The Combined Company Supports All the Critical Operations of Seafood Processors and Distributors Across Purchasing, Processing, Sales, Traceability, Logistics and Reporting

LINCOLN, RI / ACCESSWIRE / February 28, 2024 / CAI Software, LLC, ("CAI" or "CAI Software"), a portfolio company of STG and a leader in integrated software and technology solutions for mission-critical, production-oriented enterprise resource planning (ERP), manufacturing execution systems (MES), eCommerce EDI (electronic data interchange), and warehouse management software (WMS) today announced that they have acquired Maritech, a leading cloud-based ERP provider for the seafood and logistics industries across European and North American markets.

CAI Software - Production-oriented solutions for manufacturers, processors, and distributors.

The addition of Maritech to the CAI Software portfolio adds seafood processing and distribution software, enhancing capabilities across the entire seafood production lifecycle from catch, purchasing, processing, packing, sales (including importing and exporting), logistics and analytics & reporting. Founded in Norway, Maritech has an expansive, blue-chip customer base in the seafood industry. The combination of CAI and Maritech will help expand Maritech's presence in North America and the rest of Europe. Together, CAI Software and Maritech will build a leading, global seafood ERP platform to serve companies of all sizes.

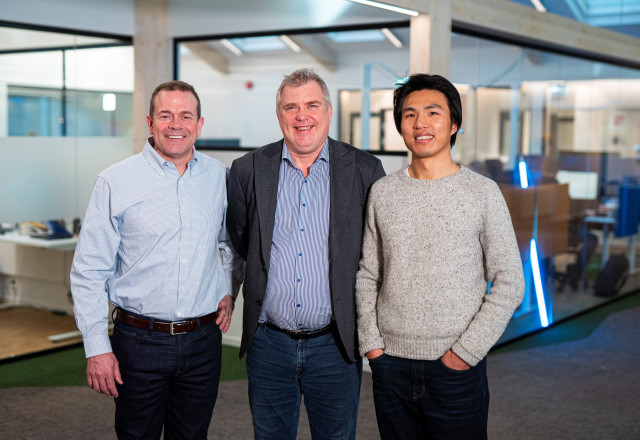

"Combining CAI Software and Maritech brings key granular information for seafood manufacturers of all sizes to make more informed and timely business decisions in this ever-changing business environment," said Brian Rigney, CEO of CAI Software. "As we bring the companies together, we will continue to collaborate with our customers to develop solutions purpose-built to serve the unique requirements of this industry. In our next chapter of growth, I look forward to working with the Maritech team and Broodstock, who will continue to be an investor in the combined company."

"This is a great milestone for us, and a natural next step towards global growth for Maritech," says Maritech CEO Odd Arne Kristengård. "Together with CAI, we will continue to have a laser focus on our Norwegian home market and customers while increasing the international traction that we have built over the last several years."

William Chisholm, Managing Partner of STG, said, "We see a strong opportunity to combine the experience and capabilities of CAI and Maritech to build a leading, global ERP software for the seafood industry. We look forward to collaborating with our combined team to drive success for our employees, customers, and partners."

"The combination of CAI and Maritech will enable us to leapfrog to the next level of performance in the seafood industry. I am so proud of what our team has accomplished so far and am excited about taking our growth strategies to the next level to serve more seafood companies around the world," added Jan Erik Lovik, Partner Broodstock Capital.

About Maritech AS

Since the 1970s we have created solutions driving innovation and supporting our customers' processes through their value chain. From the beginning, Maritech decided to focus on innovation for the growing seafood industry. Maritech is also known within the transport industry and recently launched a new cloud TMS. Today, we are proud to be a world-leading provider of seafood ERP SaaS software, and a trusted advisor to many of the biggest companies around the global market. www.maritech.com

About STG

STG is a private equity partner to market-leading companies in data, software, and analytics. The firm brings experience, flexibility, and resources to build strategic value and unlock the potential of innovative companies. Partnering to build customer-centric, market-winning portfolio companies, STG creates sustainable foundations for growth that bring value to existing and future stakeholders. The firm is dedicated to transforming and building outstanding technology companies in partnership with world-class management teams. STG's expansive portfolio consists of more than 50 global companies. https://www.stg.com

About Broodstock Capital

Established in 2016, Broodstock Capital is a Norwegian private equity partner and pure-play seafood investor, with a local presence and global reach. Through active ownership and close partnerships with company owners and management, we develop local business to global leaders that contributes to a more sustainable seafood industry. www.broodstock.no

Contact Information

Drea Toretti

CMO

info@caisoft.com

800.422.4782

Related Images

|

SOURCE: CAI Software

View the original press release on newswire.com.