Grant dollars will be used to support Homeport's mission of closing the housing gap for low-to-moderate income individuals, families and seniors

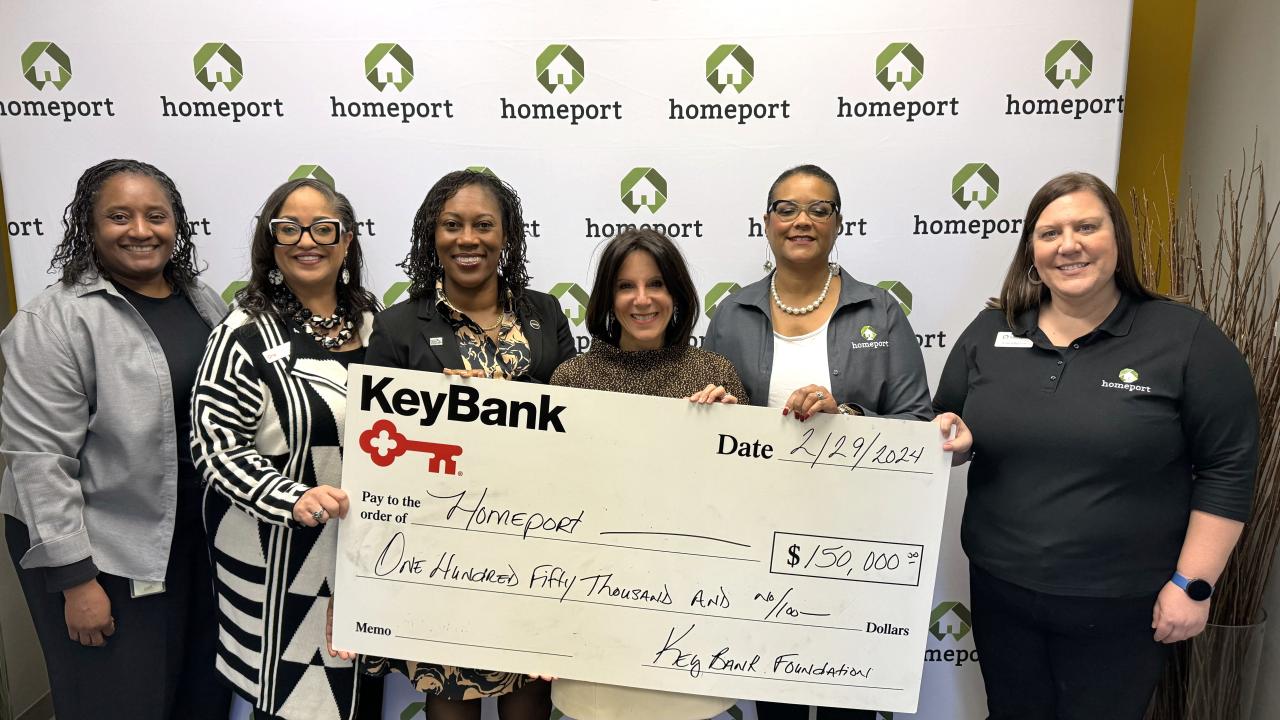

NORTHAMPTON, MA / ACCESSWIRE / March 1, 2024 / KeyBank and the KeyBank Foundation announced an investment of $150,000 in Columbus-based Homeport, aimed at bolstering its Housing Advisory Services (HAS) program.

HAS is an evidenced-based, HUD-certified education and counseling program for low- and moderate-income individuals and families in managing finances, building wealth and purchasing a first home. It is available to residents and the public. Homeport's strategy is to assist more families living paycheck-to-paycheck as they are most vulnerable to the impacts of job loss, health, transportation and other factors. The program is expanding down payment assistance and lease option homeownership to support low-income Black and minority homebuyers on the journey to homeownership.

"KeyBank's purpose is to help the communities we serve thrive, and accessibility to homeownership resources is a crucial element," said Lara DeLeone, KeyBank Central Ohio Market President. "We are excited to partner with and support Homeport, helping to connect Central Ohioans to industry experts and resources in the homeownership arena. This partnership will not only strengthen our community, but it will provide equitable access to jobs, education, healthcare and more."

"KeyBank's generous investment directly underwrites our strategic priority to expand household equity for Black people, people of color, and low- to moderate-income buyers," said Homeport President and CEO Leah Evans. "A key element of that is ensuring that homeownership is not just accessible, but sustainable. Homebuyer education is the number one foreclosure prevention tool and prepares our clients for the ups and downs of homeownership, ensuring that we create opportunities that last and empower people to build generational wealth."

Since Homeport's inception in 1987, it has given greater security, opportunity and dignity to thousands of low-income people by building quality, affordable homes, primarily financed with private investment leveraged by Federal tax credits. The non-profit also develops new and renovated single- and multi-family homes designed to catalyze neighborhood revitalization, including market-rate homes, single-family, and lease-to-purchase homes.

Each year, Homeport equips thousands of Central Ohioans with the foundational skills needed for successful home ownership. Through group classes and one-on-one coaching, Homeport provides direction and training in key areas such as the home buying process, setting a budget, and avoiding foreclosure, with the goal of providing the tools everyone needs to be long-term stewards of a home.

KeyBank has supported the Homeport since 2000.

ABOUT KEYCORP

KeyCorp's roots trace back nearly 200 years to Albany, New York. Headquartered in Cleveland, Ohio, Key is one of the nation's largest bank-based financial services companies, with assets of approximately $188 billion at December 31, 2023.

Key provides deposit, lending, cash management, and investment services to individuals and businesses in 15 states under the name KeyBank National Association through a network of approximately 1,000 branches and approximately 1,200 ATMs. Key also provides a broad range of sophisticated corporate and investment banking products, such as merger and acquisition advice, public and private debt and equity, syndications and derivatives to middle market companies in selected industries throughout the United States under the KeyBanc Capital Markets trade name. For more information, visit https://www.key.com/. KeyBank is Member FDIC.

ABOUT HOMEPORT

Homeport is the largest nonprofit developer of affordable housing in Central Ohio. Having served the area since 1987, Homeport owns 2,931 affordable rental apartments and homes in 46 communities. Our 6,529 residents, families and seniors, can access a broad range of services ranging from after school programming to emergency assistance for rent and utilities. Homeport partnerships also link our residents to food, furniture and employment assistance as well as medical and mental health services. Homeport is a leading provider of homebuyer education and budget and credit counseling for Central Ohio.

View additional multimedia and more ESG storytelling from KeyBank on 3blmedia.com.

Contact Info:

Spokesperson: KeyBank

Website: https://www.3blmedia.com/profiles/keybank

Email: info@3blmedia.com

SOURCE: KeyBank

View the original press release on accesswire.com