to 2024, we plan to continue to invest to fast-track development of the additional SaaS functionality that will comprise our expanded platform that our customers are requesting. With another year behind us, we continue to gain better visibility into pipeline miles that will generate revenue and business growth in future periods. Based on this, we believe the Company is well positioned to continue similar year over year growth in Fiscal 2024 and we are confident that we can execute our current Fiscal 2024 business and operational plans without raising additional capital."

Update Regarding Pipeline and CIM Data-Miles

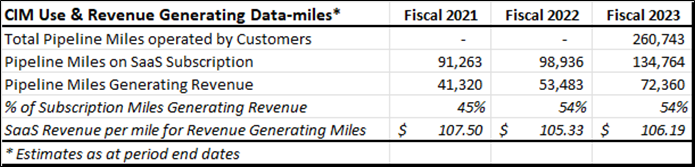

The Pipeline Miles table estimates the aggregate pipeline miles operated by all customers, miles of customers' pipeline assets that are subject to multi-year SaaS agreements and miles of pipeline data ingested into our CIM platform on which revenue is earned ("data-miles"). As these figures are subject to constant changes, we caution that information in this table should only be viewed as approximations, as a snapshot in time.

Notes regarding above table:

- "Pipeline Miles Generating Revenue" estimates the cumulative data-miles ingested into CIM that were revenue generating as at the end of each year.

- "% of Subscription Miles Generating Revenue" is "Pipeline Miles Generating Revenue" divided by "Pipeline Miles on SaaS Subscription.

- "SaaS Revenue per mile for Revenue Generating Miles" is the calculation of total CIM SaaS (excluding services and other) revenue divided by Pipeline Miles Generating Revenue. This calculation is only an approximation, as the revenue per data-mile figure will only be accurate when all customers' miles become revenue generating for the entire fiscal year and is subject to fluctuation due to customer pipeline maintenance schedules. Management uses this revenue per mile figure as a metric for trending analysis.

Fiscal 2024 Financial Guidance

Brandon Taylor, Chief Operating Officer, added, "We are forecasting revenue in Fiscal 2024 to exceed $15 million, with approximately 50% growth over 2023. Most of 2024 revenue is expected to come from increased use of our SaaS solutions due to existing and new customers onboarding more pipeline miles and commercialization of some of the new modules that are under development. Regarding sales and marketing efforts, we intend to invest more resources to pursue new customers in South America and Europe in 2024, as well as seek relationships with industry partners who can assist us to broaden the adoption of our solutions world-wide. We believe 2024 will be another good year for the Company and its stakeholders."

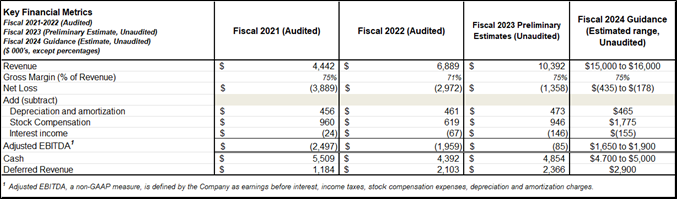

The following chart summarizes audited figures for the 2021 and 2022 fiscal years, estimated figures for Fiscal 2023 which are subject to verification post-audit, and Fiscal 2024 guidance.

Notes regarding 2024 Guidance:

- Fiscal 2023 figures (non-audited) are comprised of results as reported for Q1 through Q3 2023 plus preliminary results for Q4 2023. The Company expects to file its audited financial statements and annual report for Fiscal 2023 in April 2024.

- Fiscal 2024 revenue is estimated to be in the range of $15 million to $16 million, representing a 44% to 54% increase, respectively, over Fiscal 2023 revenue. Because the Company invoices most of its revenue and incurs a significant portion of its costs in U.S. dollars, changes in the U.S. to Canadian dollar exchange rate ("FX Rate") can potentially affect financial performance materially. Management's assumptions regarding FX Rates for 2024 are influenced by the reviews of 2024 FX Rate forecasts as recently published by RBC Capital Markets, TD Bank, CIBC and Scotia Bank, which range quarterly during 2024 between 1.28 and 1.37. The FX Rate for OneSoft averaged 1.35 for Fiscal 2023. Higher FX Rates would increase top line revenue, net income and Adjusted EBITDA and positively influence cash and deferred revenue; conversely, a lower FX Rate would create negative impacts to these metrics.

