The addition of Exchange Traded Funds (ETFs) enhances Gotrade Indonesia's offerings, enabling investors to access diversified assets with lower fees, marking a significant milestone in the democratisation of investment opportunities.

JAKARTA, INDONESIA / ACCESSWIRE / February 22, 2024 / Gotrade Indonesia, a leading platform in fractional investments, is expanding its portfolio by introducing Exchange Traded Funds (ETFs). This new feature allows Indonesian investors to diversify their investments and enjoy the benefits of lower fees. This move comes in response to the growing demand for more diversified investment options and the increasing awareness of the cost-effectiveness of ETFs among investors. The introduction of ETFs is set to revolutionise the investment landscape in Indonesia by offering access to a range of assets with an average expense ratio significantly lower than that of actively managed mutual funds.

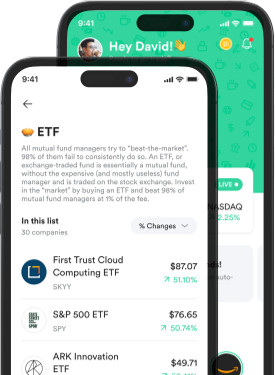

Gotrade Indonesia ETF stock screen, showing access to US etfs on Gotrade Indonesia for fractional investing

An article published by Investopedia in 2024 shows that ETF fees are generally cheaper than mutual fund fees. In 2022, in the United States, the average expense ratio for index ETFs was 0.16%, lower than the average expense ratio for US mutual funds of 0.66%.

Norman Wanto, CEO of Gotrade, welcomed the enactment of the Indonesian Commodity and Futures Trading Regulatory Agency (CoFTRA) Regulation No. 1 of 2024 that allows the recent introduction of ETFs into the Indonesian market. "We would like to express our gratitude to CoFTRA as the regulator of our industry. Many of our users have expressed their hopes of being able to buy ETFs, and we are grateful that Bappebti has followed up on these aspirations, along with the support of Jakarta Futures Exchange (JFX)." Norman further continued, "The introduction of ETFs is a game-changer for our users. It not only broadens their investment options but also aligns with our commitment to offer innovative, cost-effective investment solutions. By incorporating ETFs into our platform, we are enabling Indonesian investors to build diversified portfolios with lower fees, enhancing their potential for long-term growth and financial stability."

Gotrade Indonesia is a revolutionary investment platform that enables Indonesian investors to access the U.S. stock market with ease and efficiency through the Channeling of Customer Mandates to Foreign Exchanges (PALN) scheme. Through its partnership with Valbury Asia Futures, Gotrade offers fractional investment opportunities, allowing users to invest in shares of over 600 U.S. companies via PALN derivative contracts, including the "magnificent seven" technology giants and popular ETFs. Committed to making investing and trading accessible to all Indonesians, Gotrade Indonesia provides a secure, user-friendly platform for investors to grow their assets and achieve their financial goals.

Contact Information

Aji Suleiman

VP Indonesia

aji@tr8.io

SOURCE: Gotrade Financial Inc.

View the original press release on newswire.com.