- Approximately 81% of forecasted revenue for Fiscal 2024 is expected to come from existing customers, reflecting their projected consumption of CIM and associated services. The remaining 19% of revenue is expected to be derived from new sales to prospective customers which the Company anticipates will close in 2024.

- Potential risks to these revenue projections are unforeseen factors that might negatively affect our customers' and prospects' decisions to purchase our solutions, such as regulatory changes that reduce pipeline operators' urgency to adopt new technologies or changes in economic conditions that might affect pipeline industry operations. Such events may reduce industry spending, resulting in delays to expected adoption of our solutions by prospective customers, new SaaS modules of OneBridge (a wholly owned subsidiary of OneSoft) not selling as expected and a reduction of expected CIM usage by current customers. Because the Company reports in Canadian dollars, volatility in the FX Rate may affect financial results, possibly to material amounts.

- Fiscal 2024 forecasts of Gross Margin, Net Income, Adjusted EBITDA, Cash and Deferred Revenue figures are based on the Company's operating budget as at the date of this press release. The budgeted cash balance may vary materially if certain scenarios not currently anticipated occur during 2024, including but not limited to: (i) revenue, deferred revenue and cash collections not materializing as anticipated; (ii) planned expenditures; (iii) the Company's current business plan being changed during the year; and/or (iv) the Company completing a material transaction such as an M&A transaction during the year. At this point in time, Management does not anticipate any requirement to raise additional capital in Fiscal 2024 if no such unforeseen events occur.

- Management expects that the Company's past experience regarding historic deferred revenue patterns will continue as anticipated in Fiscal 2024. However, deferred revenue may vary materially due to timing of cash receipts and CIM utilization by customers and is also dependent upon achieving planned revenue and closing of sales to new customers during 2024 as anticipated.

Fiscal 2024 Outlook

Fiscal 2023 was a pivotal year for OneSoft, with the Company achieving its key objectives of: (a) exceeding $10 million revenue; (b) achieving near zero adjusted EBITDA for the year; and (c) gaining more traction to become the next generation data management and analytics platform for the oil and gas ("O&G") pipeline industry. Management believes the Company has securely crossed the new technology adoption chasm wherein its technology and solutions have been strongly validated by industry innovators and visionary early adopters. The Company's 2024 objectives include completing the new functionality modules, integrating those into the CIM platform and continuing to become the sole SaaS vendor to fulfill all customers' functionality requirements. Recent new customer acquisitions confirm that the Company has successfully progressed to attract more pragmatic customers, who are conservative in their adoption of new technology and represent the majority of opportunities in the marketplace.

The Company is also investigating alternatives to accelerate revenue growth and business development, potentially through synergistic M&A activities. Management is optimistic that OneSoft is well positioned to capitalize on its first mover technology advantage to deliver enhanced benefits to customers and increase value for shareholders.

Fiscal 2023 Operational Update

- In October, the Company hosted its first annual user group event at the Microsoft Executive Center in Houston. Based on customer feedback, Management believes that customers are highly referenceable and that peer-to-peer positive comments in the pipeline integrity community are highly supportive of OneSoft's reputation and business. We believe there is a very good probability that our customer retention will continue to be near 100% unless a OneBridge customer is acquired by another pipeline operator who mandates adoption of its own integrity management processes. As of today, we know of no customer that intends to stop using our solutions.

- Management estimates that the CIM platform is currently being used for approximately 20% of the piggable pipeline infrastructure in the U.S.A. - i.e., approximately 150,000 of 660,000 piggable pipeline miles are now under multi year SaaS agreements with OneBridge. The balance of piggable miles is currently managed using legacy systems and processes and, with no known competing cloud solution, we believe this represents significant future opportunity for the Company.

- Management is optimistic that new functionality modules that integrate with the CIM platform, including Internal Corrosion Management ("ICM"), External Corrosion Management ("ECM"), Crack Management ("CM"), Probabilistic Risk Management ("RM") and Geohazard Strain Management ("GS") will be embraced by current and future customers. Certain customers have already added ICM to their annual SaaS renewal purchase orders and others have engaged as private preview users of the modules still under development. Management's optimism is bolstered by expressions of interest from customers and from the formalized steering committee initiated at the October 2023 user group event, comprised of senior industry personnel whose roles generally direct integrity management functions and control the associated budgets.

- Management is pleased with the continued evolution of internal operational processes that occurred during Fiscal 2023, including those that optimize efficiencies pertaining to sales, marketing, client support, product development, financial and corporate initiatives. In 2023, the Company's marketing team updated marketing collateral to align with our evolving technology and product development and adopted new taglines "Where Data and Integrity Converge", "Integrity Management made smarter" and "Visualize. Predict. Mitigate." Sales, marketing and customer support materials and processes have been organized within "Wiki" libraries, to document and share knowledge and improve operational and cost efficiencies. New marketing software was implemented to capture data that assists our employees to better understand and serve our stakeholders, including metrics regarding website visitors, unique contacts, blog views, email outreach and gated downloads that track visitors who view white paper and informational videos posted on our website. The Company's sales, development and customer support teams were reorganized in Fiscal 2023 to support additional marketing and sales tactics in Fiscal 2024 using new and existing customer success plans and strategic prospect playbooks.

- The Company attended several key O&G industry tradeshow and exhibition events during Fiscal 2023, including the Pipeline Pigging and Integrity Management ("PPIM"), the American Gas Association ("AGA"), the Pipeline Technology Conference in Berlin, Germany, the annual Banff Pipeline Conference and participated in industry educational events wherein Company personnel presented white paper research learnings. Additionally, OneBridge hosted its first annual User Group Conference, in collaboration with the Microsoft team that focuses on O&G customers. Microsoft considers OneBridge to be a "managed partner" and some of its O&G sales team members continue to collaborate with OneBridge personnel to pursue joint sales opportunities involving our CIM platform and Microsoft's Azure cloud platform.

- Use of the CIM platform by customers increased in accordance with Management's expectations during Fiscal 2023, with higher pipeline miles operated by customers and miles under SaaS subscriptions that drove revenue in Fiscal 2023. OneBridge onboarded five additional pipeline operators during Fiscal 2023, who became new CIM users due to direct sales efforts or after being acquired by existing customers who use the CIM platform. Some customers expanded their use of the CIM platform to include ICM and other new functionality modules, a trend we believe will generate additional revenue in future periods.

- The Company's development team consisted of 21 employees and a 7-person offshore team as at the end of Fiscal 2023. This team released 6 major CIM platform updates during the year, evolved the ICM, ECM, CM, RM and GS functionality modules, evolved various data science and machine learning projects and assisted customer service and implementation teams to onboard five new pipeline operators during Fiscal 2023. During Fiscal 2023, this team addressed 221 User Stories, 180 Bugs and 2,496 commitments for customers and upgraded the CIM platform to .NET 6 status. One new customer presented an atypical challenge, requiring more than 18,000 pipeline data miles to be ingested into CIM, "go live" with the CIM platform within a 6-month period (which was essentially completed in early 2024), and the customization of various integrations between CIM and the customers' internal systems.

- The Company's client services team addressed 17 projects during Fiscal 2023, primarily involving 6 clients and 5 core CIM platform implementations, collectively involving 15 divisional operators and more than 700 pipeline systems. Projects included work associated with integrity management and compliance, geographic information system ("GIS") integrations, loading of more than 3,700 ILI assessments and 67 million anomalies into CIM, migrating data from legacy systems into CIM, integrations with various customer software applications and training.

- The Company's employee roster continued to increase with 20 new hires completed during the past 20 months and employee retention remains high. Development staff trained in new Microsoft technologies and systems during Fiscal 2023 and this, together with our new customer additions, resulted in the Company earning the Microsoft Solutions Partner designation for "Digital and App Innovation (Azure)". This provides the Company access to accelerated support status and discounted or free internal user rights for a wide swath of Microsoft products.

- OneSoft also successfully completed the second audit of its SOC 2 Type 2 certification process, which provides independent verification that OneSoft is compliant with key "trust service principles", including security, availability, processing integrity, confidentiality and privacy (as defined by the American Institute of CPAs). SOC 2 Type 2 certification is recognized as an important accreditation of a company's trustful capability, a key vendor requirement of customers and prospective customers world-wide.

Fiscal 2023 Corporate Update

- Management attended several in-person investor events in Canada and U.S.A during Fiscal 2023 and hosted numerous one on one meetings with current and prospective shareholders of OneSoft. The Company renewed the appointment of Sophic Capital Inc. to provide investor relations and capital markets advisory services for Fiscal 2024.

- In Fiscal 2022, the OneSoft Board of Directors and Management took steps to review and implement succession plans for the Company's senior executive management team and Board of Directors, which initiatives are ongoing. Two individuals relinquished their roles as Directors in 2023 and one new Director has been onboarded to date.

- During Fiscal 2023, Management and Directors continued to consider alternatives that can potentially advance the Company, including pursuit of organic revenue growth initiative and M&A scenarios that might further accelerate Company advancement and revenue growth, with the overall objectives of increasing shareholder value and positioning the Company to better serve all of its stakeholders.

About OneSoft and OneBridge

OneSoft has developed software technology and products that have capability to transition legacy, on-premises licensed software applications to operate on the Microsoft Azure Cloud Platform. Our business strategy is to seek opportunities to incorporate Data Science and Machine Learning, business intelligence and predictive analytics to create cost-efficient, subscription-based software-as-a-service solutions. Visit www.onesoft.ca for more information.

OneSoft's wholly owned OneBridge Canadian and U.S. subsidiaries develop and market revolutionary new SaaS solutions that use advanced Data Sciences and Machine Learning to analyze big data using predictive analytics to assist Oil & Gas pipeline operators to predict pipeline failures and thereby save lives, protect the environment, reduce operational costs, and address regulatory compliance requirements. Visit www.onebridgesolutions.com for more information.

For more information, please contact.

| OneSoft Solutions Inc. Dwayne Kushniruk, CEO dkushniruk@onesoft.ca 587-416-6787 | Sean Peasgood, Investor Relations Sean@SophicCapital.com 647-494-7710 |

Forward-looking Statements

This news release contains forward-looking statements relating to the future operations and profitability of OneSoft Solutions Inc. (the "Company") and other statements that are not historical facts. Forward-looking statements are often identified by terms such as "may", "should", "anticipate", "expects", "believe", "will", "intends", "plans" and similar expressions. Any statements that are contained in this news release that are not statements of historical fact may be deemed to be forward-looking statements. Such forward-looking information is provided to deliver information about management's current expectations and plans relating to the future. Investors are cautioned that reliance on such information may not be appropriate for other purposes, such as making investment decisions.

In respect of the forward-looking information and statements the Company has placed reliance on certain assumptions that it believes are reasonable at this time, including expectations and assumptions concerning, among other things: the impact of Covid-19 on the business operations of the Company and its current and prospective customers; the availability and cost of labor and services; the efficacy of its software; our interpretation based on various industry information sources regarding the total miles of pipeline in the USA and globally and which segments are piggable; our understanding of metrics, activities and costs regarding evaluation, inspection and maintenance is in alignment with various industry information sources and is reasonably accurate; that counterparties to material agreements will continue to perform in a timely manner; that there are no unforeseen events preventing the performance of contracts; that there are no unforeseen material development or other costs related to current growth projects or current operations; the success of growth projects; future operating costs; interest and foreign exchange rates; planned synergies, capital efficiencies and cost-savings; the sufficiency of budgeted capital expenditures in carrying out planned activities; and no changes in applicable tax laws. Accordingly, readers should not place undue reliance on the forward-looking information contained in this press release. Since forward-looking information addresses future events and conditions, such information by its very nature involves inherent risks and uncertainties. Actual results could differ materially from those currently anticipated due to many factors and risks. These include but are not limited to the risks associated with the industries in which the Company operates in general such as: costs and expenses; interest rate and exchange rate fluctuations; competition; ability to access sufficient capital from internal and external sources; and changes in legislation, including but not limited to tax laws.

Readers are cautioned that the foregoing list of factors is not exhaustive. Forward-looking statements contained in this news release are expressly qualified by this cautionary statement. The forward-looking statements contained in this news release are made as of the date of this news release, and the Company undertakes no obligation to update publicly or to revise any of the included forward-looking statements, whether because of new information, future events or otherwise, except as expressly required by Canadian securities law.

This news release does not constitute an offer to sell or the solicitation of an offer to buy any securities within the United States. The securities to be offered have not been and will not be registered under the U.S. Securities Act of 1933, as amended, or any state securities laws, and may not be offered or sold in the United States absent registration or an applicable exemption from the registration requirements of such Act or other laws.

The TSX Venture Exchange has not reviewed and does not accept responsibility for the adequacy or accuracy of this release.

SOURCE: OneSoft Solutions Inc.

View the original press release on accesswire.com